Village Farms Reports Q2 Earnings

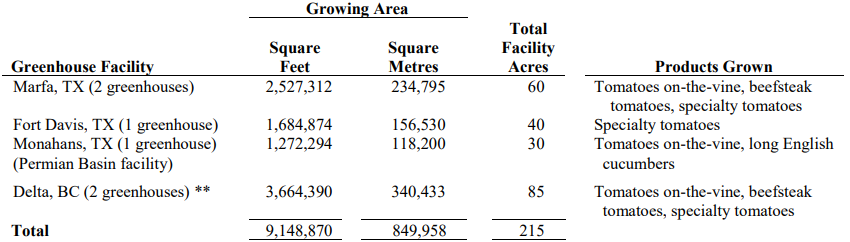

Village Farms International (TSX: VFF) is one of the largest producers, marketers and distributors of greenhouse-grown vegetables in North America. These products are grown in agricultural greenhouse facilities located in British Columbia and Texas. They currently own the following facilities:

A Quick Background on Village Farms

In June 2017, Village Farms and Emerald Health formed a joint venture called Pure Sunfarms for cultivation of cannabis. Both Village Farms and Emerald each own 50% of Pure Sunfarms. The JV’s total production area is 2.2 million square feet and with annual cannabis production potential of approximately 150,000 kilograms.

The company has second a joint venture with Nature Crisp named VFH, focused on outdoor cultivation of Hemp and CBD extraction in various states. Village Farms is expecting to contribute $15M towards this venture will own 65% of the JV.

The company has a third Joint Venture with AV Hemp focoused on outdoor cultivation of hemp and extraction of CBD in Colorado. The joint venture, AVGGH, will be 60% owned by the Company, 35% owned by AV Hemp, and 5% owned by VFH. Village Farms is expecting to lend AVGGH approximately $5M for startup costs at an interest rate of 8%/annum.

The Earnings

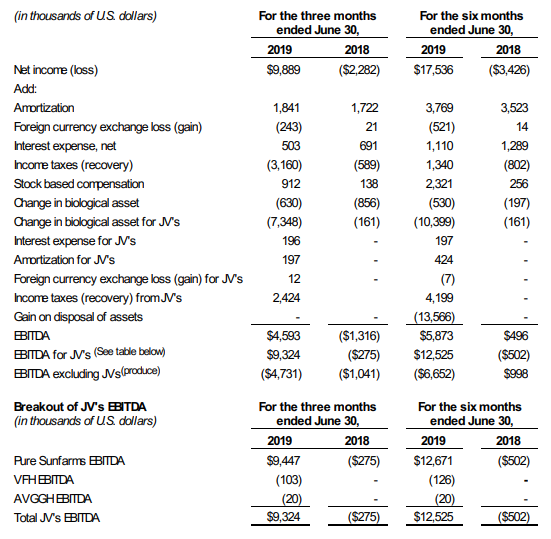

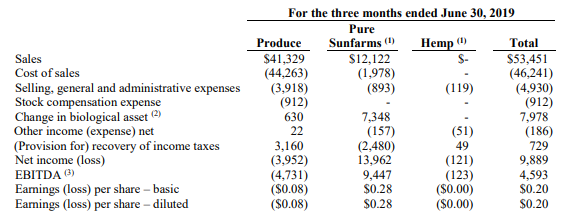

It was a very positive quarter for Village Farms. In the quarter, they achieved net income of $9.9M, which was largely helped by their 50% share in Pure Sunfarms which brought the company $14M in revenue ($28M total for the JV). EBITDA improved to $4.6M which included a contribution from Pur Sunfarms of $9.4M ($18.8M total for the JV).

Some of the key highlights from the quarter include:

Hightlight from the Second Quarter Financial Results for Pure Sunfarms

- Sales, which consisted entirely of dried cannabis sold primarily to other licensed producers, increased 125% QoQ to US$24.2 million

- Cost of goods sold (“all in cost”) per gram was US$0.49 per gram

- Gross margin was 84%;

- Net income increased 226% sequentially to US$27.9 million

- Pure SunFarms third consecutive quarter of profitability

- EBITDA increased 194% sequentially to US$18.9 million resulting in an EBITDA margin of 78%

Investors looking at those highlights are probably wondering how do you have a gross margin of 84% and an EBITDA margin of 78%, the answer lies in the tiny SG&A costs:

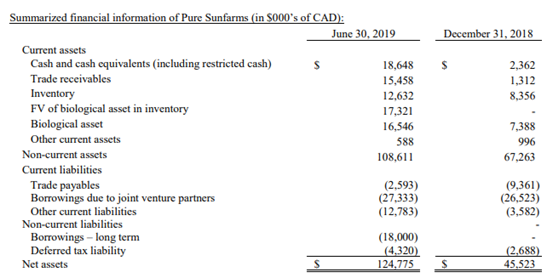

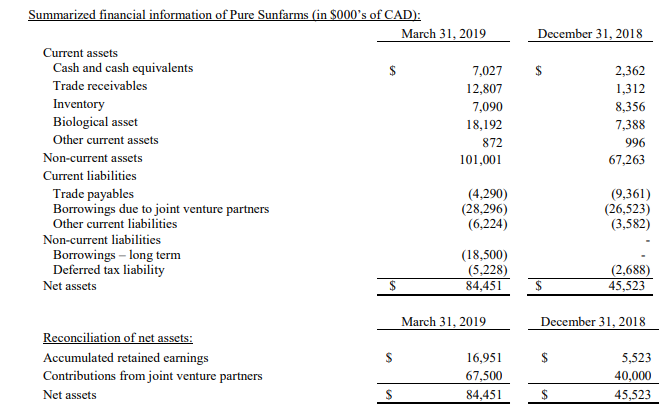

For those wondering about Pure Sunfarms Inventory, we pulled up the following from Note 7 in the financial statements from this quarter and last:

The company had Inventory and Biological Assets grow 84% from $25.3M to $46.5M during the quarter.

Village Farms closed yesterdays session at $17.60

Information for this briefing was found via Sedar and Village Farms International. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

SmallCapSteve started blogging in the Winter of 2009. During that time, he was able to spot many take over candidates and pick a variety of stocks that generated returns in excess of 200%. Today he consults with microcap companies helping them with capital markets strategy and focuses on industries including cannabis, tech, and junior mining.