Artemis Gold (TSXV: ARTG) is already looking to substantially increase production at their flagship Blackwater mine in British Columbia, despite hitting commercial production just months ago in May. The company this morning indicated they intend to increase their nameplate capacity by 33% by the end of 2026.

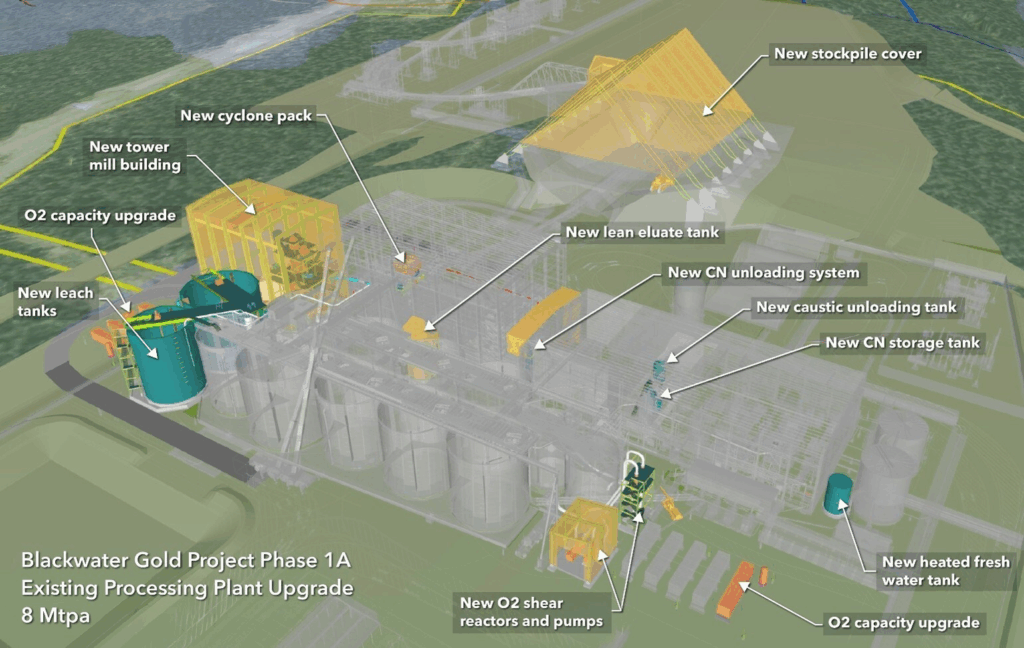

The expansion, referred to as Phase 1A, will see nameplate capacity at the mine increased from 6 million tonnes per year to 8 million tonnes per year by Q4 2026. The newly defined phase is being advanced ahead of Phase 2 expansion, which is expected to have a final investment decision made by the end of Q4 2025.

The Phase 1A expansion is expected to come at a cost of between $100 and $110 million, which results in a cost of $50 to $55 per additional annual tonne of processing capacity. Major mechanical equipment for the expansion is already said to have been ordered, which includes a vertical mill for further primary grinding capacity. Construction work has also already begun, with excavation work currently underway.

In addition to the vertical mill, the expansion is expected to see an expanded leach circuit implemented, along with upgrades to the oxygen supply system and elution circuits. Optimization of reagents used will also occur to increase efficiency, while two storage ponds will be added to the mix, along with an crushed ore stockpile cover to improve winter operations.

At the same time, orders have been placed for an 18MW SAG grinding mill and an 18MW ball mill for the Phase 2 expansion, the latter of which is already fully fabricated due to a cancelled order by a different customer, which will derisk the expansion schedule. Upgrades to the mine plan for both Phase 1A and Phase 2 are currently ongoing.

“We expect Phase 1A to de-risk and enhance future free cash flows that are aimed at funding a larger Phase 2 expansion. On completion, Phase 2 has the potential to increase production to over 500,000 gold equivalent ounces per year. We are working on delivering the Phase 2 strategy and execution plan and are targeting Board approval before the end of the year,” commented Dale Andres, CEO of Artemis Gold.

Funding for Phase 1A expansion is to come from existing cash flows, with an estimated $80 to $90 million to be spent in 2026. Project payback is expected to be under six months from commissioning.

Artemis Gold last traded at $32.41 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.