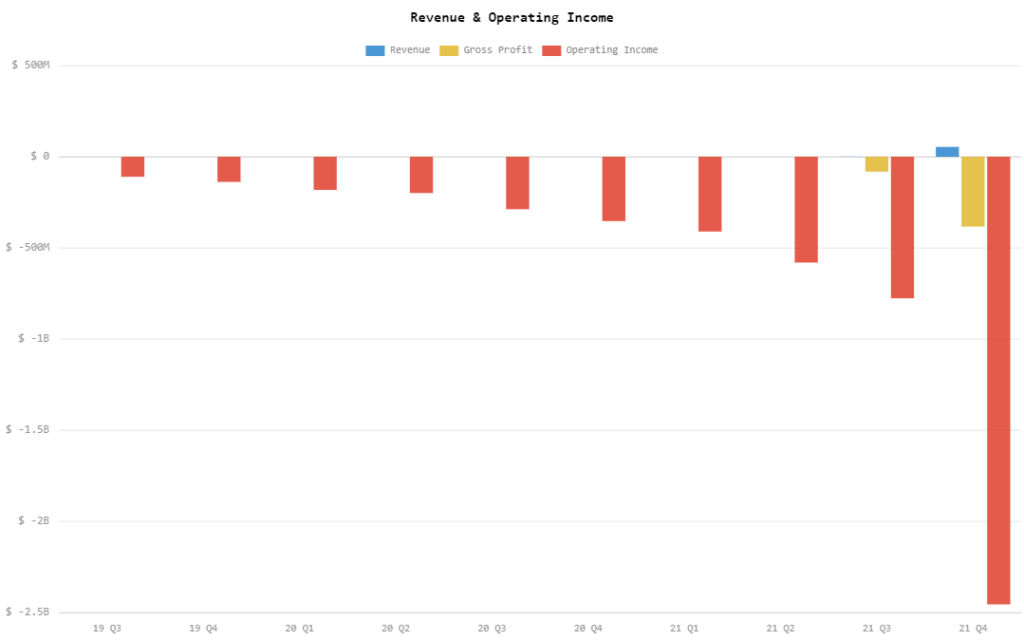

Rivian Automotive, Inc. (Nasdaq: RIVN) shared on Thursday in a letter to shareholders its Q4 and full-year 2021 financial results, its first quarterly report since its IPO in November 2021. The firm recorded US$55.0 million in annual revenue, US$54.0 million of which was generated during Q4.

The startup electric vehicle maker, which started production in October 2021, said it has produced 1,015 vehicles and delivered 920 vehicles in 2021. As of March 8, 2022, the firm has produced a total of 2,425 vehicles.

The firm further recorded a gross loss of US$465 million, US$383 million of which was recorded in Q4.

“As we produce vehicles at low volumes on production lines designed for higher volumes, we have and will continue to experience negative gross profit related to significant labor and overhead costs,” said the company in its letter.

Operating expenses also grew year-on-year, coming in at US$3.76 billion in 2021 leading to an operating loss of US$4.22 billion for the year. This compares to the operating expenses of US$1.02 billion in 2020 which also became its operating loss.

Further down, the company recorded a net loss of US$4.69 billion, US$2.46 billion of which was recorded in Q4. Calibrating for financial items –including US$570 million in stock-based compensation and a US$663 million donation to Forever by Rivian Inc. — the firm ended with a negative adjusted EBITDA of US$2.79 billion for the year.

Adjusted net loss per share ended at US$14.78 per share for the year’s performance.

The firm also burned operating cash flow at US$2.62 billion for the year. With capital expenditures at US$1.79 billion, the firm also ended with a free cash outflow of US$4.42 billion.

But the company ended with US$18.13 billion in cash and cash equivalents, mainly driven by raising US$13.7 billion from its recently concluded IPO.

The automaker recently faced production woes but is set to maximize the capacity of its Normal and Georgia plants, pegged at approximately 600,000 in annual vehicle production in total. The firm is also banking on the approximately 83,000 preorders for its R1 platform and Amazon’s (Nasdaq: AMZN) 100,000-EDV order announced in 2019.

But that’s the plan. The firm is pointing to supply chain problems becoming “a limiting factor” in its ability to deliver over 50,000 vehicles in 2022.

“[Due] to the supply chain constraints currently visible to us, we believe we will have sufficient parts and materials to produce 25,000 vehicles across our R1 and RCV platforms in 2022,” the company said about its outlook next year.

Furthermore, the automaker expects to have an even lower adjusted EBITDA for next year, estimating a loss of US$4.75 billion “due primarily to continued forward investment in [its] ecosystem”. Add to that, the firm is targeting to spend more in capital expenditures, pegged at US$2.60 billion next year.

Rivian shares dropped following the earnings release, falling as much as 15.0% post-closing bell. The results also did not sit well with some retail investors, with a few comparing the firm to Tesla (Nasdaq: TSLA).

When $TSLA was in $RIVN's shoes with Model S:

— Taylor Ogan (@TaylorOgan) March 10, 2022

Employees: 3,200 (Tesla) vs. 11,500 (Rivian)

Studios/Service Centers: 29 (Tesla) vs. 15 (Rivian, service)

Vehicle reservations: 13,200 (Tesla) vs. 83,000 +100,000 from AMZN (Rivian)

Cash: $330M (Tesla, 2012) vs. $18.4B (Rivian)

Tesla Q2 2011 vs Rivian Q4 2021

— Paper Bag Investor (@PaperBagInvest) March 11, 2022

(soon after IPO)

Auto Rev:

$39M vs $54M

Auto Gross Margin:

22% vs -709%

OpEx:

$77M vs $2,071M

Net Loss:

$59M vs $2,461M$TSLA vs $RIVN pic.twitter.com/u6zx0vTYTx

Why do they so many employees and building small amount of cars?

— @Sanman (@TeslaManny) March 11, 2022

One thing that probably the automaker is doing to address its bottom line is the pricing strategy. Following the announcement of the dual-motor propulsion system and standard battery pack this month, the firm is widening the price range for its R1 platform to US$67,500—US$95,000.

At the midpoint of that price range and assuming that the 2022 production outlook will all be delivered, the firm might be looking at around US$4.06 billion in revenue.

So the question remains: when does the automaker project to take its financial turn?

Rivian last traded at US$41.16 on Nasdaq, down 6.35% on the day then 8.41% pre-market as of this writing.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.