Lenders within the Canadian cannabis market appear to be nearing their wits end as they move to collect on well-past due debts. Aleafia Health (TSX: AH) appears to be the latest source of lender frustration, with the company having until May 31 to come up with the cash to settle a credit facility taken out at the end of 2021.

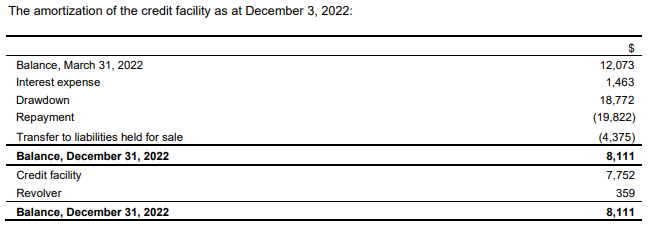

The lender in question for Aleafia is referred to as NE SPC II LP, whom originally agreed to lend the company $12.0 million under a term facility, with an additional revolver of up to $7.0 million. Between the two facilities, the company as of December 31, 2022, collectively owes $8.1 million.

The loan reportedly is payable on demand, however the lender has been gracious enough to provide the company an amendment to the debt, that will see it refrain from calling in the loan until the earlier of an event of default, or May 31, 2023. Aleafia is said to currently be in breach of certain covenants related to the debt.

The company had just $434,000 in cash on hand as of December 31.

As a result of the oncoming need to pay off the debt, Aleafia appears to have tossed in the towel after years of struggling, with a strategic review process having now begun to evaluate potential strategic alternatives for the company. Proposed options are said to include refinancing of the debt, a sale of all or a portion of the firms assets, a business combination, issuance of equity, a strategic investment, or “other strategic transaction structure.”

Aleafia Health last traded at $0.045 on the TSX.

Information for this briefing was found via Sedar and Aleafia Health. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.