Tomorrow, Acreage Holdings (CSE: ACRG.u) reports their first quarter 2020 financials after the close of markets, which covers January 1st to March 31st. Here’s the ranges and estimates that analysts are expecting for this upcoming quarter through to current third quarter 2020 estimates.

Acreage currently has exposure in 19 different states with facilities in 12 that total to 679,000 square feet. The company also has 30 stores open over 13 different states.

As of June 24, eight analysts cover the multi state operator. Seaport Global’s analyst Brett Hundley has the highest price target at U$14, nearly a 500% upside along with a Buy rating on the stock, while the lowest price target comes from Beacon Securities analyst Russell Stanley with a U$4.25 price target, which is only an 80% upside while also having a Buy rating on the stock. Out of the eight analysts who now have a rating on Acreage, six of them are Buys, while only two of them are market performs. There are currently zero sell ratings.

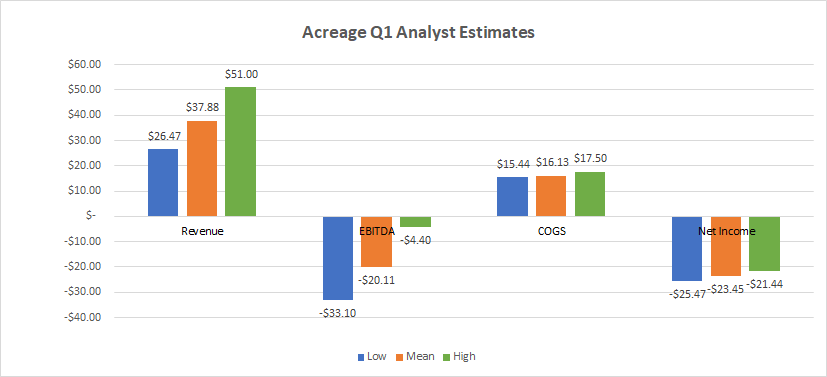

Now before we cover the estimates for Acreage’s Q1’20 Revenue, EBITDA, COGS and Net Income, we need to warn readers that even though 8 analysts are covering this company, the analysts that give estimates for each item are between 2 and 5 which means the forecast is in limited in quantity – and not necessarily a full spectrum of estimates.

Surprisingly there is only little variance in 3 out of the 4 items covered, with the most significant variance being in EBITDA. Here,MKM Partner’s analyst William Kirk estimates -$4.4 million EBITDA, 72% above the current mean estimate of -$20.11 million.

Analysts have a mean estimate of $37.88 million in revenue this quarter, which would be a +80% increase quarter over quarter (QoQ). In terms of estimate ranges, the highest rating comes in at $51 million, which would be a +142% increase QoQ and the lowest estimate comes in at $26.47 million.

With how the stock has been trading recently, down ~61% year to date, ~26% month to date and basically being flat quarter to date, alongside the multiple raises they have had to do to keep operations afloat (which includes taking a 4 month loan with 60% interest), it’s expected estimates, price targets and ratings will likely be modified following quarterly results.

Acreage Holdings last traded at US$2.32 on the CSE.

Information for this briefing was found via Sedar, Refinitiv and Acreage Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.