Canada’s Fall 2025 mortgage report shows expanding originations, modestly improving risk metrics, and stabilizing debt ratios, while elevated household leverage, surging renewals, and regional delinquency increases keep systemwide pressures high.

In H1 2025, lenders grew mortgage originations versus H1 2024 as insured mortgages and refinances surged. Chartered banks issued $291 billion in newly extended mortgages, up from $189 billion a year earlier. Same-lender renewals more than doubled, driven by large 2020–2021 cohorts reaching maturity along with shorter-term loans from 2022–2023. Removing the stress test for renewal switches sent uninsured switches up 67% to $19 billion.

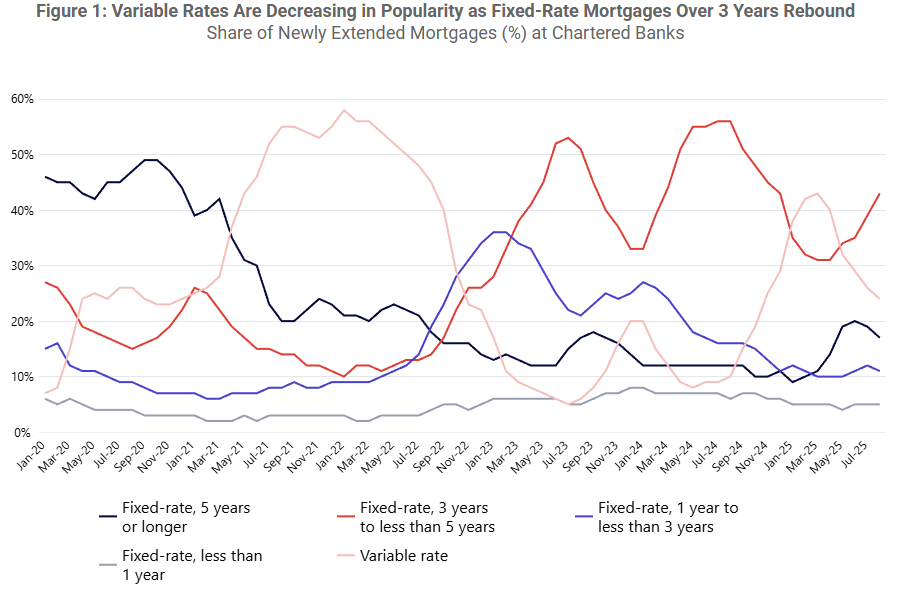

Borrowers shifted sharply back to fixed-rate terms. By August 2025, fixed terms between three and under five years accounted for 43% of newly extended mortgages, while five-year-plus terms remained low at 17%. Variable-rate mortgages continued their decline, reversing the 2024 trend as borrowers avoided rate risk during economic uncertainty.

Residential mortgage debt reached $2.3 trillion in August 2025, up 4.8% year over year. Household disposable income rose 4.6% in Q2 2025, keeping the debt-to-income ratio flat at 181.8% after seven quarters of declines. Debt as a share of GDP stayed high at 100.2%.

Market share concentrated further as the Big 6 expanded outstanding mortgage share by 2.6 percentage points in Q1 2025 due largely to RBC’s acquisition of HSBC Canada, while “other chartered banks” fell 1.4 points. In originations, the Big 6 reached 59% share and credit unions 18%.

Risk metrics for new uninsured borrowers improved modestly. The share of originations with total debt service ratios above 45% fell from 33.8% in Q2 2023 to 31.3% in Q2 2025. But more than 60% of new uninsured mortgages carried amortizations over 25 years for the fourth straight year, increasing lenders’ loss severity in default.

Credit unions posted 20% year-over-year originations growth for the four quarters ending March 2025, powered by refinances and switches. Insured refinances climbed 103%, insured switches 187%, and insured purchases 25%. Seventy-eight percent of credit-union originations were uninsured.

Alternative lenders grew faster than the national average while reducing risk. Assets under management at the top 25 mortgage investment entities rose 6.5% to $11.4 billion in Q2 2025. Debt-to-capital ratios fell to 19.2%, foreclosure rates eased to 2.9% and Stage 3 impairments dipped to 4.9%, even as exposure tilted further toward single-family loans at 64.1%.

Delinquency rates diverged sharply. National mortgage delinquencies fell slightly to 0.22% in Q2 2025 but stayed above 0.19% a year earlier. Ontario rose to 0.23%, exceeding the national average for the first time since at least 2012, while Toronto jumped 60% to 0.24%. British Columbia rose from 0.16% to 0.19%.

More than 750,000 mortgages will renew in late 2025, followed by 1.15 million in 2026 and 940,000 in 2027. The average five-year uninsured rate rose from 2.36% in 2020 to 3.95% in 2025, ensuring most borrowers still reset higher despite recent rate declines.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.