Aris Mining (TSX: ARIS) has published the results of a prefeasibility study for their 51% owned Soto Norte Gold Project in Colombia. The study has revised prior operating plans for the mine, cutting planned processing capacity from over 7,000 tonnes per day to 3,500 tonnes per day, of which 750 tonnes per day is dedicated to local artisanal miners.

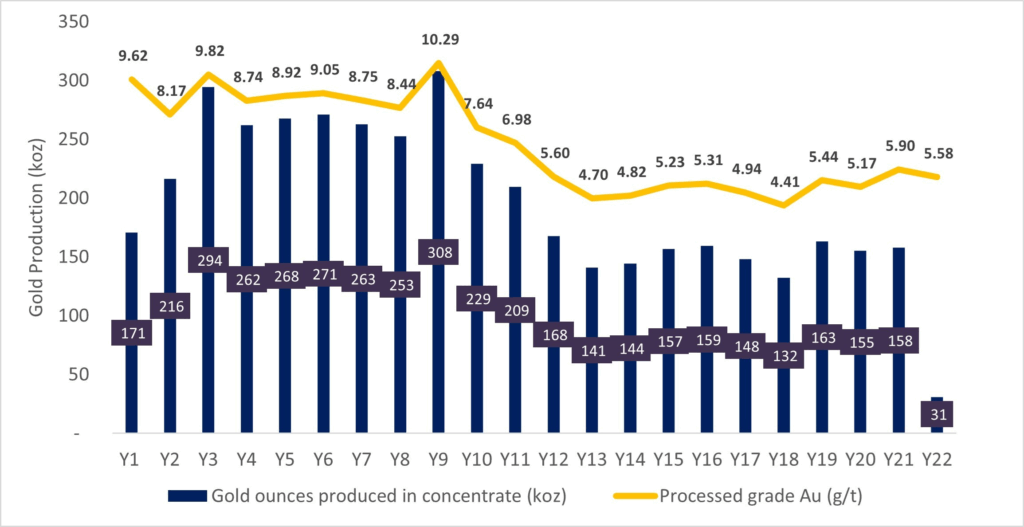

The revised operating plan for Soto Norte consists of a life of mine of 22 years at an owner-mining rate of 2,750 tonnes per day. Gold production over the first 10 years is expected to average 263,000 ounces a year of gold in concentrate, while over the life of mine the average annual production is a lower 203,000 ounces.

Those ounces are expected to be produced at some of the lowest cost levels in the industry, with cash costs expected to be just $345 an ounce, while all in sustaining costs are expected to be $534 an ounce.

Initial capital meanwhile is pegged at $625 million, which includes pre-production costs, value added tax, and contingencies.

At $2,600 an ounce gold, Soto Norte is said to have an after-tax net present value of $2.7 billion and an internal rate of return of 35.4%, with a payback of just 2.3 years based on a discount rate of 5%. At $3,200 gold, that NPV is said to rise to $3.6 billion while with IRR climbs to 42.1%.

“The Soto Norte PFS outlines a project that balances scale, profitability, environmental stewardship, and community input. [..] With the PFS complete, we are completing environmental studies and preparing to apply for an environmental license in early 2026. Soto Norte stands out as one of the most attractive gold projects in the Americas,” commented Neil Woodyer, CEO of Aris Mining.

Aris Mining last traded at $12.07 on the TSX.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.