A popular notion among bullish investors is that the U.S. Federal Reserve will pivot fairly soon to a less restrictive policy, either through a lessening in the magnitude of future hikes from the recent 75 basis-point level, or an outright stoppage of any increases. Such a policy change could allow the economy to skirt a possible recession. In turn, the thinking goes, the stock market will perk up from the malaise it has endured since the calendar turned to 2022.

October 21 statements which seemed to supported the first interest rate scenario from San Francisco Federal Reserve Bank President Mary Daly, a fairly dovish member of the Fed, caused equity markets to soar: the S&P 500 Index and the NASDAQ Composite each rose about 2.3% that day. However, shares of American Express Company (NYSE: AXP), the world-famous credit card company, surprisingly bucked this trend (down ~2%) despite reporting better-than-expected quarterly results and management’s optimism that positive consumer spending trends will continue.

American Express reported 3Q 2022 diluted EPS of US$2.47, up from US$2.27 in 3Q 2021, and ahead of the analysts’ consensus reading of US$2.40. Even more impressive, revenue in the quarter reached US$13.6 billion, 21% higher than the year-ago period and slightly higher than the US$13.5 billion consensus.

| (in millions of US $) | 3Q 2022 | 2Q 2022 | 1Q 2022 | 4Q 2021 | 3Q 2021 |

| Revenue | $13,556 | $13,395 | $11,735 | $12,145 | $10,928 |

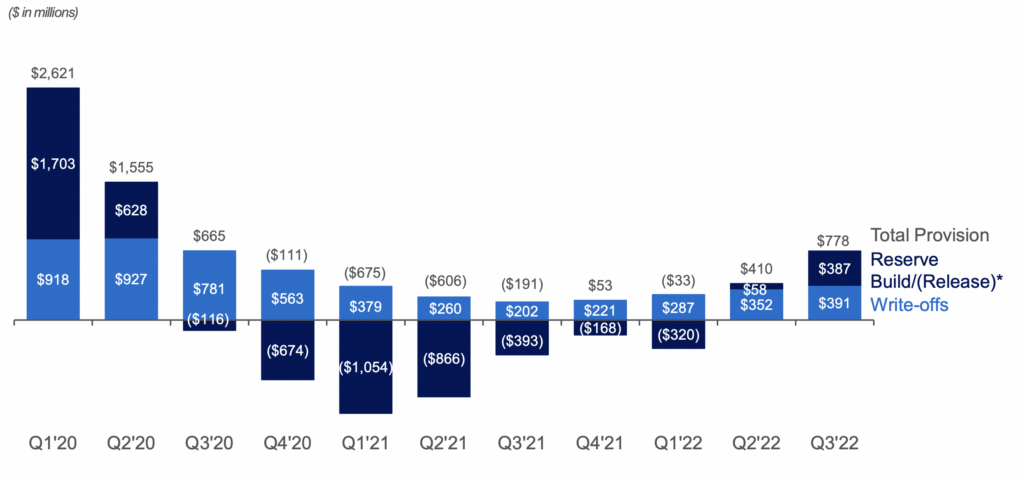

| Provision for Credit Losses | $778 | $410 | ($33) | $53 | ($191) |

| Return on Average Common Equity | 33.6% | 36.5% | 40.0% | 35.8% | 31.0% |

| Cash – Period End | $31,000 | $26,000 | $28,000 | $22,000 | $28,000 |

| Debt – Period End | $44,000 | $42,000 | $40,000 | $41,000 | $36,000 |

| Adjusted EPS | $2.47 | $2.57 | $2.73 | $2.18 | $2.27 |

| Shares Outstanding (Millions) | 747 | 751 | 755 | 761 | 778 |

One negative in the release was American Express’ 3Q 2022 provision for credit losses of US$778 million, up from US$410 million in 2Q 2022. About US$391 million of the US$778 million represents write-offs. The provision increase in 3Q 2022 was the biggest quarterly boost since 2Q 2020, the first full quarter of the COVID pandemic. In 3Q 2021, the company reversed a net US$191 million of credit allowances.

American Express projects full-year 2022 revenue growth of 23%-25%, and now believes it will surpass its original 2022 earning guidance of US$9.25 to US$9.65. Despite most economists’ limited ability to forecast fast-changing overall trends, American Express expects 2024 revenue and EPS to increase by more than 10% and 15%, respectively.

The company’s CEO Stephen Squeri is indeed optimistic. In an interview he said, “We’re not seeing any changes in consumer spending. We have strong credit quality.”

It would seem the action in American Express shares suggests that investors expect one of two quite different economic/stock market environments will ultimately prevail: 1) there could be a significant opportunity in American Express shares as investors potentially overreacted to the boost in provision for credit losses; or 2) detail-oriented investors believe the fundamentals in American Express’ credit card business are bound to deteriorate. Such a downturn would presumably augur poorly for both the economy and the stock market.

American Express Company last traded at US$140.04 on the NYSE.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.