A Look at the Combined Newstrike Brands and Hexo Corp

Newstrike Brands (TSXV: HIP) posted it’s FY18 financial figures yesterday, giving us some insight into what a combined entity with Hexo Corp (TSX: HEXO) might look like following the completion of the proposed merger. Although not a goliath in the space, Newstrike certainly has some compelling numbers to add to that of Hexo Corp’s.

To begin, lets be clear in stating that the two firms don’t exactly line up in terms of reporting periods – they’re staggered by a month. However, it’s close enough that we’re comfortable combining figures for purposes of comparison.

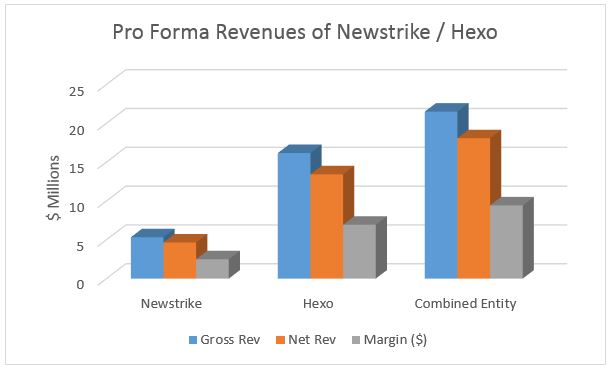

Top line revenue came in at $5.33mm for Newstrike for the fourth quarter of 2018, which equated to $4.65mm net of excise taxes. Gross margin for the period came out to $2.49mm. On an annual basis, Newstrike reported $8.97m in gross revenues, which net down to $8.07m in revenues with a gross margin of $3.55m. It should be noted that the company only had revenues for a total of two quarters for the fiscal year.

As a combined entity with that of Hexo Corp, gross revenues of roughly $21.51mm ($18.09mm net) for the quarter would have been reported, resulting in a gross margin of $9.43mm.

In terms of sales avenues, for the fourth quarter Newstrike reported wholesale sales of $2.04mm to other producers in the sector. The remaining $2.61mm in revenues was through the wholesale sale of cannabis to provincial distributors. On an annual basis, these figures were $3.21mm and $4.86mm respectively. No medical sales were present, with Newstrike being focused only on the adult-use market.

Although Newstrike does not explicitly state the price per gram that it is obtaining through wholesale channels, nor does it indicate how many grams it has sold, we can calculate this based on excise tax charges. As per the Excise Act, a minimum of $1.00 or 10% must be levied on each gram of cannabis sold, whichever is higher. Due to the wholesale nature of Newstrike’s business model, we can assume that the minimum $1.00 was imposed on each gram sold, rather than a higher figure representative of 10%.

Based on this as a whole 684,000 grams of cannabis are estimated to have been sold by Newstrike in the fourth quarter. With net revenues of $4.65mm, this equates to a per gram average of $6.80 per gram, which is relatively inline with competitor figures. As a comparison, Hexo Corp indicates an average selling price of $5.00 per gram is used for their biological estimates.

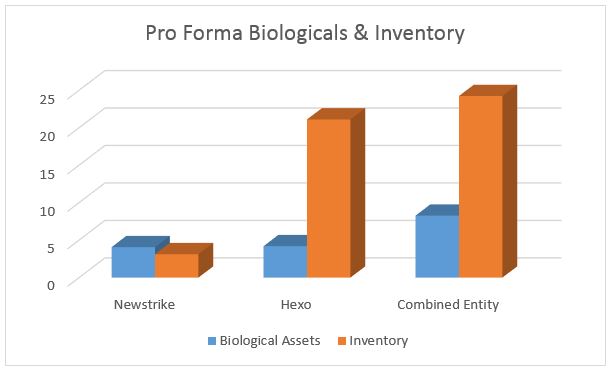

In terms of assets reported, biological assets for Newstrike as of the quarter end are sitting at $4.07mm, while inventory is parked at $3.12mm, providing us insight as to next quarters potential earnings. Hexo Corp meanwhile reported $4.20mm and $21.11mm respectively, which points to a relatively flat oncoming quarter in terms of expected revenues.

SG&A costs for the year came in at a reasonable $4.37mm for Newstrike, however there was Sales, Marketing & Business Development costs at $8.30mm which seems high given total revenues for the fiscal year. This was on top of consulting fees to the tune of $4.30mm.

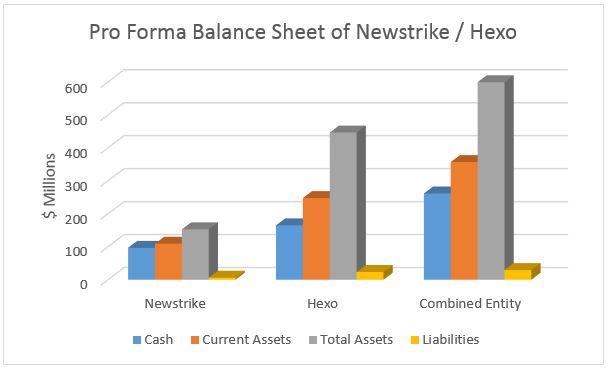

By and large, the most attractive aspect of Newstrike Brands is that of its balance sheet. The company reported $96.64mm in cash, on assets of $152.80mm – indicating that the most attractive part of the company is in fact whats in the bank. In terms of liabilities, the company reported only $5.92mm – a balance easily covered by cash on hand.

The balance sheet however, is also Hexo Corps strong point with $165.04mm in the bank on assets of $446.55mm. It too has a very small amount of liabilities given its stated assets, at $23.35mm. Combined, the entity will have a massive amount of cash on hand with very, very minimal liabilities – putting it in an excellent position for future acquisitions.

Overall, it was a decent quarter for Newstrike Brands. However, it’s strong suit is certainly in the form of its balance sheet. With current production levels at a relatively small scale, it will need to focus on completing current planned production increases in order to eliminate cash burn as it finds its way to profitability.

The definitive agreement between Hexo Corp and Newstrike Brands was announced March 12, 2019. Under the terms of the arrangement, Newstrike shareholders will receive 0.06332 Hexo Corp shares for each Newstrike Brand share held. The transaction is valued at roughly $263mm. A date was not given for an estimate close date.

Information for this analysis was found via Sedar, Hexo Corp, and Newstrike Brands. The author has no securities or affiliations related to either organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. Figures presented as estimates only and not to be taken as actuals.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.