When it rains, it pours. Food shortages and subsequent inflation are about to get a whole lot worse, because it looks like an imminent fertilizer supply shock will only slash yield and push crop prices even higher.

CF Industries Holdings, one of the world’s biggest fertilizer companies, last week warned rail shipments of crop fertilizers will be significantly cut back, after the Union Pacific railway unexpectedly demanded a reduction in the number of private railcars on its railways. Under the new mandate, shipments of urea and urea ammonium nitrate will be prioritized to America’s main agricultural states, marking a 20% reduction in CF Industries’ overall crop nutrient shipments.

UP rail situation:

— Josh Linville (@JLinvilleFert) April 14, 2022

Sounds like the UP is backed up on shipments. As a result, they are restricting "private car" shipments (i.e. not UP equipment) by almost 20%.

We were already struggling with fert logistics coming into spring. This doesn't help at all…#blackswan pic.twitter.com/YOo36UWj2J

“The timing of this action by Union Pacific could not come at a worse time for farmers,” said CF Industries CEO Tony Will. “Not only will fertilizer be delayed by these shipping restrictions, but additional fertilizer needed to complete spring applications may be unable to reach farmers at all. By placing this arbitrary restriction on just a handful of shippers, Union Pacific is jeopardizing farmers’ harvests and increasing the cost of food for consumers,” he warned.

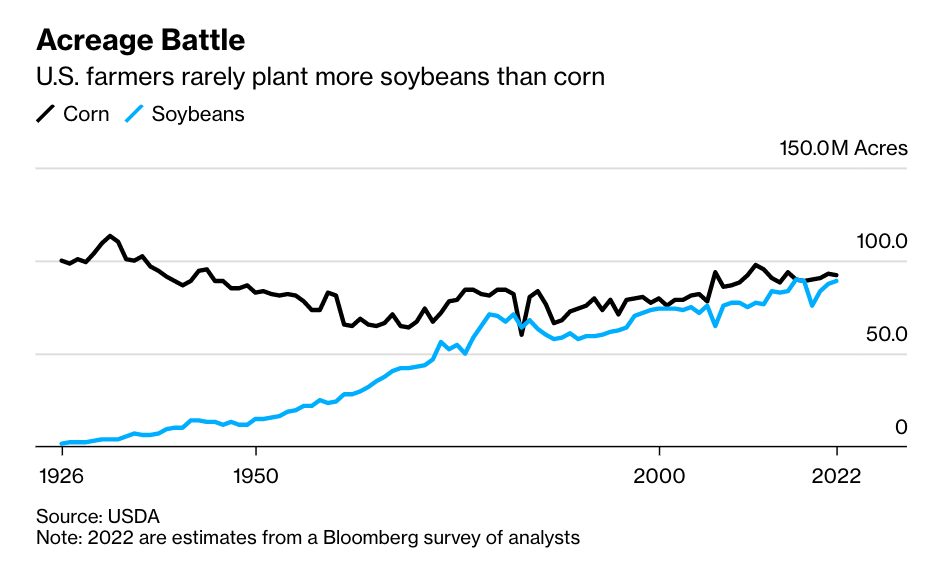

Union Pacific’s move is especially detrimental for America’s midwest, which is responsible for producing about 80% and 90% of the country’s soybean and corn crop, respectively. CF Industries warned that if farmers are unable to secure adequate amounts of nitrogen fertilizer for the current planting season, yields will be substantially lower. “This will likely extend the timeline to replenish global grains stocks. Low global grains stocks continue to support high front month and forward prices for nitrogen-consuming crops, which has contributed to higher food prices,” read a company statement.

In response to tighter fertilizer supplies, some agricultural producers are switching their fields from corn to soybeans, given that the latter requires significantly less fertilizer. However, the move is a double-edged sword, because a reduction in corn crops will have a detrimental impact on the livestock industry since its a main energy ingredient in feed, not to mention the cascading shortage effect for food and industrial production.

Are we sleepwalking into a food crisis?

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.