Canaccord Genuity is the first investment bank to initiate coverage on Ascend Wellness (CSE: AAWH.u). Bobby Burleson initiated coverage on Ascend with a U$15 price target and speculative buy rating. He says that despite its expanding footprint in limited-license states while having one of the best track records for execution in the space, the company still currently trades at a discount to peers.

The company traded last at US$9.50, or just over a $1 billion market cap, and has a 7.2x 22′ EV/EBITDA multiple compared to its peers which trade at 11x. Burleson adds, “We see healthy upside for the shares as management delivers on its fully funded plan for driving considerable revenue growth.”

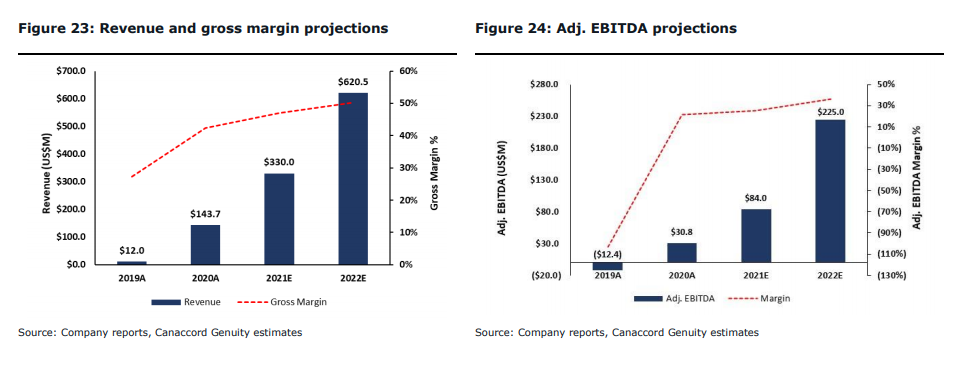

Burleson believes that the company will be able to meet its 2021 revenue guidance of $320 – $340 million, as Canaccord’s estimates for full-year 2021 is $330 million in revenue and $84 million in EBITDA. Revenue is expected to almost double to $620.5 million while EBITDA will almost triple to $225 million in 2022. It is noted that the pending acquisition of MedMen’s New York license is not being factored into their forecasts.

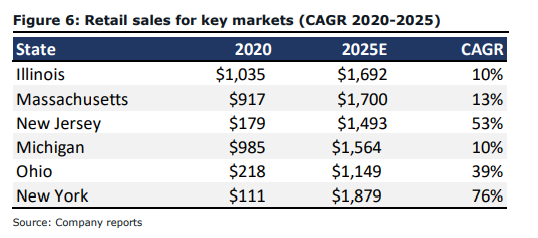

They believe that Ascend Wellness has a direct competitive advantage as they exclusively invest in limited license med/rec states with a focus on flagship B&M stores. Burleson writes, “we believe AAWH’s track record of strong execution positions the company well to deliver on the next critical phase of its expansion, including a dramatic build-out of cultivation.” Ascend is in four of the top seven states for retail sales being Illinois, Michigan, New Jersey, and Massachusetts.

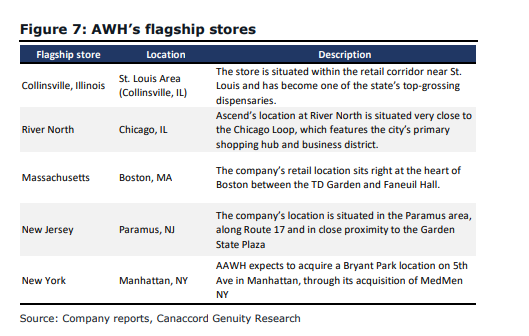

Onto the flagship stores,tThe company’s whole retail strategy has been built around dominating major metropolitan locations.

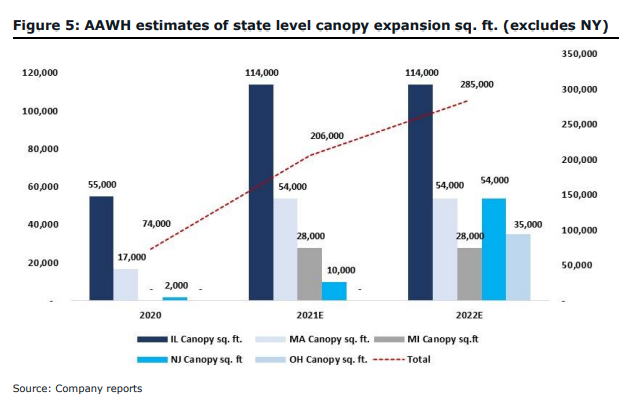

The company is expected to double its open dispensaries by 2022 with the company also expanding its production capacity to meet demand. The company will increase its total canopy by 123,000 sq feet this year with the company guiding that in 2022 they will build facilities in Ohio and New Jersey for an additional 89,000 in canopy.

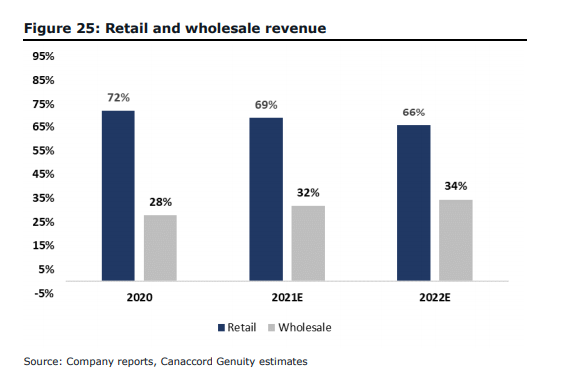

Burleson believes that the company will experience strong margin and revenue growth due to the companies core markets, being Illinois and Massachusetts, while the company opens new stores. This will also be impacted by a transition in terms of their retail/wholesale split, which is expected to start to get closer to a 60/40 split.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.