It seems Affirm Holdings, Inc. (Nasdaq: AFRM) is affirming a u-turn in its performance after the company’s shares rose 33.6% in after-market trading. This is on top of its 23.3% surge on the day.

The payment platform has seen its shares in a constant downward trend overall, having traded at the US$95-mark when the year began, but has traded below the US$20-mark within the last week.

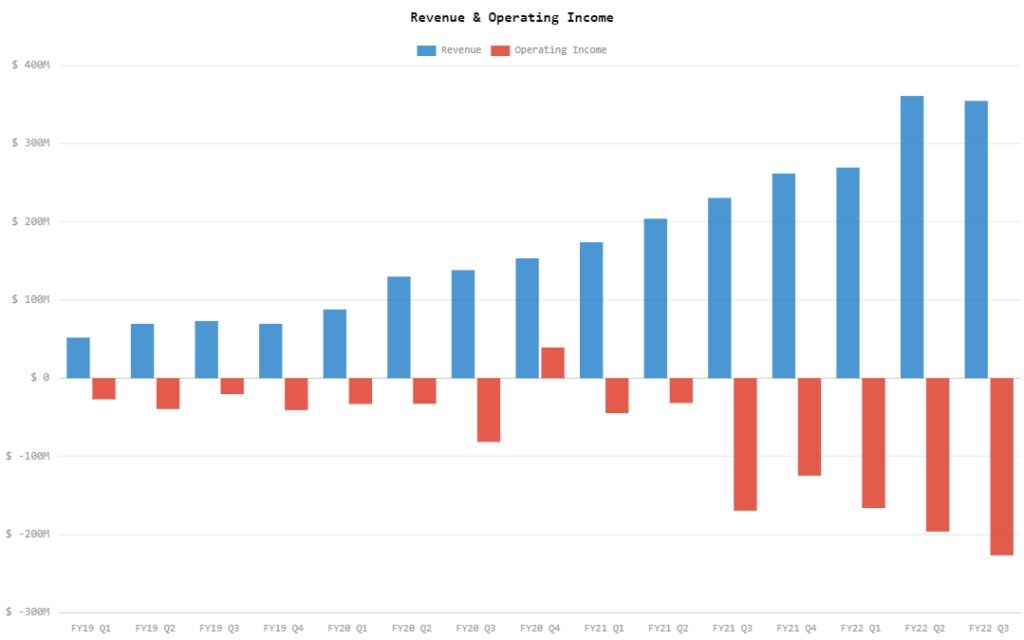

The resurgence can be attributed to the firm beating the estimates for its fiscal Q3 2022 financials, toplined by a quarterly revenue of US$354.8 million vis-a-vis the expected US$344.0 million. This is also an increase from Q3 2021’s revenue of US$230.7 million.

The revenue growth is being attributed to growth in gross merchandise volume, jumping to US$3.9 billion from US$2.3 billion last year. Active consumers also surged to 12.7 million for the quarter compared to 5.4 million last year.

However, the firm incurred operating expenses during the quarter at US$581.3 million–still greater than its revenue and higher than its counterpart last year of US$440.0 million. This led the company to record an operating loss of US$226.6 million compared to last year’s loss of US$209.3 million.

The decrease is being attributed to continued investment in sales and marketing. It also includes a stock-based compensation expense of US$81.3 million.

But thanks to US$172.1 million in other income recorded during the quarter–as opposed to other expense amounting to US77.8 million last year–the firm was able to end with a net loss of US$54.7 million compared to the previous year’s loss of US$287.1 million. This translates to US$0.19 loss per share, which beat the estimated US$0.54 loss per share.

The company also ended the quarter with US$2.26 billion in cash.

For Q4 2022, the firm is guiding its gross merchandise volume to land between US$3.95 – US$4.05 billion and its revenue to end between US$345 – US$355 billion–which offers little room for quarter-on-quarter growth.

The firm is also expecting to record a gross merchandise volume of US$15.04 – US$15.14 billion and annual revenue of US$1.33 – US$1.34 billion for 2022.

Immediately after, the firm announced the multi-year extension of its partnership with e-commerce platform Shopify. The agreement will include employing Affirm’s Adaptive Checkout, which offers flexible biweekly and monthly payment options.

“Together with Shopify, we set out to build a custom payment option that would help Shopify merchants of all sizes accelerate growth, while empowering their millions of buyers with a transparent and flexible way to pay,” said Affirm Chief Commercial Officer Silvija Martincevic. “Since its launch in June 2021, Shop Pay Installments has done just that, enabling buyers to split a total purchase amount into four interest-free bi-weekly payments at checkout.”

Affirm Holdings last traded at US$18.04 on the Nasdaq, up 23.31% on the day, then moved up 33.59% in after-market trading.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.