Liberty Health is Primed for a Takeover – By Green Growth Brands

For those of whom are following the drama of Liberty Health Sciences (CSE: LHS, OTCMKTS: LHSIF), it has become clear that the company has been priming itself as a takeover target. For avid potstocks followers, it seems clear that this takeover is to come via Green Growth Brands (CSE: GGB, OTCMKTS: GGBXF). The latest moves by management at Liberty Health only seems to reinforce this theory.

As a quick refresher, over the last month Liberty Health has seen a complete refresh of both its management team as well as its board of directors. Vic Neufeld, John Cervini, Ian Mckinnon, and John Hicks have all vacated their roles on the BoD recently. Following the news released late friday that CEO George Scorsis and CFO Rene Gulliver have also now departed, the C-Suite at Liberty has done a complete 180 turn. You can read more on that here.

Now that Aphria has given up its interest in Liberty Health entirely by terminating it’s option in the company, the company appears to be lost without direction. If you recall, Liberty Health came to exist through Aphria’s desire to enter the US market two years ago. They were behind all assets that the company currently owns, including Schottenstein Aphria in Ohio, and Chestnut Hill Tree Farms in Florida. Without the influence of Aphria behind it, the company is now in a much weaker position to execute. Thus, it has become a prime takeover target given current assets.

Green Growth investor comparisons

The strongest argument that can be made for Green Growth brands to purchase Liberty Health, undoubtedly, is that of its investor base. This much is clear to anyone that even remotely follows the sector. The Schottenstein family, one of the richest in America, is the financial backer behind Green Growth, and is responsible for taking the company public – to the point of hand picking members of management from other equities in which they own.

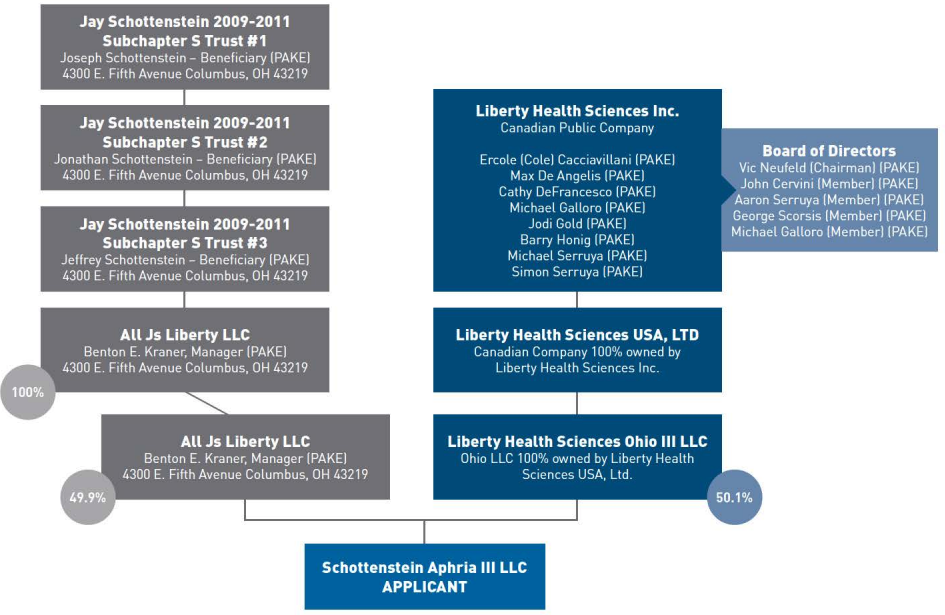

Coincidentally, the Schottensteins also are responsible for the Ohio based operations of Liberty Health Sciences through that of Schottenstein Aphria LLC, of which there are four separate entities. In each case, Liberty Health owns exactly 50.1% of the equity, with a version of “All J’s xxx LLC” owning 49.9% of the equity.

If you recall, All J’s Greenspace LLC is the firm utilized to bring Schottenstein Arviv Group Inc, later renamed Green Growth Brands LLC, public. Rather than use the same entity for all transactions, the Schottenstein’s establish separate entities utilizing the “All J’s” format, likely for tax purposes.

The Schottensteins currently hold 37.5mm, or 20.47% of the common shares of Green Growth Brands on an undiluted basis. In addition to this, they hold 38,194 or 100% of the PV (proportional voting) shares of GGB, which each represent 500 votes. As a result, they are the largest shareholder of Green Growth.

In addition to the Schottenstein’s, it should be noted the role that numerous individuals from the Serruya family play in Liberty Health Sciences. The largest investor of Liberty Health is that of Samuel Serruya, who owns over 64mm shares of the firm. Meanwhile, Aaron Serruya is on the board of directors. Several others from the family are also listed as founding investors in Liberty Health. This is significant, in that as far back as 2013 there are noted connections between the Serruya family and the Schottenstein family, such as joint ownership of Cold Stone Creamery.

Lastly, it should also be stated that Adam Arviv was an original investor in Green Growth Brands, and has also participated in Liberty Health Sciences private placements. Although not a majority owner in either instance, he’s a recognizable figure that has some weight behind his name within the sector.

Location, location, location

In addition to the noted investor connections, lets elaborate on an important aspect: location. The importance of this is two fold, in that this applies to operational locations, as well as head office locations.

The corporate head office of Green Growth Brands is listed as being at 4300 E 5th Ave Columbus, OH 43219. Notably, the building at this facility is the headquarters for Schottenstein Property Group. This is also the listed address for the Schottenstein Aphria entities, with the recently awarded processor license listing next door, 4296 E 5th Ave, as its physical location.

More importantly, however, is the operational locations of Liberty Health Sciences and Green Growth Brands. Little overlap exists between the two entities as it currently stands. Currently, Green Growth is only operational in Nevada and Massaachusetts in terms of its cannabis focused operations. In the Nevada locale, it currently has two dispensarys online, with an additional seven being recently awarded. Within Mass., the firm has a total of three licenses, however it is unclear whether any of them are currently operational.

In total, Green Growth has twelve dispensaries that are either open or licenses are held for. This is five locations short of their year end estimate of seventeen as per their investor presentation.

Meanwhile, Liberty Health Sciences currently has operations established in Florida, Massachusetts, and Ohio. In the case of Florida, Liberty Health has nine dispensaries open for business, with several more set to open in the near term. In Ohio, under the joint ventures of Schottenstein Aphria, one dispensary is live while a processing facility is also underway. Finally, an investment has been made in the Mass. market for 75% ownership of a dispensary and cultivation facility.

Separately, each company has achieved notable revenues and operations as of the latest reporting period. However, combined they could transform into a true multi state operator with operations across four states. This would be beneficial in that Green Growth could implement its strong marketing prowess across Liberty Health’s dispensary network. Given the strong revenues at its current dispensarys, Green Growth could transform the current operations of Liberty Health to drastically increase revenues and margins at these locations, amplifying investor returns.

In the case of Green Growth, they would gain valuable access to markets in which they currently have no presence, including its home state of Ohio. This would be the easiest way in which they can grow their cannabis dispensary portfolio, while being able to remain focused on their CBD operations at the same time. Not to mention the fact that this would put them on pace for their FY2020 location projections a full year in advance.

Realism on Green Growth’s Aphria attempt

Now, there are some obstacles in place before the suggested transaction could proceed. Most significantly, is the outstanding bid for Aphria that will overhang until the end of May at the earliest. When it was first proposed, one of the bull cases towards the deal was specifically what we’ve previously addressed – the Liberty Health Sciences assets. With Aphria since terminating the option to have its ownership returned, the value of the deal for Green Growth Brands has decreased significantly.

Speaking specifically to Green Growth, the assets of Aphria are relatively undesirable now that Liberty Health has been removed from the equation. GGB is focused on currently building a U.S. based behemoth that is a heavyweight in both cannabis and CBD. Meanwhile, Aphria now represents international assets of heavily debated worth, in addition to weak Canadian brands that are likely to be insignificant in US markets.

Clearly, Aphria has Canadian based assets as any APHA bull would point out that largely makes up the stated value of the firm. However, to Green Growth these assets are of marginal value – due to the federal status of cannabis, the cannabis grown in these large facilities cannot be imported to the US. Further, the Canadian market is marginal in size and will likely soon be oversaturated, akin to markets in Oregon and Washington State. Sales projections in this market appear to so far have been overstated sector wide, while pricing of cannabis products is set to decline over the next 2-3 years as more and more massive facilities come online.

Add to this a shareholder base that has minimal desire at best to be acquired by a US operator, and its grounds for forgetting about the potential merger altogether. And truth be told, without Aphria’s US assets, it’s hard to make a bullish case for this acquisition that makes logical sense. Instead, Green Growth Brands would be much better off setting its sights on that of Liberty Health Sciences, and setting foot on its path of becoming a true multi state operator.

Information for this analysis was found via Sedar, Liberty Health Sciences, Aphria Inc, and Green Growth Brands. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

As the founder of The Deep Dive, Jay is focused on all aspects of the firm. This includes operations, as well as acting as the primary writer for The Deep Dive’s stock analysis. In addition to The Deep Dive, Jay performs freelance writing for a number of firms and has been published on Stockhouse.com and CannaInvestor Magazine among others.