The crypto space is beginning to appear to be rather circular.

Following the Chapter 11 Bankruptcy filing made by Voyager Digital (TSX: VOYG), numerous documents have been filed revealing the inner details of the company. Some of which, the firm had previously worked to keep private from market participants.

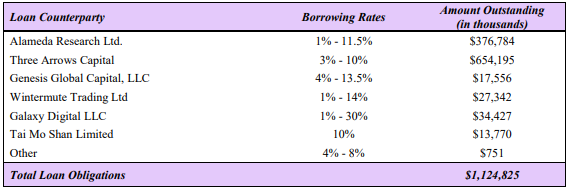

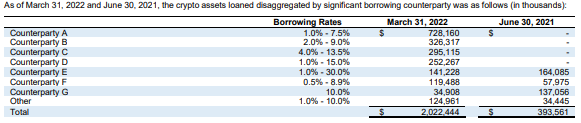

One key item revealed as part of the filing, is the previously undisclosed counterparties that the firm has loaned funds too. Chief among them, outside of Three Arrows Capital, is apparently major shareholder and creditor Alameda Research.

As it turns out, Alameda has borrowed roughly $376.8 million from the crypto lender, and is the firm that was previously only known as “Counterparty A.” Other borrowers include familiar names in the space as well, including Genesis Global, and Galaxy Digital.

The data is interesting on the basis that Alameda just weeks ago provided the company with what essentially amounted to an attempt at a bailout, when, despite having apparently borrowed funds from Voyager, provided a credit facility to Voyager for up to 15,000 bitcoin as well as $200 million in cash and USDC.

$75 million of those funds were ultimately drawn on, prior to the Chapter 11 filing having been made. What’s more, is Alameda’s $75 million facility is junior to general unsecured claims, which is questionable in and of itself.

I need @matt_levine and/or @petition to write about this. How on earth did Alameda end up junior to general unsecured claims? How did their lawyers not insert even a basic pari passu clause? https://t.co/ntyEGwlv1M pic.twitter.com/KQSQaIENg1

— Felix Salmon (@felixsalmon) July 6, 2022

Alameda is also one of the largest shareholders of Voyager, holding a 9.49% stake in the firm after having returned 4.5 million shares for cancellation at no cost just two weeks ago.

Surprisingly, #Alameda appears to have maintained its 9.49% stake in $VOYG instead of unloading its position after returning those shares. pic.twitter.com/dNFkN0rHBq

— The Deep Dive (@TheDeepDive_ca) July 6, 2022

While being one of the largest counterparties to Voyager, Alameda notably reduced its outstanding loans rather substantially from the end of the first quarter. As of March 31, the company had a total of $728.2 million in outstanding debt with Voyager, meaning it has returned roughly half of its outstanding debt over the last 90 days.

The bankruptcy filing by Voyager Digital follows the company seeing its loans to Three Arrows Capital go into default, couple with what amounted to a “bank run” on the company following poor sentiment within the larger crypto market.

Voyager Digital last traded at $0.335 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.