Sentiment among US consumers continued on its deteriorating trend this month, as inflation fears become more and more pronounced.

According to the University of Michigan’s final sentiment reading for the month of May, the index fell from 88.3 in April to 82.9, coinciding with the the consensus estimate among economists surveyed by Bloomberg. The latest reading, which was published on Friday, suggests that consumers’ expectations of rising prices are only growing stronger, as respondents anticipate inflation to hit a whooping 4.6% over the next twelve months— a new decade-high.

On the other hand, however, the respondents do not expect the increased price pressures to continue for an extended period of time. Consumers said they foresee annual inflation to decline to 3% within the next five years. “It is hardly surprising that the resurgent strength of the economy produced more immediate gains in demand than supply, causing consumers to expect a surge in inflation,” explained the survey’s director, Richard Curtin.

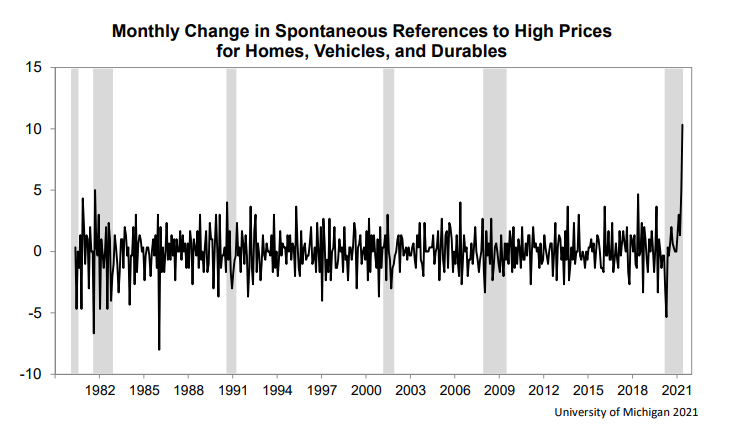

In the meantime, a record number of consumers noted higher prices across a wide variety of discretionary purchases, including homes, household durables, and vehicles. But don’t worry, it’s just “transitory.”

Information for this briefing was found via the University of Michigan and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.