LGC Capital: A Look Into the Current Share Structure

LGC Capital Ltd (TSXV: LG) is a company that has been at the forefront of the twittersphere for a handful of months now. The company has had loyal investors for several months now, which actually resulted in it being the focus of our first full analysis that we conducted. Since that article in early November, it appears that the popularity of the company has only risen. This is thanks in part to an active social media presence by several members of its executive team.

As a result of this favoritism by many Twitter users, LGC Capital is always present within our newsfeed. Due to this presence, we witnessed this past weekend an exchange between a handful of users wherein they were attempting to place a finger on the current share structure of the company. As many know, this is our specialty here at The Deep Dive. As such, we couldn’t pass this opportunity up.

We’ve spent far more time than we care to admit compiling this data, which was quite the task considering the latest financials are as of June 30, 2017. This in turn resulted in over six months of stock information for us to tediously crawl through in search of answers. However, we think we have what it is your after. Here we go.

LGC Capital: A Look Into the Current Share Structure

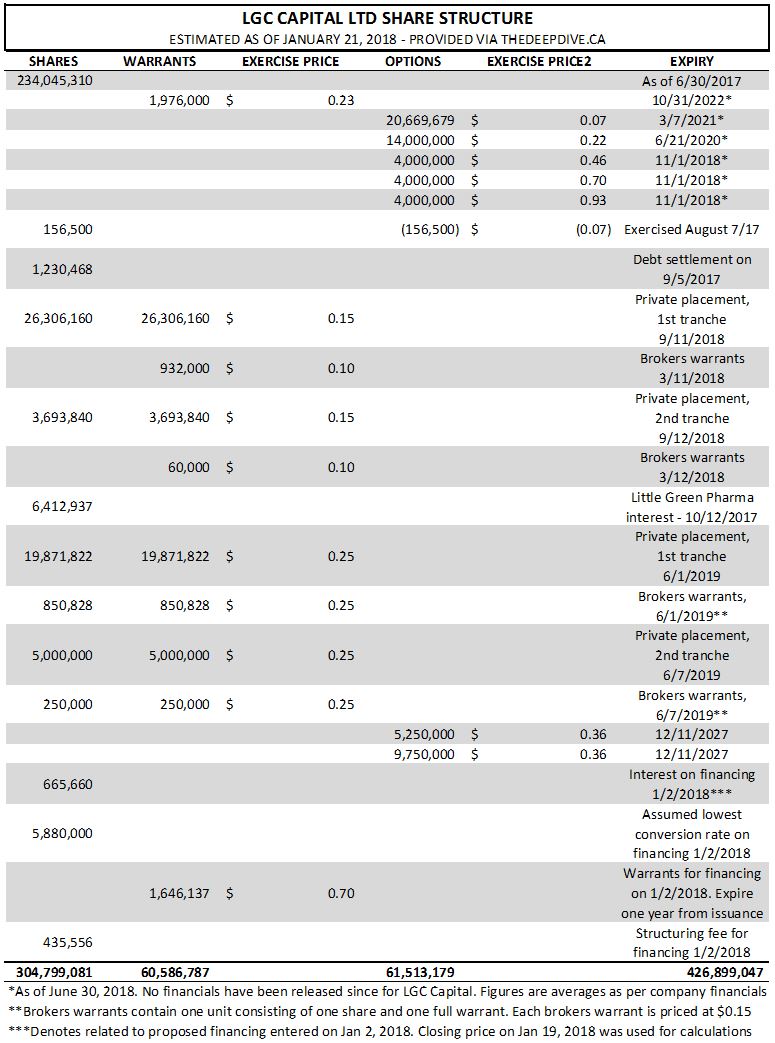

Share Structure of LGC Capital

When we last visited LGC Capital, we didn’t place a whole lot of emphasis on the format in which we presented the following data. Due to this oversight, we had to reexamine all information issued from the company since the date of its latest financials. The data contained below is based on what has been presented by the company in SEDAR filings.

The figure will be off slightly to what is reported by TMXMoney, as we always convert any special warrants. Further to this, we also include any shares that are reserved to be issued in the future. Lastly, it was unclear if any warrants or options had been exercised since the last reporting period.

In addition to calculating out brokers warrants that contain units, we took the liberty of making a major assumption. That assumption, is that the investment agreement that LGC Capital entered into on January 2, 2018, was executed on todays date. For this, we used Friday’s closing price of $0.53 where required for calculations. This was done as a means to demonstrate the impact the financing has on the company’s share structure. The agreement and subsequent cash injection is expected to occur on or before January 31, 2018.

With regards to this agreement, there are several complications involved for the proper calculation of what the impact will be for LGC Capital’s share structure. They include share issuance for interest, share issuance to cover the value of the loan, warrant issuance upon the advance of funds, and a structuring fee payable on the advance of funding. In turn, it has the impact of an estimated 6.98 million shares being issued, as well as 1.6 million warrants in exchange for a funding of roughly $2.94 million Canadian. When calculated out, the financing is essentially at a rate of $0.34 per share.

With regards to current derivatives outstanding, there are 60.5 million warrants outstanding in addition to 61.5 million options. These are estimated only, as it is unclear just how many of these have been exercised. The data is thin in this regard due to the stretch of time since the latest financials were released by the company.

In total, it is estimated that there are 304,799,081 shares outstanding for the company, which translates in to a market capitalization of $161.5 million based on a closing price of $0.53. When looking at the estimated fully diluted figure of 426,899,047, LGC Capital’s valuation jumps up to $226.3 million.

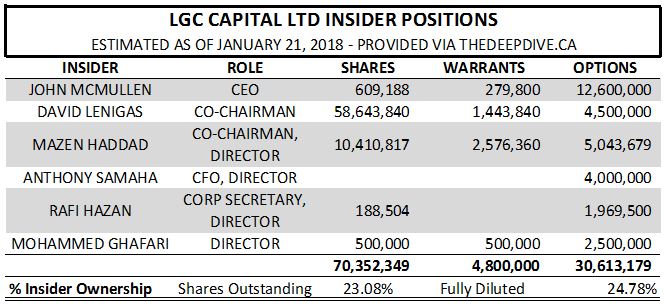

LGC Capital’s Insider Positions

Even with the excessive dilution that LGC Capital current faces, its insider positions are actually quite strong. On a fully diluted basis, this is largely due in part to fifteen million options that company executives determined they had earned in early December. The figure was so large, that they actually had to increase the company’s stock option plan to accommodate the large amount of options issued. Of the 12.1 million options this made available for issuance, 9.75 million were issued. The remainder were able to be issued under the previous stock option plan that was in place.

In total, company insiders currently have control over 23.08% of the outstanding share count, which was reconciled above. On a fully diluted basis, largely due to the recent options issued, this figure actually increases to 24.78%. Option issuance grievances aside, the current holdings of company insiders represent a high level of strength in the company.

Closing Remarks

LGC Capital currently demonstrates an extremely dedicated shareholder base. This much is evident on numerous social media platforms, wherein investors are quick to defend any negativity projected towards the stock. The company certainly has a lot going for it, with regards to its numerous investments around the globe. However, investors need to keep the company in check with regards to its dilution. It’s often forgotten by young investors that the frequent dilution also has an impact on their ownership in the company.

With regards specifically to its share structure, the company is currently limited in terms of upward momentum. Stating as much will likely scorn a few investors, however it needs to be blatantly stated. The recent series of financing conducted by the company at a low share price will provide significant downward pressure on the equity.

Of the 60.5 million warrants currently outstanding, 59 million are currently in the money, at a price less than half of the most recent closing price. Further to this, half of them became free trading as of last week. Be aware of the implications this has for your investment, and act accordingly if required.

Having faith in a company is great, but don’t let it blind you. Dive Deep.

Information for this analysis was found via Sedar, TMXMoney, SEDI, and LGC Capital Ltd. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.