The market for nickel, one of the most important elements used in electric vehicle (EV) batteries, has been broken for the last month, and no ready fix looks to be in the offing. Amazingly, no entity really benefits from this.

It really is no exaggeration to say that the inability for nickel producers to effectively hedge their future output will translate into higher prices that EV makers will have to charge for their models, as OEMs must account for higher and more volatile nickel prices in vehicle pricing. In turn, prospective customers could face some degree of sticker shock, prompting a slower transition to the energy efficient vehicles than many industry watchers expect.

The reason for all this traces to a nickel short position of about 150,000 tonnes that China-based Tsingshan Holding Group established on the London Metals Exchange (LME) earlier this year to quasi-hedge at least some of its nickel production. The LME is (was?) known as the foremost trading and price discovery venue for industrial metals. Tsingshan, China’s leading nickel producer, is led by Xiang Guangda, a politically well-connected tycoon.

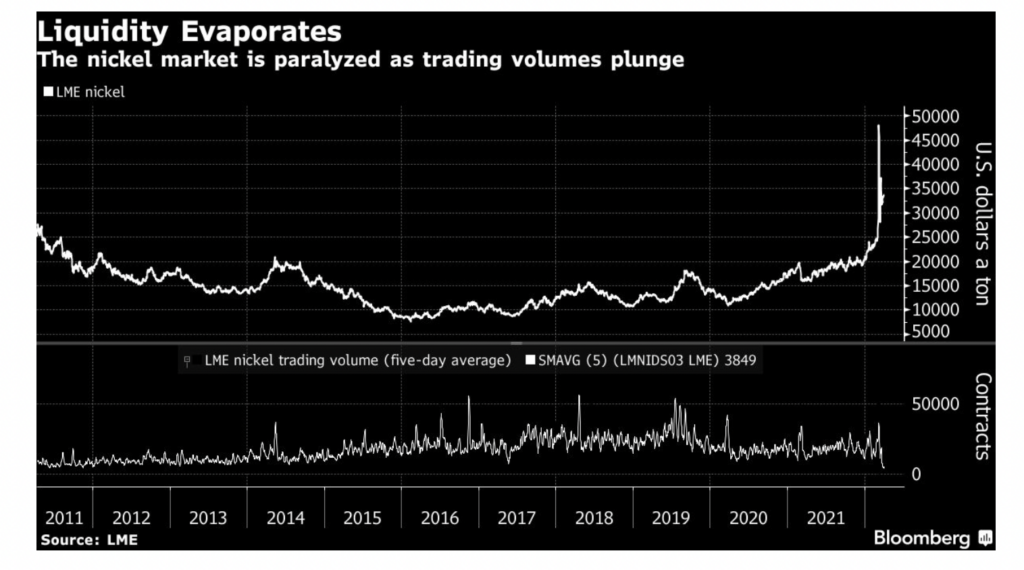

Russia’s invasion of Ukraine provided a catalyst for nickel prices to move sharply higher in early March, and rumors of a short squeeze provided even more impetus. Prices spiked to US$100,000 per tonne on March 8 as Tsingshan faced mounting margin calls on its short position. The company faced a reported US$8 billion margin call based on the size of its nickel short and the all-time high price of the metal.

In an unprecedented decision, the LME decided to retroactively cancel about US$4 billion in trades agreed to by buyers and sellers at the highest prices in the name of market stability. (Imagine the outrage of a typical trader if he/she completed a very profitable stock trade on the TSX, and then the TSX decided to invalidate the trade after the fact.) The LME then decided to close its nickel futures market for more than a week.

Tsingshan was able to utilize its political connections to renegotiate its margin contracts with major banks (which reportedly included JP Morgan), such that the company is now pressured far less by upward movements in nickel prices. The LME subsequently reopened nickel trading, and nickel has settled at around US$30,000 a ton, still much higher than before the short squeeze and a price last consistently seen in the markets in mid-2007.

Not surprisingly because of the more lenient margin contract terms and the cold reality that attempting to cover at current prices would lock in a substantial loss, Tsingshan reportedly still has about a 120,000 tonne short position. Also contributing to the company’s being able to stubbornly maintain its position is a new LME rule that allows an entity which has a short position due for delivery and cannot deliver the physical nickel to simply pay a fee to roll the contract over. (This LME rule looks even more suspicious when one considers that Tsingshan does not produce Class 1 nickel, the only type of nickel the exchange accepts for delivery on a nickel futures contract.)

Taken together, the changes implemented at the LME and the lenient revised margin terms offered to Tsingshan by banks have caused liquidity to dry up in the nickel market. Nickel contract trading volumes (see the lower of the two graphs in the figure below) are the lowest they have been in at least a decade – and at a time when physical nickel demand is at its highest. Furthermore, nickel prices no longer seem to move on fundamental supply-demand developments.

None of this is a positive for nickel producers which want to reach long-term supply deals with EV makers and quite understandably want to lock in the profitability of those contracts. Nor is it a constructive development for EV OEMs, which very well may have to pay higher prices for nickel and attempt to pass those higher costs on to consumers.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.