On June 28th, Antibe Therapeutics (TSX: ATE) reported their fourth quarter and year-end financials. The company announced full-year revenue of $9.7 million, which came in flat year over year, with a larger than expected net loss of $26.3 million. The company ended the year with $72 million in cash.

The company has seven analysts covering it, with a weighted 12-month price target of C$14.55, or an almost 300% upside. Out of the seven analysts, one has a strong buy rating while the other six have buy ratings. The street high comes from Brookline Capital with a C$20.60 price target and the lowest sits at C$7.00 from Raymond James.

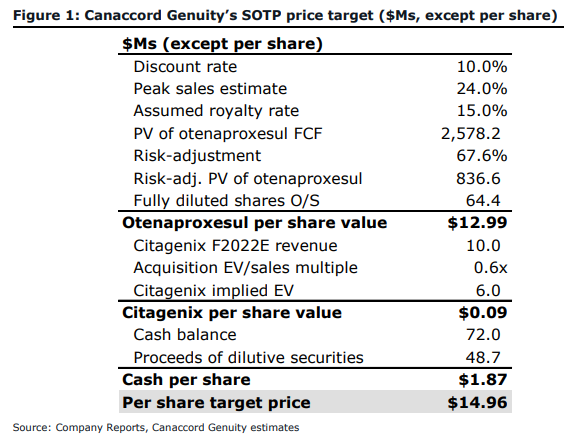

Canaccord Genuity raised its 12-month price target to C$15.00, up from C$14.50, while reiterating their speculative buy rating. Tania Gonsalves, Canaccord’s analyst, says that the company left 2021, “well-capitalized and de-risked.”

For the fourth quarter and full-year results, Gonsalves says that there were no real deviations into the results and they came generally in line with their expectations. For the fourth quarter, Citegenix revenue came in slightly higher at $3 million versus their $2.6 million estimate. Meanwhile R&D expenses came in slightly higher at $3.1 million versus their $2.5 million estimate. She adds, “as a clinical stage biotechnology company, quarterly financials are not a materially impactful event.”

The most important thing she says is after the two raises the company has $72 million in cash, which by their estimates “will be sufficient to fund operations for over two years, including otenaproxesul’s full ~$60.0M adaptive Phase 2/3 program.” She then refers to this quarter as a very productive de-risking quarter for the company.

Gonsalves says that the collaboration with Dalriade will help drive pipeline expansion. The team at Dalriada has 50 scientists and specializes in developing small-molecule drugs. She says it will help “Accelerate screening, selection, and advancement of drug candidates for IND-enabling studies.”

Below you can see Canaccord’s changes to estimates, which were used to get to the new price target.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.