FULL DISCLOSURE: Antimony Resources is a sponsor of theDeepDive.ca via a third party.

Antimony has been deemed a critical mineral by the US, the European Union, Japan, Australia, Canada and the UK. While used traditionally for cosmetics, medicine and metallurgy, today its role in modern industry such as in clean energy storage, and semiconductors, alongside military applications has grown substantially.

China currently dominates global antimony production, accounting for nearly 48% of the world’s output. The nation has become the largest supplier not just of the raw mineral but also of the refined antimony products essential for various industrial applications.

This dominance has led to an almost monopolistic control over the global supply chain, with other major producers like Myanmar and Russia contributing only a fraction of what China offers.

Given the rising tension with China and the East, the West now has to factor in the threat to antimony availability and has no choice but to look internally for production. There are no domestically mined antimony sources, and if you include processing, China alone controls 80% of the world’s supply. When combined with Russia and Tajikistan, together the trio control 90% of global antimony supply.

And in December of 2024, China explicitly restricted antimony exports to the US. The U.S. previously relied on imports for 82% of its antimony supply, with China supplying 63% of that demand. Despite having a stockpile of just 1,100 tonnes, the U.S. consumed 23,000 tonnes in 2023 alone, underscoring the scale of the challenge ahead.

The Canadian Opportunity

One of Canada’s great hopes in the space is Antimony Resources (CSE: ATMY), led by Cambridge Ontario’s Jim Atkinson. Unlike many players rushing to fill the need for this mineral, Antimony Resources has a CEO with significant experience in the space. Atkinson has four and a half decades of experience as a geologist and at one time was the Head Geologist at New Brunswick’s Lake George Antimony Mine. The mine at one time produced 4% of the world’s antimony demand.

Antimony Resource’s flagship is the Bald Hill Antimony Property, located in Southern New Brunswick. The property is known for high-grade antimony, with historic drilling outlining a deposit over 500 meters long, with widths averaging over 3 meters and grades of 3% to 4% antimony.

There is access to excellent provincial and regional highways.

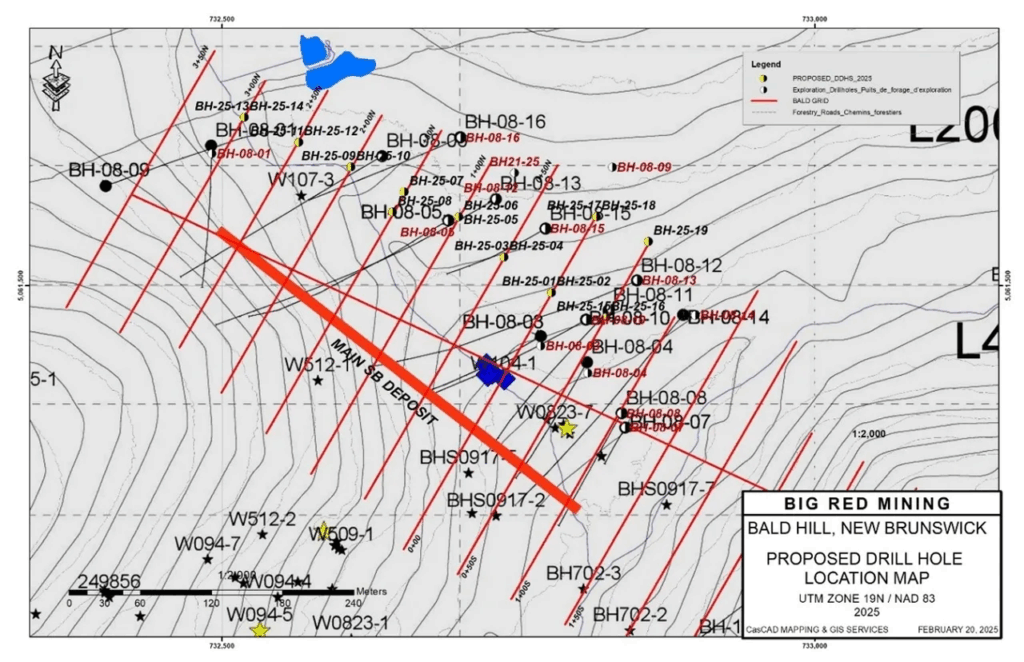

Since its 2008 discovery, 25 drill holes have been completed on the property, with highlights including the discovery drill hole, DDH08-03, which intersected 4.51 metres of 11.7% antimony, including 2.29 metres of 20.9% antimony. There are three known antimony-bearing breccias and hydrothermal veins trending northwesterly on site, while mineralization has been defined across a 700 metre strike length to a vertical depth of 300 metres, while the deposit remains open in all directions and to depth.

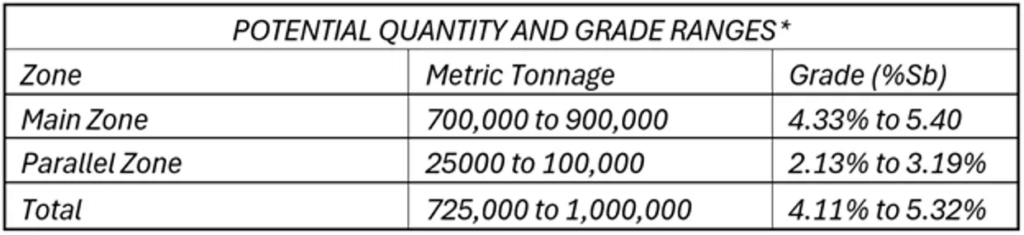

While no resource currently exists for the project, a historic 43-101 technical report conducted in 2010 outlined the potential for the project, with up to 1.0 million tonnes estimated to contain antimony at grades ranging from 4.11% to 5.32%.

The fact that Antimony Resource is a pure play makes it something of an outlier. That may be something discerning investors are looking for, as for instance, metallurgy-wise, it could make for a more economic production process.

Current Exploration

Drilling commenced at the Bald Hill property on April 15, with a planned 2500 meters of drilling over approximately 20 holes targeting the Main Zone. Visual inspections to date on the core are said to have identified antimony mineralization over widths of 20 metres core length, which translates to an estimated 12 metres of true width.

As of May 5, a total of six holes had been completed under the program, with antimony identified to be present in at least five holes. Initial assays from the program are expected to be released imminently based on the timelines provided in that same release.

That timeline was then again reiterated in a release made just weeks later, with CEO Jim Atkinson commenting at the time, “I recently visited the Bald Hill project and had an opportunity to see the antimony mineralization we have intersected in the drilling so far in the Main Zone. It is very impressive to see the actual zones of stibnite (Antimony) in the drill core. I also visited the area of surface exposures and saw massive boulders and outcroppings of stibnite. The location of the actual surface exposures of the antimony mineralized zone will allow more precise targeting of our ongoing drilling. This mapping has allowed us to confirm the trend of the zones.”

US Government Support For Antimony

While Antimony Resources may be a junior, other names in the subsector, such as Perpetua Resources (TSX: PPTA) have been making waves for strong recent developments. For instance, Perpetua just raised $425 million in funding for their Stibnite Gold Project.

While it is arguable that much of Perpetua’s value is in its 4.8 million ounce gold reserves, but it has been theorized that the approval of the project was heavily impacted by the antimony angle to the store. Environmental issues were overcome due to a defined antimony resource that should re-establish US domestic antimony production.

Perpetua have been selected as a priority project by the White House, with the project fast tracked for approvals that were granted in May due in part to their 148 million pound antimony reserve, however those reserves are at grades of just 0.06% antimony. Perpetua has also secured funding from the Department of Defense to the tune $22.4 million in support of developing the project, while having applied for $2.0 billion in funding from the Export-Import Bank of the United States.

Wrapping It Up

As for Antimony Resources, imminent assays are a sign that more eyes will be on the play. What the assays tell investors remains to be seen.

If the company can turn their “potential” numbers into a viable resource, one could say they have a good chance of quickly becoming a big fish in a small lake. The fact that they are one of the only pure play antimony companies out there makes them stand out.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive, has been compensated by a third party to provide sponsored content for Antimony Resources. The author has been compensated to cover Antimony Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.