BRIEF: A Brief Analysis on Block One Capital

Block One Capital Inc (TSXV: BLOK) has been one hot stock as of late. As a result of the raging price of bitcoin, this company that is newly established in the blockchain market has been the talk of the twittersphere. Although it has only formally been in the blockchain market for one full month as of yesterday, it would seem it has been in the industry for years based on investor sentiment.

Initially, we had planned on performing a full analysis on this stock for our avid readers. However as it turns out, there is actually little to this company in terms of its blockchain connection. Block One didn’t enter the sector until November 6, 2017. Before this point in time, it was simply a capital pool company. As a result of this, we’ll instead do a semi-full analysis in the format of a briefing.

Block One Capital: A Very Brief Overview

The Current History

On November 6, 2017, Essex Angel Capital Inc formally announced that it was changing its name to Block One Capital. In addition to this, it made investors aware that the Board of Directors had determined to focus the firm on investments in the blockchain sector. Although no details were announced further to this, it began the stocks current run.

The following day, the stock opened $0.05 higher than its previous close, at a price of $0.30. It continued through out the coming days to hit new highs, to the point that the company had to issue a release indicating nothing had changed. Before any further announcement was made, the price per share hit a high of $0.71.

Next, on November 30, the company announced that it signed a binding term sheet. Within, it was defined that Block One would acquire 90% of TG12 Ventures, for a total purchase price of $2,300,000. TG12 is a Quebec based organization that is focused on mining Bitcoin. Most significantly, TG12 had recently signed a purchase order for the purchase of 1,000 individual Bitcoin mining devices. With an all-in rate of $0.10 per KWH, the miners are expected to generate $7.8 million in annual revenue, based on a Bitcoin price of $8,000. The facility is expected to be running by the end of February 2018.

Under the terms of the agreement, 40% of TG12 is to be acquired via an initial cash payment of $250,000. The remainder is to be paid over a twelve month period subject to certain milestones being met.

In addition to this acquisition, yesterday it was announced that Block One had entered a second binding term sheet. This time, it was to acquire 40% of Finzat LLC, a blockchain company focused on redefining the current mortgage process. Total acquisition costs related to this venture is $680,000, of which $600,000 will be paid initially. The remaining funds are to be released after an undefined milestone is met. It is not yet clear how this venture will provide revenue to the company.

The Financials

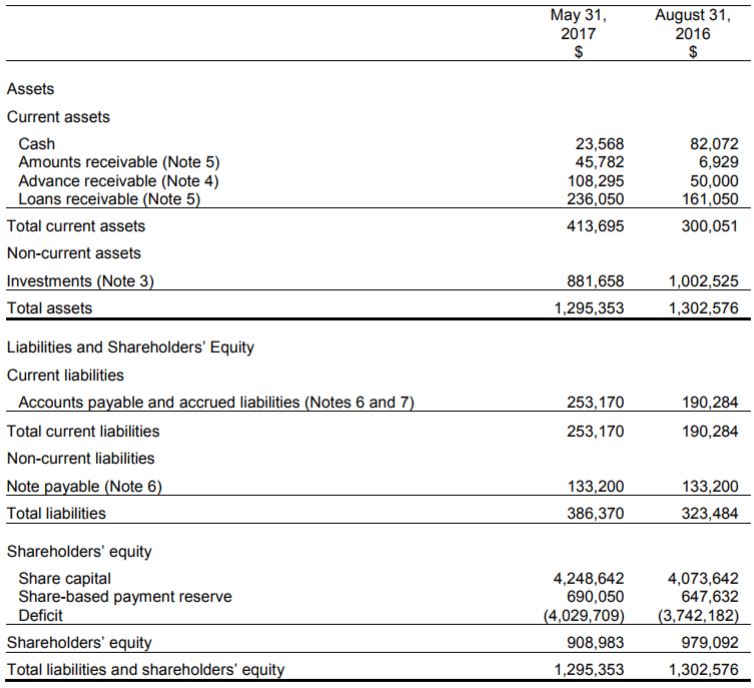

Believe it or not, for being a blockchain focused company the financials truly are not all that bad for Block One Capital. The latest filings are as of May 31, 2017. With the companies year end being August 31, 2017, financials are not believed to be due until the end of December for the latest quarter.

At a glance, there is certainly strength to be seen in the companies balance sheet. As of the latest financials, the company had $386,370 in liabilities versus $1,295,353 in assets. $253,170 of these liabilities are current, compared to $413,695 in current assets. It is believed that a portion of these liabilities were paid off with a financing that closed in October.

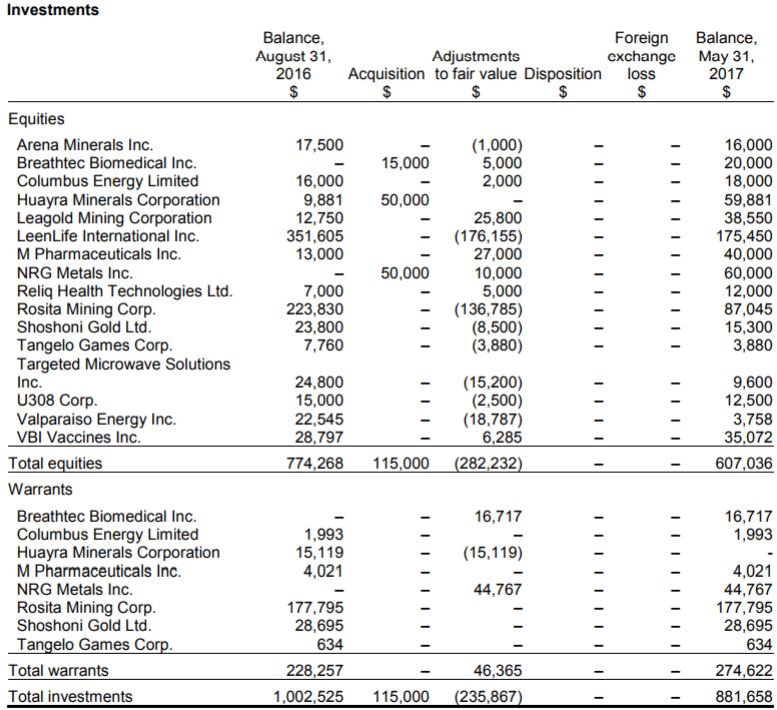

Of these assets, $881,658 is currently invested in long term investments in various industries. The company is actually quite diversified in this regard, as can be seen below. They are currently invested in several sectors, which is an excellent practice.

We did not examine the current valuations of these investments for this report. However, specific pricing is provided in the May 31, 2017 financials posted on July 31, 2017 to SEDAR should you wish to.

Share Structure of Block One Capital

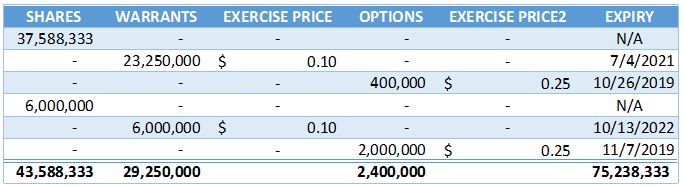

Unlike many in the sector, there isn’t a whole lot to the share structure of Block One. It has had few raises in the past, although these were at less than desirable pricing. However, this was largely the result of a depressed share price.

Overall, the company has just over 43 million shares outstanding. However, it needs to be noted that 25,000,000 were raised last July at a price of $0.02 per unit. Furthermore, an additional 6,000,000 were raised in October at a price of $0.075. For both situations, the warrants are at a price of $0.10. This in turn means that although on a fully diluted basis there are only 75 million shares outstanding, they are almost all on cheap paper.

Based on the current share price, the market cap is approximately $64 million. Although there are very little current revenues, there is expected revenues on the horizon.

Closing Statements

Block One Capital Inc is perhaps one of the few new blockchain related players that actually looks like it has a chance of success. Due to managements approach of focusing on the mining aspect of the industry, it is clear to investors where revenue will come from in the future. This is a very positive aspect for shareholders, as not many involved in the industry have a defined revenue path.

With the rising price of bitcoin, the potential revenues that Block One will attain continues to improve. The current business plan for their acquisition is based on a price of $8,000USD per Bitcoin. At the time of writing, the current market value is approximately $14,000 per coin. Although mining difficulty may increase slightly, the potential revenue generated by the operation continues to climb while the expected expenses remain at a fixed price. This is almost unheard of in the majority of sectors.

One thing that investors need to be aware of however, is the current volatility that Bitcoin experiences. Furthermore, at some point, prices either need to stabilize or consolidate to provide stability to the sector. Until then, the value of each coin is at risk of falling just as quickly as it climbed. If this were to happen, Block One would quickly be in the red on its current investments. Thus this can still be defined as a high risk investment, although potentially one of the better methods to enter the emerging sector.

Weight the risks. Consider all options. Dive Deep.

Information for this analysis was found via TMXMoney, SEDAR, and Block One Capital. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.