Former WeWork CEO Adam Neumann has risen, and he’s come to tokenize carbon credits. His tech firm Flowcarbon just raised US$70 million in a recent venture capital funding round and the sale of its carbon-backed token.

The funding was led by Marc Andreessen and Ben Horowitz’s a16z crypto venture firm and also includes General Catalyst, Samsung Next, Invesco Private Capital, 166 2nd, Sam and Ashley Levinson, Kevin Turen, RSE Ventures, and Allegory Labs.

Flowcarbon was founded by Neumann and his wife Rebekah, alongside CEO Dana Gibber and two other members, Caroline Klatt and Ilan Stern.

“There are powerful economic incentives to destroy and degrade critical natural landscapes around the world, but the voluntary carbon market is a brilliant financial mechanism that creates a counterbalancing incentive to reforest, revitalize and protect nature,” said Flowcarbon CEO Dana Gibber.

Around US$32 million of the total proceeds from the funding came from venture capitalists while the remaining US$38 million was raised from the sale of Flowcarbon’s carbon-backed crypto token Goddess Nature Token (GNT). The token is said to launch on the Celo blockchain, which the company already earmarked US$10 million of GNT to offset the latter’s emissions.

“The carbon market is extremely opaque and we believe demand for offsets is rapidly outpacing the speed at which supply can be increased, especially for nature-based projects,” said a16z crypto General Partner Arianna Simpson. “Tokenization is an obvious solution.”

Flowcarbon takes a 2% tokenization fee, said Gibber, compared to around 30% cost of selling carbon credits in the traditional manner.

Neumann’s return to the investing scene follows after he resigned from WeWork, which he co-founded. The controversial Israeli-American businessman’s stint leading the coworking spaces firm has been marred with delayed IPO plans, a sexual harassment lawsuit, and an alleged marijuana trafficking incident. Prior to his resignation, some WeWork directors were seeking to remove Neumann as CEO after “a tumultuous week in which his eccentric behavior and drug use came to light.”

His entry into the voluntary carbon market through Flowcarbon has been met with skepticism and mixed reactions.

A few weeks ago I was asking some friends who the Adam Neumann of climate would be. Turns out it is Adam Neumann https://t.co/AYAWq9c2oq

— Kate Aronoff (@KateAronoff) May 24, 2022

the three horsemen of the crypto apocalypse

— Meltem Demirors (@Melt_Dem) May 24, 2022

adam neumann

martin shkreli

taking nominations for the third

what a lovely timeline we live in – truly mad and unhinged

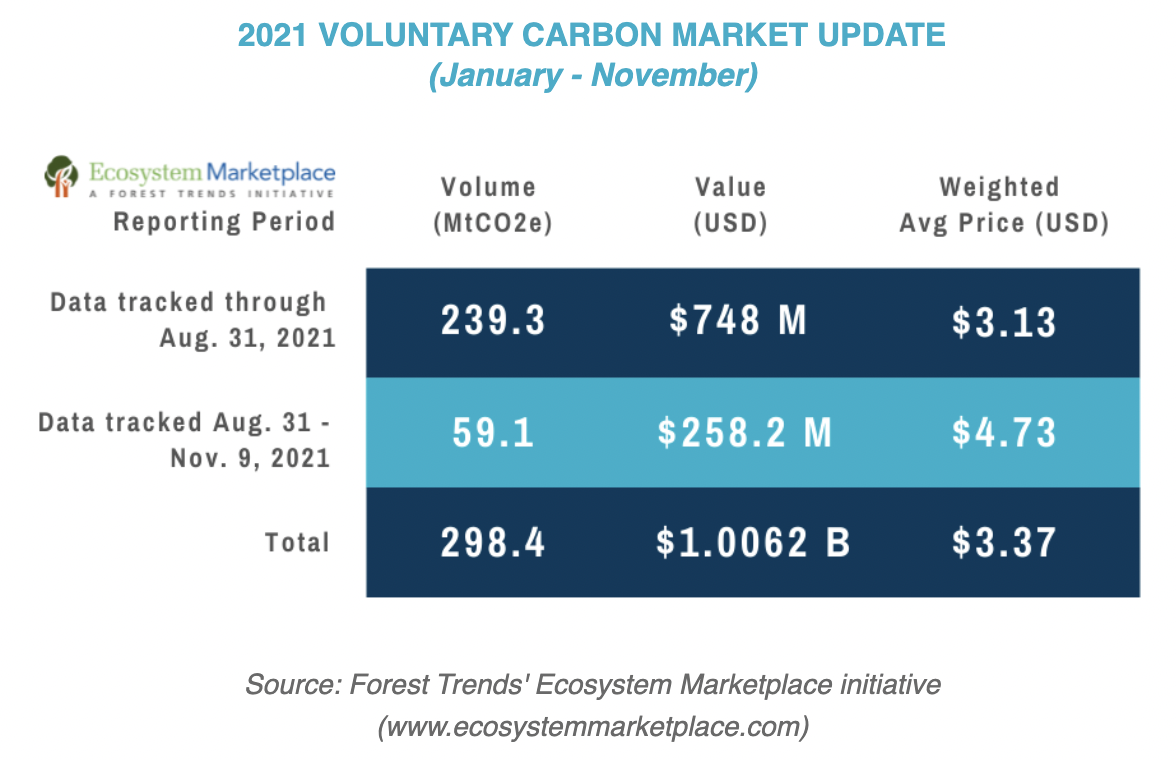

The voluntary carbon market has been growing steadily, breaching the US$1-billion mark in 2021.

“The challenge for voluntary carbon markets today is no longer finding credit buyers,” says Forest Trends CEO Michael Jenkins. “Now, we all need to guide the markets to deliver the highest quality possible, with the greatest benefit possible for planet and communities.”

Neumann is not the first businessman to enter the fray of tokenized carbon credits. In November 2021, American businessman Mark Cuban announced that he was buying US$50,000-worth of tokenized carbon offsets every ten days using blockchain technology. Canadian investment firm Carbon Streaming Corporation (NEO: NETZ) CEO Justin Cochrane then said that investments like these are “fantastic to the industry.”

“It brings in confidence, it brings in transparency and liquidity into the market, which this market has lacked for the past decade,” said Cochrane. “The carbon market will be multiples bigger than bitcoin, and certainly with a potential to be bigger than oil.”

Information for this briefing was found via Reuters, Techcrunch and the companies mentioned. The author has no securities or affiliations related to FlowCarbon. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.