FULL DISCLOSURE: Antimony Resources is a sponsor of theDeepDive.ca via a third party.

The US government seems to be accelerating mining firm funding recently with a $245 million, five-year contract to US Antimony and a $43.4 million grant award to Nova Minerals to build yet its antimony operations, signalling an intent to on-shore supply for munitions and electronics.

Earlier in May, Perpetua Resources also received additional government support of up to $6.9 million, building on a grant of $15.5 million awarded in 2023 to demonstrate a fully domestic antimony trisulfide.

The White House spree also involved Canadian firm Lithium Americas, which closed a $2.26 billion Department of Energy loan in exchange of 5% company stake and a 5% economic interest in the Thacker Pass joint venture.

The rationale is explicit as the US lists antimony and lithium as a critical mineral, with the US Army highlighting antimony sulfide as a primer ingredient for ammunition. US mine output for antimony has been negligible in recent years, prompting stockpile and government funding measures.

Antimony rising

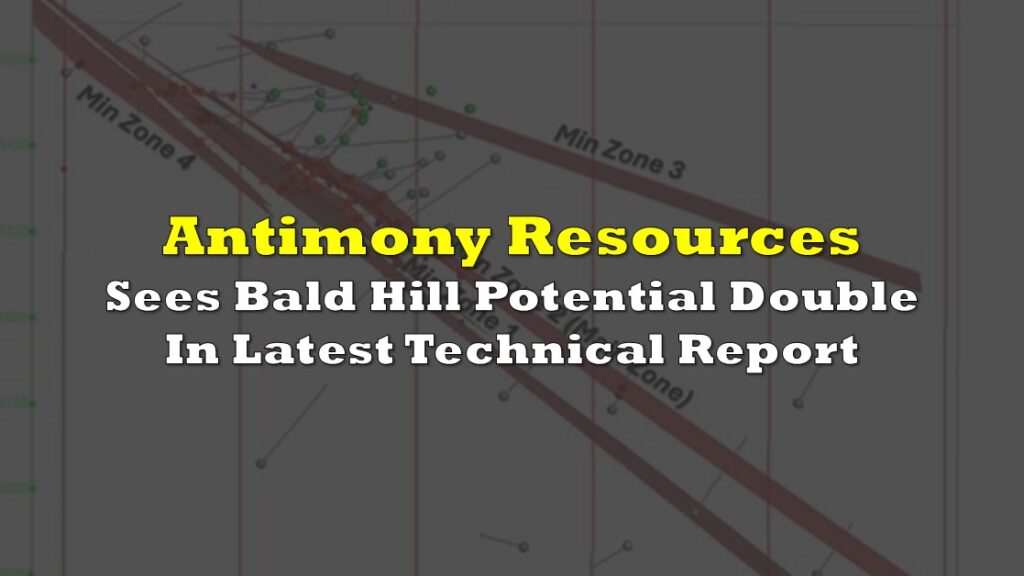

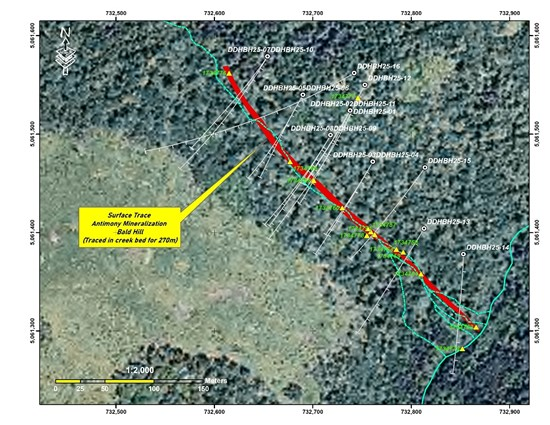

Against this backdrop, Antimony Resources (CSE: ATMY) is advancing the Bald Hill project in southern New Brunswick, a road-accessible 1,100-hectare, 46-claim property with a deep-sea port approximately 45 km away. In recent activity, mineralization has been defined over 700 meters of strike to 300 meters vertical depth and remains open, with an additional mineralized area 800 meters south.

Reported high-grade results include discovery at 4.51 meters grading 11.7% Sb (including 2.29 meters at 20.9% Sb), plus intercepts of 14.91% Sb over 3.0 meters (including 28.76% Sb over 1.7 m), and 9.85% Sb over 4.3 meters (including 18.19% Sb).

READ: Antimony Resources Drills 5.27% Sb Over 4.95 Metres In Latest Results

A historical assessment discussed conceptual potential of 725,000–1,000,000 tonnes at 4.11%–5.32% Sb (around 30,000–40,000 tonnes contained Sb) and historical metallurgical test work indicating 96% recovery.

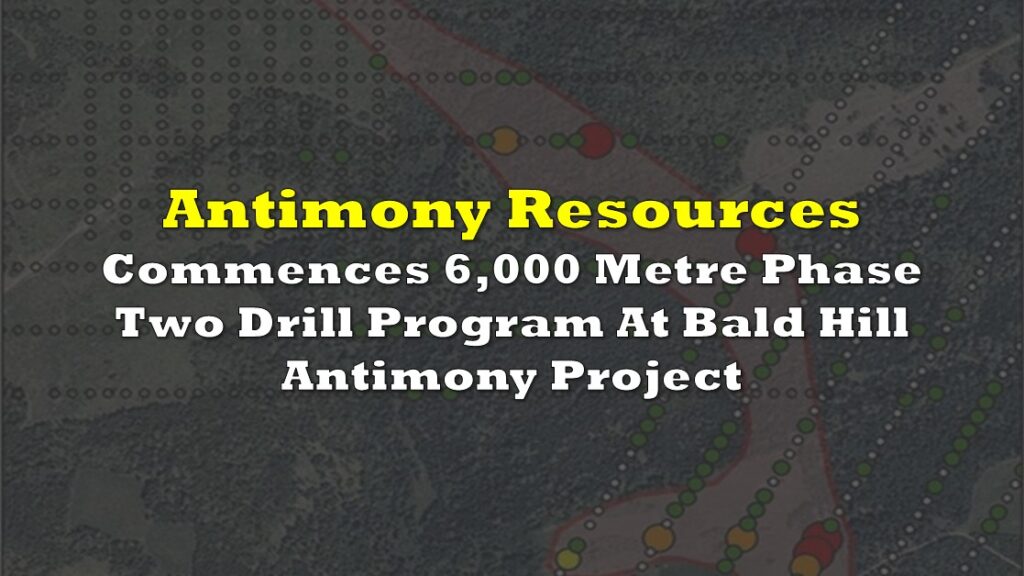

Management indicates next steps include further exploration and up to 6,000 meters of diamond drilling to expand known mineralization and work toward a compliant resource.

WATCH: We Have the Highest-Grade Antimony Deposit in North America!? | Jim Atkinson – Antimony Resources

The US government investing in mining firms is aligned with its protectionist policies. Currently, US mines no antimony today, runs essentially one domestic smelter on imported feedstock, and backfills demand with secondary antimony—leaving the system import-heavy (around 85% reliance). Prices and availability remain sensitive to China-centric supply, so Washington is bridging the gap with stockpile purchases, processing upgrades, and grants while pushing the next wave of projects toward production.

Antimony Resources last traded at $0.23 on the CSE.

FULL DISCLOSURE: Antimony Resources Corp. is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Antimony Resources Corp. The author has been compensated to cover Antimony Resources Corp. on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.