BRIEF: A Quick Briefing on Friday Night Inc Q1 Results

Friday Night Inc. (CSE: TGIF) investors received a wonderful gift this week in the form of excellent financials. With the reported figures representing the first full quarter under recreational marijuana in Nevada, they serve as an excellent sign of what’s to come for the company. Furthermore, these financials do not include the expanded canopy space the company obtained in early November, which further bolsters future expectations for Friday Night.

Following the release of these positive financials, Friday Night closed the day on December 20 up just under 30%. The stock closed at an even $1.00, after running $0.23. Following the close of the markets, Friday Night Inc was halted, at the exact time Body and Mind Inc (CSE: BAMM) was halted. This further fueled the fire for the company on online communities, as rumours of a merger or acquisition began to circulate.

A Quick Briefing on Friday Night Inc Q1 Results

Friday Night Revenues for Quarter One

Perhaps the most significant item within the financials released this week, are the revenues that Friday Night Inc recorded for the first quarter of 2018. Due to recreational use becoming legal in the state of Nevada on July 1st, unlike Canadian operations, Friday Night has a significant customer base. Furthermore, as a result of a lack of established operations in the state, it gives Friday Night a first mover advantage.

Overall, Friday Night recorded revenues of $2,464,487 for the three month period. Averaged across the three months, it comes to approximately $821,000 in revenues on a monthly basis. With costs of $1.3 million, it equates to 46.01% gross margin.

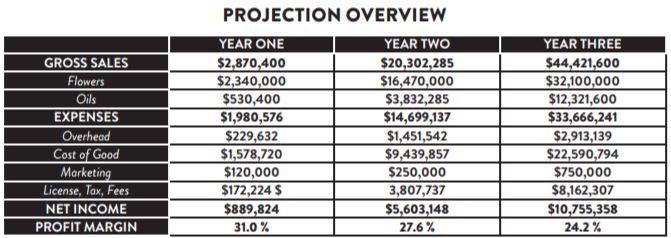

If the company can consistently post similar figures each quarter, we can expect approximately $9.85 million in sales for the current fiscal year. Based on company projections within their investor presentation, this is more than double what the company anticipated. Furthermore, this crude estimate for the fiscal year does not include the recently obtained ten thousand square feet of additional canopy space.

The above projection is from the company’s investor presentation dated “2017”, and is in reference to only the AMA subsidiary of Friday Night Inc. The projection for Infused MFG contains an addition $650,000 for year one. This brings the total revenue projection for the first year to approximately $3.5 million.

Although not explicitly stated in the investor presentation, it is assumed that “year one” is representative of the first full year of Friday Night’s operations. If it is in fact referencing the year ending July 31, 2017, then we are sitting in an entirely different scenario regarding the company’s projections.

Expenses for Quarter One

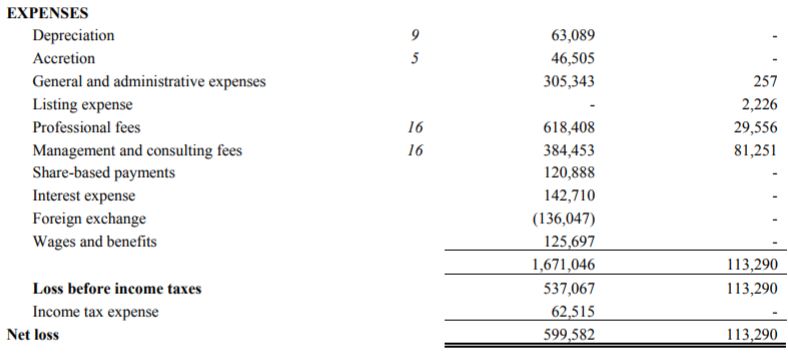

Although the revenues for the first quarter of the fiscal year were spectacular, unfortunately the company still managed to post a loss for the quarter. This was largely due to professional and management fees which were slightly excessive for a single quarter.

Overall, the loss for the quarter came in at just under $600,000. This is disappointing for a company that generated $2.4 million in revenues for the same period. However, there are signs that not all expenses will be recurring.

For instance, the excessive professional fees are addressed by the company in the associated MD&A documents filed to SEDAR. These fees are associated with the two raises that occurred over the quarter, however an exact dollar value for this is not explicitly stated. Referencing the August 16 news release for the first financing, it is indicated that $395,800 was paid to an agent for this raise, in addition to 200 debenture units. It also included 2,155,200 agents options recorded as a transaction cost of $283,661. Furthermore, as per the October 5 release for the second financing, $42,524 was paid as finders fees in addition to 24,000 warrants. It is not clear how the value was calculated for the debenture units and warrants with respect to the professional fees expense line.

Share Structure

Although the company may be beating projected revenues, it leaves a lot to be desired with respect to the share structure. Friday Night has a large outstanding share count, and it is slated to significantly increase over the next several months. This is a result of convertible debenture units that continue to be exercised. Furthermore, it is likely the company will force the conversion of these units shortly provided the current share price is sustained.

For ease of understanding, in our chart above we treated the convertible debenture units as if they had already been converted. This gives investors a better understanding of what the structure will be like in the months ahead. Friday Night expects the debenture units to be fully converted by year end as per their latest MD&A, so we felt this was appropriate. It should also be noted that several warrants may be force converted as well. This will provide sufficient funding for operations and future acquisitions.

With the estimated share count being 182,914,835 units, and the debentures taken into consideration, the current market cap with December 20’s close at $1.00 values Friday Night at $182 million. On a fully diluted basis, its market capitalization is $253 million.

Closing Remarks

Clearly, the market was in favour of the financials released by Friday Night Inc this week. The run up yesterday says as much. Even more, beating company projections was the icing on the cake for these results. However, it’s a shame that the company still posted a loss for the period, given the size of the revenues generated. It may have equated to not even a penny per share loss, but that fact is rather insignificant when the share count is considered.

The saving grace for Friday Night is that a large portion of these costs should be a one time event. Based on the $5,637,152 in cash the company has on hand, there shouldn’t be a raise for a while. Rather, the company can focus on future acquisitions while still maintaining a reasonable float.

With respect to acquisitions, you likely noticed that we didn’t speak to the rumoured merger with Body and Mind. Why not? Because by the time you’re likely reading this, the reasoning behind the halt will already have been revealed. If it does (or did) happen to be related to BAMM, anything we could have said will already be noted in the news release. The short of it, is that they are both Nevada oriented companies. One is focused on growing and manufacturing product, the other is more focused on selling it through dispensaries. If they have joined forces, we’ll speak to it at a later date. Until then, focus on Friday Night in its current form.

Revenues are important. Related expenses are even more important. Dive Deep.

Information for this analysis was found via The CSE, SEDAR, Body and Mind Inc and Friday Night Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.