BRIEF: Fintech Select has Horrendous Financials

Fintech Select (TSXV: FTEC) is an organization that has been historically known for its prepaid financial services. These services took the form of prepaid calling cards, as well as prepaid credit cards. Recently, like many organizations, they made a slight pivot to enter the cryptocurrency craze that has taken financial markets by storm. Unlike many of the other organizations entering the sector, Fintech Select had an advantage – it was already in a related field.

For long time investors, this pivot was likely welcome news. This move quickly brought life in to a company that desperately needed it. Furthermore, it wasn’t off base from what the company was experienced in. As a result of this experience, Fintech Select was already a leg up on the competition. It enabled them to quickly integrate blockchain technology in to that of their current product offerings.

Finally, this experience allowed them to move beyond current product offerings on the market. A point of sale device was quickly developed, allowing regular businesses to enable their POS devices to act as a cryptocurrency exchange. This allows individuals to trade these currencies, using the companies specialized wallet.

Investor Reactions

Amid the whirlwind of news releases since the first announcement of this pivot in early August 2017, investors seem to have become lost in the clouds. Struggling to put a price on the value of this new industry, in the last three months Fintech Select has hit both its 52 week low, as well its 52 week high. The one thing that has been clear however, is that investors are only focusing on the positives that this company offers. Furthermore, they appear to have little interest in the core business of Fintech Select. Investors are here for the crypto technology, and thats about it.

Proof of this lies in the reaction the market had to the interim financial statements issued on August 29th, 2017. With the name change from Selectcore to Fintech Solutions being announced the day before, investors were focused on the future rather than the current state of the company. They had no desire to truly examine the position the company was in.

What was the big deal with the financials?

To begin, we look at the cash position of the company. At a quick glance, it’s impressive. Fintech Select as of June 30th, 2017, was hoarding a little over $1,000,000 in cash, with a further $500,000 in receivables. Not bad for a small company. Then your eyes fall on the current payables, and one is left picking their jaw up off the floor. Within the next twelve months, Fintech Select is due to pay just under $8,000,000 in debt. Without financing, it’s difficult to imagine these obligations being met.

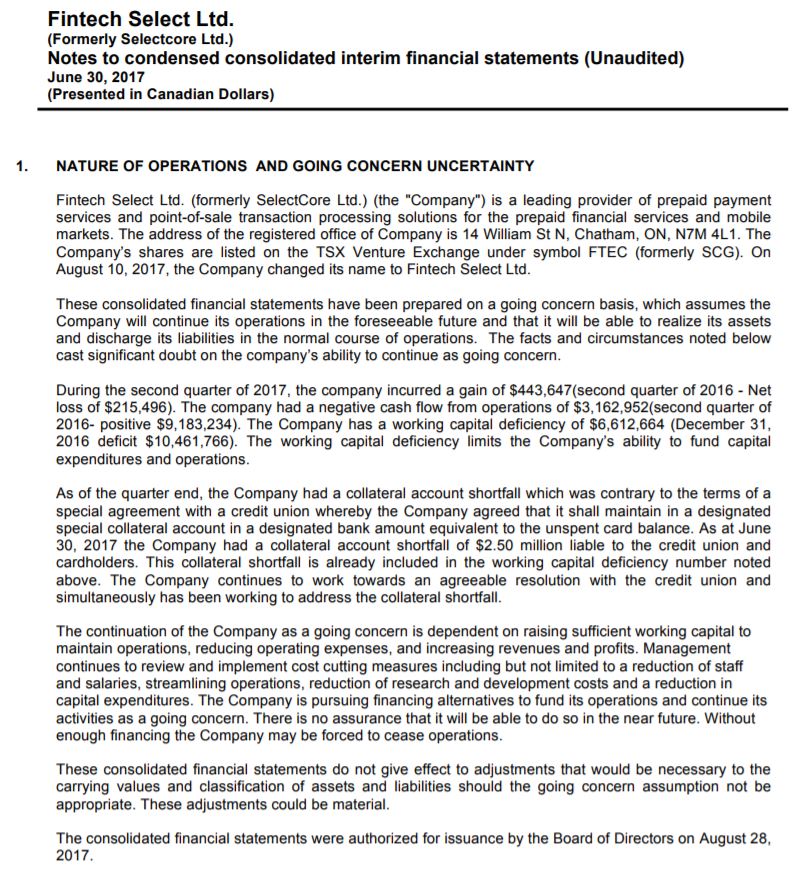

Fintech Select apparently believes the same thing and has identified this as a financial risk. Excuse the large snippet from the June 30th, 2017 interim financial statements. We believe this is something crucial for investors to fully understand.

In fact, the company identified several issues related to their financials that need to be addressed:

- Negative cash flow of $3M

- Working capital deficiency of $6.6M

- Collateral shortfall of $2.5M

- Hints of a future raise

- Potential cease of operations

It should be stated that it is respectable of the company to identify all of these issues. Often times, for fear of losing investors the data will be downplayed. Rather, Fintech Select chose to clearly identify it and put it out in the open. It doesn’t appear investors were paying attention anyways. This is further displayed when on September 28th, 2017 it was announced that a statement of claim was filed against the company for failure to maintain minimum cash balances.

The Market’s Reaction

So, how did the market react to this news? At this point, its what you likely expect. The stock rallied. After being released on the night of August 29th, 2017, the next day Fintech Select hit a new weekly high. This was after climbing for a few days as well. And the reaction to the statement of claim? The stock experienced a bit of a lull. However, there was little positive news of significance released at this time as well. All things considered, it performed extremely well given the news.

If one thing is evident at this point, its that investors need to increase their awareness. This is a company that could cease trading any day due to its current debt load. The core of its business is at risk due to not maintaining minimum cash balances. Yes, cryptocurrency is a hot topic right now, and Fintech Select is doing excellent in that regard. However, if it can’t manage to service its debt, all of that won’t matter.

The silver lining right now for Fintech Select is that in the last few days its stock price has soared. It has made new 52 week highs two days in a row now. If they were smart, they’d announce a private placement immediately to capitalize on this fact. They’d get a better bang for their buck, and investors would undoubtedly jump in due to their latest favourite buzzword. This could potentially eliminate their debt if they played it right. Until then, they are only a moments notice away from ceasing to trade.

Utilize Sedar. Read the reports. Dive deep.

Information for this briefing was found via Sedar, Canadian Insider, and Fintech Select’s website at http://www.fintechselect.com/. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.