BRIEF: Isodiol International – Four Facts to Know

Isodiol International Inc (CSE: ISOL) has been on a tear lately. It has issued news release after news release, driving the value of its shares North. It appears that this company has been firing on all cylinders as of late, and has no intention to slow down. They are set on dominating in their market, and are well on their way to do so with the latest release issued on the evening of December 17.

Previously, we covered Isodiol in an article outlining five things in a “need to know” format. It was our first attempt at such a format, and it was very well received by viewers. So much so, that in honour of this new information released by the company, we decided to issue an updated fact sheet. The previous version can be found here, and it is still accurate. However, that information is now old news, so lets get on with the new stuff!

Michael & Aaron Serruya, co-founders of Yogen Fruz recently bought in to Isodiol International

Iosdiol International recently released details surrounding a strategic financing that closed on November 29, 2017. The financing consisted of 12,183,783 units at a price of $0.74 per unit. Each unit consisted of one full share, and one full purchase warrant with an exercise price of $0.75. The warrant is valid for a full three years. In total, this strategic financing raised just over $9,000,000 for Isodiol International.

Whats the significance of this raise? It was led by the Serruya family – the family responsible for the Yogen Fruz brand, a frozen yogurt franchise company with over 1400 current locations. They also have connections to countless large corporations. For instance Michael was the CEO of Kahala Brands for a period of three years. For those that are unaware, Kahala owns Taco Time, Cold Stone Creamery, Extreme Pita, and a plethora of other franchised food chains. Meanwhile, Aaron is a director for The Second Cup, and co-owns Pinkberry, another frozen yogurt company. Needless to say, these two are extremely experienced in the food sector.

Collectively, Serruya Equity Fund and related parties purchased approximately 7,000,000 shares of isodiol International in this latest round of financing. That’s at a bare minimum, as we are only referencing the common address between a series of numbered companies. Some of these companies were identified as being owned by Serruya family members, while others had little information. However, there are several named family members. Additionally, this same address is present on previous raises, to the tune of at least 1,000,000 shares as well.

Isodiol International recently implemented blockchain technology

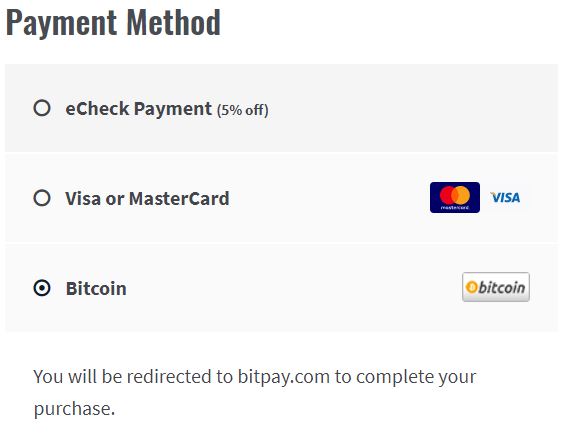

Back in mid October, Isodiol announced that it was looking to implement blockchain technology. The idea behind it, is that it would be used for payment processing as a means of better securing customer information. Furthermore, it would alleviate currency risks for international customers, and open the doors to a larger customer base.

On December 14, it was announced that Isodiol had stayed true to their word. Currently, they have implemented phase 1 of 2 with regards to this initiative. To meet this commitment, they are using BitPay as an alternative provider for processing transactions. BitPay has been in operation since 2011, and has provided the service to its clients for a number of years.

It is expected that this initative will be implemented across all Isodiol brands by the end of first quarter 2018. This will enable all users to utilize cryptocurrencies to pay for Isodiol products.

Industrial hemp is a major focus of Isodiol International

If Isodiol International has made any one thing clear through out their business transactions its this: they are increasingly focused on hemp. This fact has been prevalent in a number of its latest releases, such as the acquisition of Be Tru Organics. Be Tru owns a proprietary line of hemp products, which it formulates and markets itself. These products are focused on the health and well being of the individual. A second example of this would be the recent 25% acquisition of Canadian Natural Pharma Group, a company focused on producing cannabis and hemp extracts.

Most recently, as you likely know, is the acquisition of Biosysnthesis Pharma Group, a company entirely focused on producing industrial hemp. It is also involved in the derivatives of industrial hemp, as well as the pharmaceutical products that it is used in. These products are used in several sectors, including the food and cosmetic industries. The acquisition also includes seven entities that are located around the globe, further strengthening Isodiol’s position on the matter.

Isodiol’s insiders are long and strong

It appears that insiders at Isodiol International are long and strong on the company. During the recent run up that the company experienced, there was minimal insider activity reported.

The only real item of note pertains to Bryan Loree, chief financial officer and director of Iosdiol. He sold 15,000 shares on August 11, at an undisclosed price. However, he then exercised 115,000 warrants on September 25, at a price of $0.25 per share. Furthermore, he then bought an additional 10,000 shares on the public market at a price of $0.275 each. Currently, he holds 1.225 million shares in the company.

In addition to this, Aman Parmar, chairman and director of Isodiol acquired shares on the public market. This consisted of 100,000 units of the company at a price of $0.25 each. The transaction occurred on October 30, 2017. In total, Aman reportedly now holds 600,000 shares of the company.

That’s all we’ve got for you for this round of notes on Isodiol International. Best of luck to long term investors of the company, as this most recent news should have a very bullish reaction to the price of the stock. We’ll also post a quick update for you via our Twitter account once the most recent short data has been posted for the company. This is expected to occur at some point on December 18th. Be sure to keep an eye on us for this data. If there is a large short position currently outstanding, we just might be privy to an excellent squeeze in the next couple trading sessions.

Sometimes the most unexpected companies come out on top. All we can do, is Dive Deep.

Information for this analysis was found via The CSE, Bloomberg, Wikipedia, Sedi, Canadian Insider, and Isodiol International. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.