Demand for rare earths is heating up, with Aclara Resources (TSX: ARA) revealing this morning that it has had a major investment at the project level into a Chile-based rare earths project.

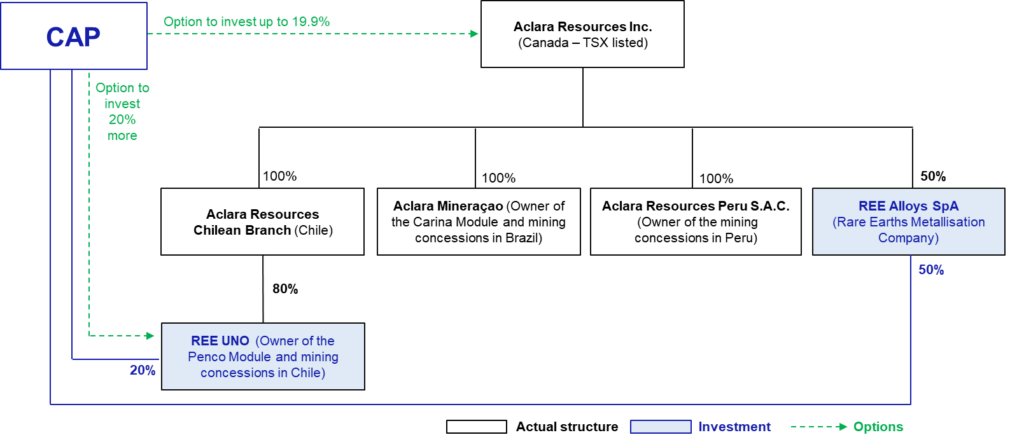

The investment, which comes from CAP S.A., a Chilean conglomerate, will see US$29 million invested into REE Uno SA, the subsidiary which holds Aclara’s Penco Module project and other mining concessions in Chile. The investment is good for a 20% stake in the subsidiary, and is to be made in three installments over a period of three years.

The tranches will see US$9.7 million invested upon closing, US$12.5 million invested in January 2025, and US$6.9 million in January 2026.

The initial investment values the subsidiary at US$116.5 million.

The major investment also comes with an option to invest an addition US$50 million for an additional 20% equity interest, once environmental permits have been received. A three year option also exists for CAP to take up to a 19.9% interest in Aclara.

Finally, the two parties have agreed to launch a joint venture for the development of metals and alloys for the rare earths permanent magnet industry.

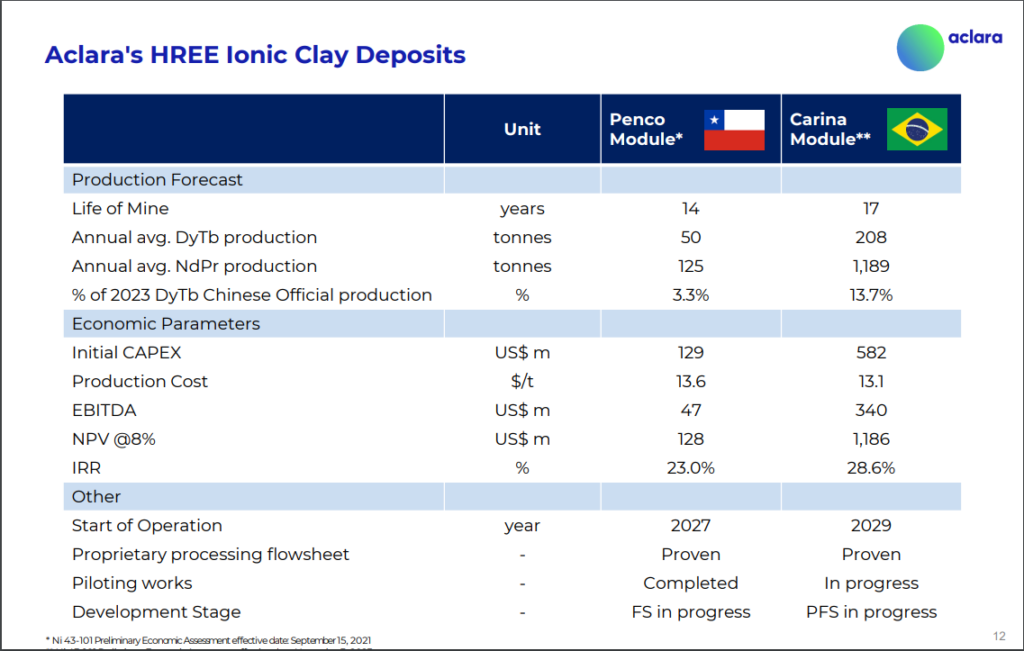

The Penco Module project currently has an estimated net present value (8%) of US$128 million, based on a preliminary economic assessment completed in September 2021. The project contains measured and indicated resources of 62.9 kilo tonnes of contained TREO.

Aclara Resources last traded at $0.53 on the TSX.

Information for this analysis was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.