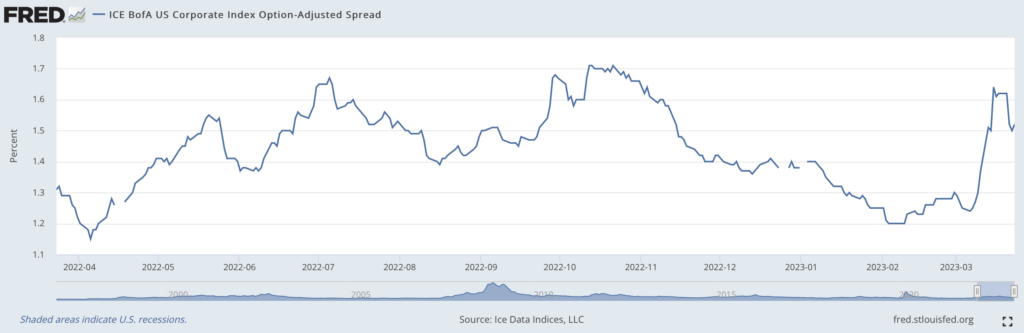

The repercussions of depositors’ fleeing regional banks and cracks in the broader global financial system (i.e. Credit Suisse and Deutsche Bank) have stretched beyond the equity markets. Corporate bond spreads have noticeably widened, signaling a higher chance of recession.

In addition, companies have found it more difficult to access credit from public and private markets. Indeed, according to Pitchbook, no U.S. investment grade-rated company issued bonds to investors in the week ended March 17, the first week of zero such business in the month of March since 2013. March is typically a busy financing month for well established companies.

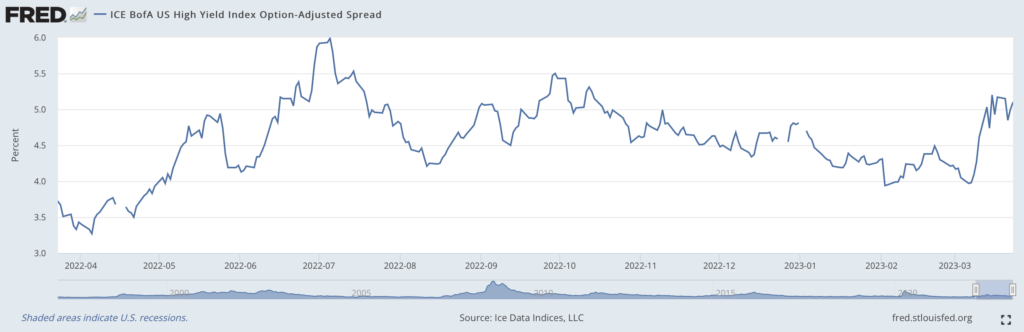

High-yield bond spreads over U.S. Treasuries have widened more than 100 basis points (bp) to 510 bp from 398 bp in just three weeks. Spreads have roundtripped to levels last seen in October 2022 and are above the 450-bp average level over the last ten years. A typical high-yield bond with a ten-year maturity now yields about 8.5%. Phrased simply, investors are now much more concerned about a company’s credit risk, not just rising Treasury rates.

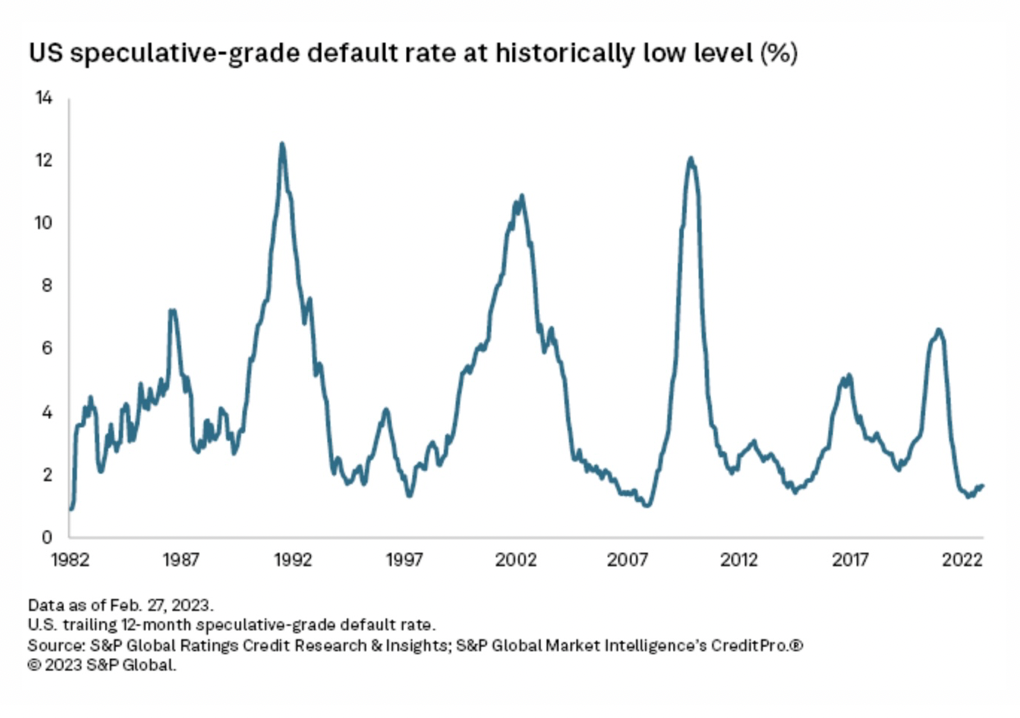

While above historic norms, a 510-bp spread is still well below levels observed in periods of severe economic stress. During sharp downturns like the dot-com bust in the early 2000’s and the 2008-2009 Financial Crisis, the extra yield necessary to offset the risk of a sharp downturn reached or exceeded 1,000 bp. Even for short periods in late 2011 and in 2016, the junk bond yield premium topped 700 bp for at least several months in each instance.

According to Fitch, default rates on junk bonds ticked higher to 1.6% in February 2023, the highest level since June 2020, but still well below the 12% pace seen during the Financial Crisis. A point of concern: Fitch expects default rates to move toward the historic average of 3.6%. S&P Global Ratings is more bearish; it expects the default rate to approach 6%.

Investment-grade bond spreads have also widened since the collapse of SVB Financial Group (NASDAQ: SIVB). The average yield spread on these higher quality bonds has jumped to 152 bp from 125 bp in just three trading weeks and are now back at November 2022 readings.

Governments bond spreads are still predicting an economic downtown, although the yield spread between the U.S. two-year Treasury note (3.77%) and the U.S. ten-year government bond (3.37%) has narrowed to negative 40 bp from a 42-year high of 109 bp in early March. An inverted yield curve generally suggests investors are worried about the economy’s long-term prospects; they are lending their money out for the long term at rates well below short-term rates.

In summary, the trading patterns of high yield, investment grade and U.S. Treasury bonds are flashing synchronized warning signals that an economic downturn may be coming. This represents a significant change for the junk and investment grade bond markets, which were trading at tighter-than-normal spreads just three weeks ago.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.