Yesterday, investors in ABcann Global Corporation (TSXV: ABCN) received an operational update, which followed a recent close of a financing. Within, it outlined several key metrics of the company in addition to the go-forward path that the company has elected to take. Initially, this was greeted with optimism from investors.

However, by midday the tide had quickly turned in favour of the bears. What was originally viewed with optimism for one reason or another quickly turned to pessimism. After taking a look at the company and what it has to offer, we aren’t entirely certain why the release was taken negatively. Perhaps it was just an issue of investors being dissatisfied with progress to date, or the lure of quicker returns elsewhere.

Let’s take a look at what the operational update has to offer.

ABcann Global: A Dive into the Operational Update

The most significant piece of the operational update, in our opinion, was the current cash position that ABcann is privy to. According to the filing, the company has over $135 million sitting in the bank, waiting to be utilized. Of these funds, roughly $75 million is the result of a recently closed financing conducted by the company. In total, the company intends to allocate the funds to four specific areas of focus.

- Expansion of the current facilities to 500,000 square feet, which will provide roughly 32,400 KG of dried cannabis on an annual basis

- Focus on the branding and innovation of its ABcann Medical products as well as its recreational offerings

- Expand the recently acquired Harvest Medicine cannabis clinics to other cities and regions

- Develop strategic partnerships in the industry

1. Expansion of current facilities

In regards to its expansion projects, two expansions are presently underway. The first of which, is the expansion of its original facility to a total of 30,000 square feet. At the time of completion, it will have an estimated 1,400 KG per year annual output of dried cannabis.

The second is a new facility located just down the road from its current operations. Situated on 65 acres of land, the new facility build out is a bit complicated. Repeatedly issued news releases indicate the company is somewhat indecisive on just how big the facility will be. What began as 71,000 sq ft grew to be first 100,000 sq ft, and then 150,000 sq ft. The latest investor presentation now pegs it at 470,000 sq ft, with an annual capacity of roughly 31,000 KG. What has statyed consistent however, is the company statement indicating that the facility can reach a maximum expanded size of 1.2 million sq ft.

There is however, a discrepancy present in the production figures. On May 29, it was announced that ABcann had partnered with Cannabis Wheaton (TSXV: CBW) to assist in funding a 50,000 square foot expansion to the facility that was at the time intended to be 100,000 sq ft in size. Within the news release, it indicated that CBW would be privy to 50% of the cannabis grown in this expansion area. It then indicated that this would amount to 8,000 KG for CBW on an annual basis. Thereby, it infers that this 50,000 sq ft expansion would be producing 16,000 KG of cannabis annually.

Utilizing this same rate of production per square foot from this deal, the facility in whole at 470,000 sq ft should be producing closer to 150,400 KG annually. A figure that is nowhere near the current estimate of 31,000 KG.

2. Branding and product innovation focus

One major item that ABcann Global has elected to focus on, is product innovation. This is due to the increasing revenues that can be generated from value added products or processes. Within the current market, many players are of the belief that cannabis will quickly become a low-margin cash crop as a result of oncoming growing capacity. In order to generate higher revenues as well as higher margins, innovation is required.

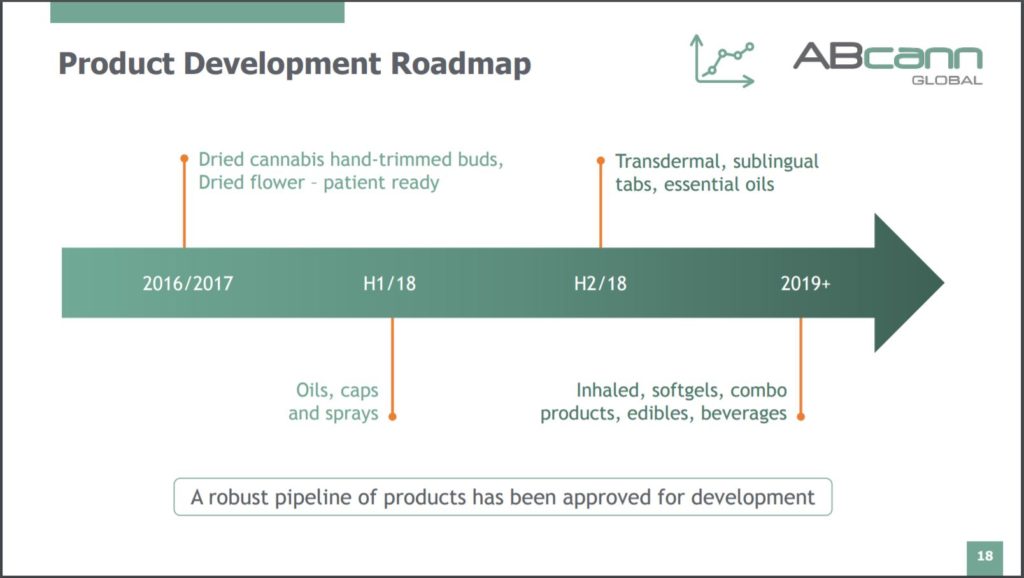

In that sense, ABcann has elected to focus on the means of consumption that users of cannabis may partake in. They have developed a road map, as seen below, on how they plan to satisfy this demand from the market.

Speaking specifically to the timeline the company has given itself, it is relatively on track. It currently sells both hand-trimmed and “patient ready” dried cannabis through its ABcann Medical subsidiary. The next step, is to develop oils, caps, and sprays. Early this year the company acquired it’s license to process cannabis oil, and is now awaiting the license to sell these products. In relation to the given timeline, the company expects to have it’s oil sales license by the end of Q1 2018. Given the current date, that should be any day now.

Following this, will be the focus of bringing to market transdermal, and sublingual methods of consumption. In this regard, they may be best off to partner with an experienced vendor in the industry, such as Delivra Corp (TSXV: DVA), than to try and reinvent the wheel.

3. Expand the Harvest Medicine subsidiary

For those of whom may be unaware ABcann Global recently acquired Harvest Medicine, a medical cannabis clinic. It’s principal operations are focused on Calgary, Alberta wherein it has seen much success in a short period of time. Between it’s opening date in February 2017 and the time of the ABcann acquisition, it managed to amass over 8,500 registered and active patients. Furthermore, this client acquisition rate is currently averaging 1,200 new clients on a monthly basis.

Due to the rapid success this company has seen with one facility, ABcann aims to replicate this success in cities across the country. Within the recently updated investor presentation, the company explicitly states that four new clinics are currently planned. However, on the adjacent map there are ten cities outlined leading us to believe that a rapid expansion plan is underway currently.

In terms of funding, as part of the $3 million acquisition ABcann Global is to utilize $1.5 million in the expansion of the subsidiary in terms of current offerings as well as operational clinics. Given the companies current cash position, we wouldn’t be surprised if more capital was allocated here.

Closing Remarks

If you didn’t notice, we skipped the final cash allocation bucket as outlined by the company. Given that it is for developing strategic partnerships, any commentary would largely be a best guess scenario that provides no material benefit to investors. Therefore, we can conclude our analysis of where ABcann has proposed to spend its current cash horde.

If you are looking for answers on why the value of the stock my have taken a sharp turn South during midday, we don’t have a full answer for you. It could be any number of factors, such as the reduced yield expectations, or the cash outlay that is still required of the company. It could also be the result of traders taking a step away as well, which does happen from time to time after news is issued. In any event, if you’re investing in a long term position be confident with your investment picks. Don’t sweat the day to day price movement of a stock.

Be confident in your investment, and in your due diligence. Dive Deep.

Information for this analysis was found via Sedar, TMX Money, and ABcann Global Corporation. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.