The Bank of England on Thursday raised borrowing costs for the third consecutive time, amid surging inflation thats running at the highest in 30 years. However, with global uncertainty mounting over the Russia-Ukraine crisis and sharply increasing energy prices, UK’s economy could face added headwinds, hindering growth and ultimately sending it into a recession.

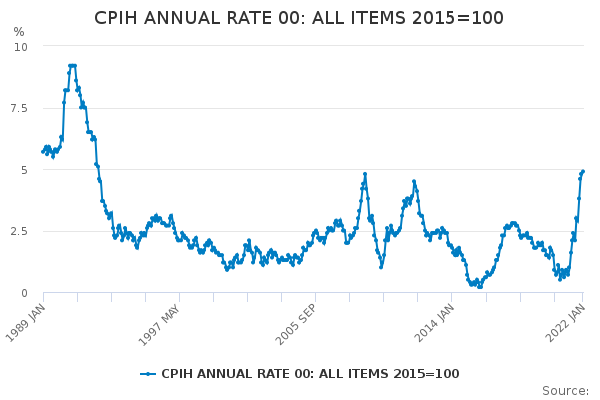

The central bank’s Monetary Policy Committee agreed to hike its policy rate by another 25 basis points to pre-pandemic levels of 0.75%, as annual inflation hit 4.9% in January— the highest in about 30 years. The committee began raising borrowing costs in December for the first time since 2004, hiking rates from a record-low of 0.1% to 0.25%, followed by another 25 basis-point increase in February.

During its policy meeting last month, the Bank of England forecast inflation would hit a peak of 7.25% in April, amid robust economic growth and strengthening labour markets. In response, the bank said additional monetary policy tightening measures would depend on medium-term inflation expectations, which have since been on the rise following Moscow’s military operation in Ukraine and subsequent surge in energy prices.

“Global inflationary pressures will strengthen considerably further over coming months, while growth in economies that are net energy importers, including the United Kingdom, is likely to slow,” the bank wrote in its report published on Thursday. Now, the central bank anticipates inflation will rise even further in the coming months, hitting at least 8% by the second quarter of the year, with potential of even reaching double-digits before the end of 2022.

With historically high inflation— and projections calling for even further increases in consumer prices, the Bank of England has no choice but to keep raising borrowing costs in order to prevent the Pound from devaluing further. However, with the unexpected unfolding of the Ukraine crisis and consequent sharp jump in oil and gas costs, UK’s economic growth and labour market rebound may face added challenges.

“Savings rates could improve from here which might offset some of the cost of living crunch, but with inflation proving difficult to contain it might all be a little too late,” warned Quilter Investors portfolio manager Paul Craig, as cited by CNBC. “With global risks and the Russia-Ukraine war having a significant economic impact, growth will be challenged and thus the Bank may need to reverse course later in the year.”

So, in other words, impending policy error?

Information for this briefing was found via the Bank of England and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.