FULL DISCLOSURE: This is sponsored content for ATHA Energy.

Saskatchewan. When you think about Saskatchewan what do you think about? Perhaps, wheat fields, flat roads, maybe even bodybuilders with high pitched voices. Of course we have the 1989 Grey Cup champions, who saw Kent Austin lead the Riders past their previous hero Ron Lancaster, in what might be one of the more memorable grey cups. And who can forget that loveable sitcom, Corner Gas.

But what us stock junkies think of when we think of Saskatchewan, is that powdery yellow metal. The good stuff. That key compound that powers nuclear plants and submarines. I’m talking about Uranium. And if you haven’t been paying attention, the uranium market is picking up again.

Let’s just look at some of the recent headlines. This past summer the first American nuclear reactor to be built from scratch in decades opened in the state of Georgia, while a previously shuttered nuclear power plant in Michigan is on-track to be reopened after signing a power purchase agreement.

Up here in Canada, Quebec is looking to restart production at a previously shuttered nuclear facility, while Ontario is conducting pre-development work at the worlds largest operating nuclear power station to expand it even further. Small nuclear reactors, or SMR’s, are also on the up-trend, with four planned in Ontario, while Saskatchewan, Alberta, and New Brunswick are pushing ahead to develop such facilities of their own.

All this is to say that the world will need more – you guessed it – Uranium.

And there is a recent junior exploration-stage company by the name of ATHA Energy (CSE: SASK) that isn’t just any exploration company, they have a treasure chest of cash, a huge land position, and a team of experienced uranium players, that are looking to find the next big mine.

Let’s dive in.

The Athabasca Region

When it comes to uranium, there is one jurisdiction globally that comes to the mind of investors – the Athabasca Basin.

Situated largely in Saskatchewan, the basin is the world’s leading source of high-grade uranium, supplying approximately 20% of the market globally. The region is also home to the Cigar Lake Mine, operated by Cameco, which boasts the highest grade uranium deposit in the world at 17.21% U3O8. For perspective, as per Kitco, the mine has grades that are 100 times the world average. Prior to Cigar Lake taking this crown, the McArthur River Mine, also found in the basin, held this title.

The region has collectively produced over 900 million pounds of uranium since 1975. Needless to say, there’s a lot of U3O8 in the basin. And high grade at that.

But why does this matter?

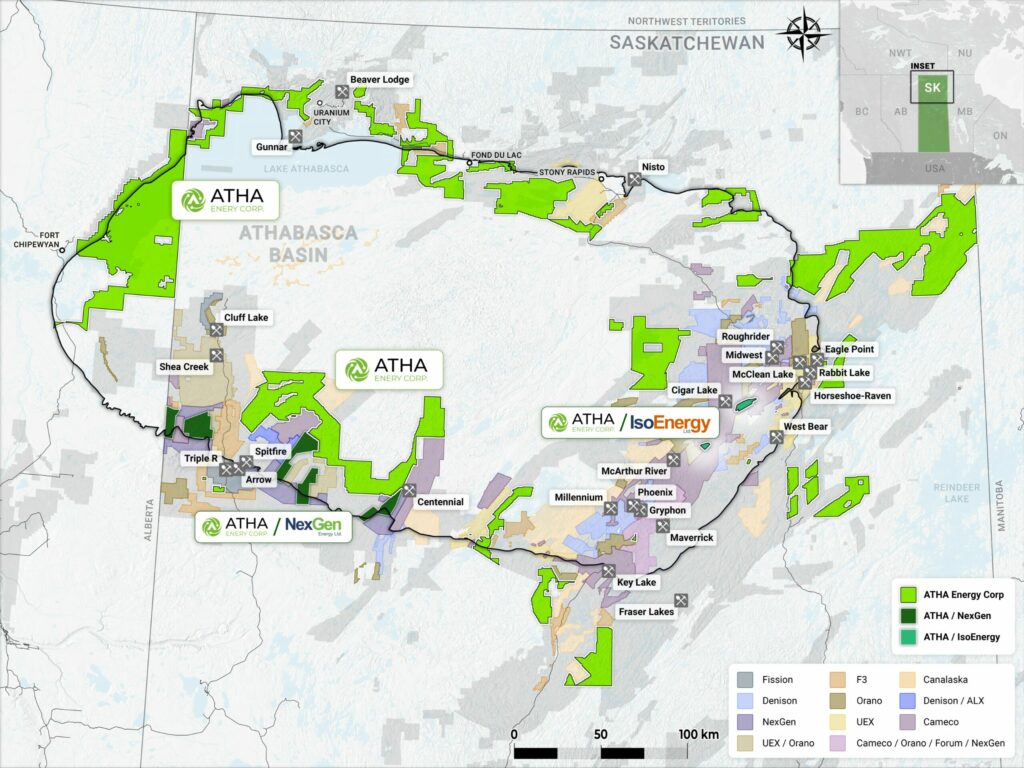

It matters because ATHA Energy has done something others have not. They’ve assembled the largest land package in the Athabasca Region. 3.4 million acres to be exact. For scale, the entirety Yellowstone National Park could fit in that space. One and a half times.

The land holdings, which are divided into four districts, East Rim, Cable Bay, North Rim and West Rim, were carefully acquired over a period of ten years by some of the most successful people involved in the region. And it includes potential upside based on a 10% carried interest held in key lands being developed by NexGen and IsoEnergy.

ATHA Energy’s Management

Lets touch on those people for a minute.

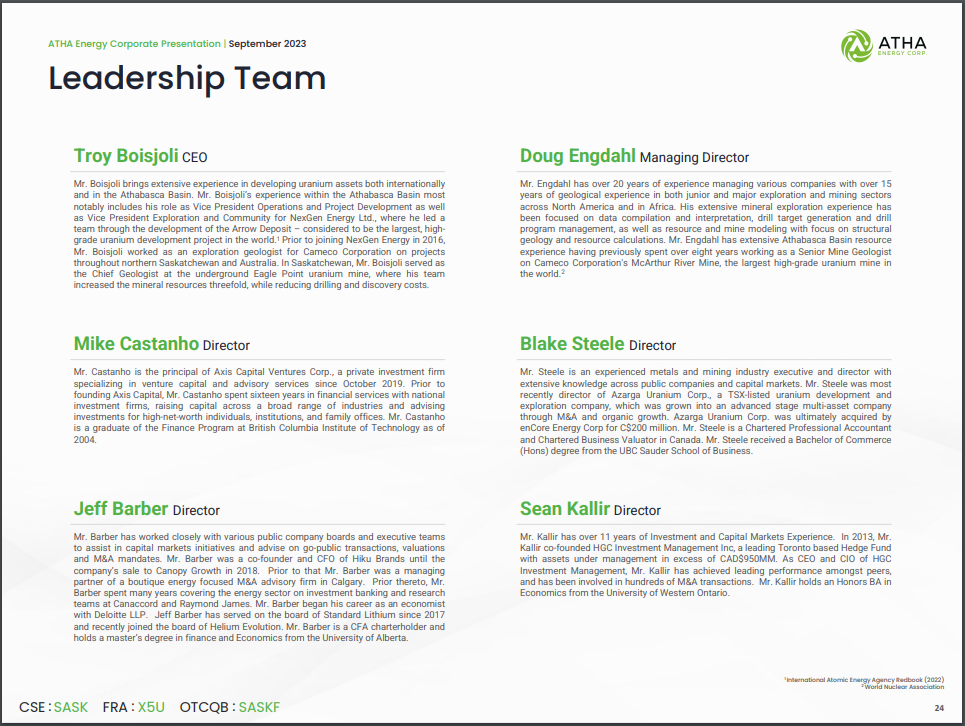

ATHA Energy is headed by Troy Boisjoli, who has a history in the basin. He’s the former VP of Operations and Project Development as well as VP of Exploration and Community for NexGen Energy, a major explorer in the region. He was a big part of building this company, which today sits a market cap of over 3.5 billion dollars.

Boisjoli notably is credited with leading the company through the development of the Arrow Deposit, which is considered to be the largest and highest-grade uranium development project globally. Troy also served time as a geo at Cameco as well.

ATHA’s technical team is filled with geologists with decades of experience at majors such as Cameco and Denison Mines, both of whom are heavily focused not just on uranium, but the Athabasca Basin as well.

The board of directors meanwhile also has extensive experience in the mining sector, with director Doug Engdahl for instance having spent eight years at Cameco’s MacArthur River Mine, while Jeff Barber has served on the board of Standard Lithium since 2017, who’s South West Arkansas project has a base-case after-tax NPV (8%) of US$3.1 billion.

Uranium Industry Forecasts

Lets talk uranium as a whole for a moment.

Nuclear is viewed as the key to a sustainable energy future, with nuclear production having the lowest carbon emissions among energy sources. And the key to nuclear is uranium.

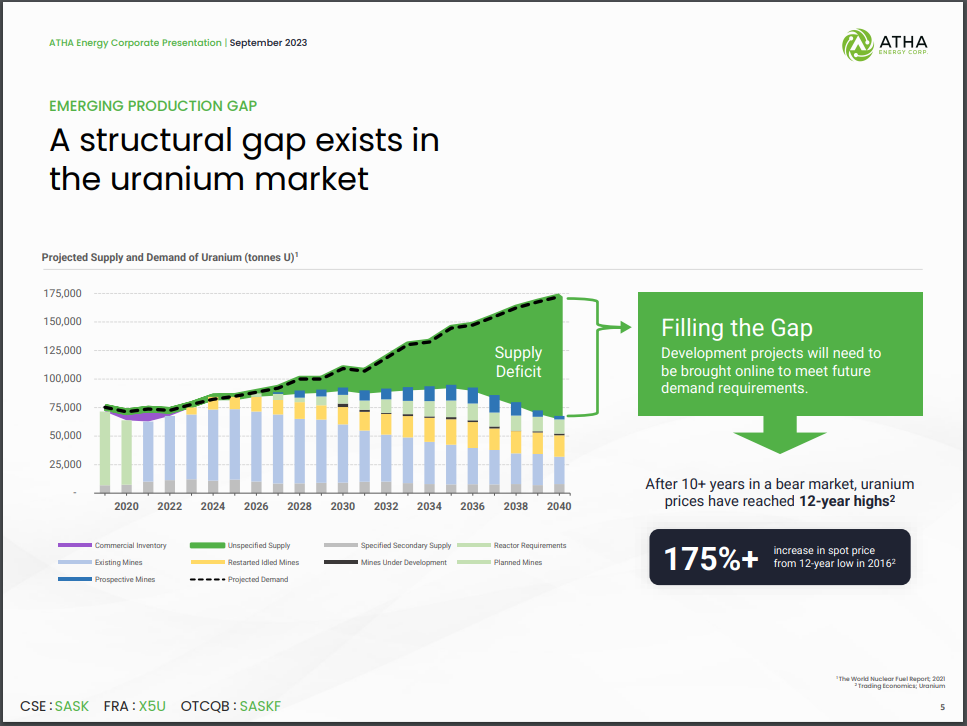

Current projections suggest that a supply deficit of several thousand tonnes is already upon us, and set to grow exponentially by 2040 to over 100,000 tonnes. Adding to that uncertainty is the fact that only 24% of global supply comes from OECD countries, who account for 69% of consumption – meaning significant geopolitical risk exists within the industry.

These shortfalls are leading to U3O8 hitting 12 year highs, climbing as high as $73 a pound, after sitting below $18 a pound back in 2016. In recent weeks we’ve encountered price levels not seen since 2008.

And yet no new supply has come online.

Current Exploration

So where does that leave ATHA Energy?

Today, they are working towards conducting one of the largest ever multi-platform electromagnetic surveys in the history of the basin, which will cover a total of 2.1 million acres. The goal of the program is to retain the largest contiguous plot of data using modern tools in the region.

A recent review of the four districts under its holdings meanwhile have shown potential to host all basin deposit models, of which there are three. Three of the four districts are the current focus for future exploration, and the company has indicated that it intends to conduct farm-out agreements to leverage its large portfolio of holdings and accelerate exploration efforts.

READ: ATHA Energy Identifies 40 Kilometres Of Conductive Corridors At East Vista Project

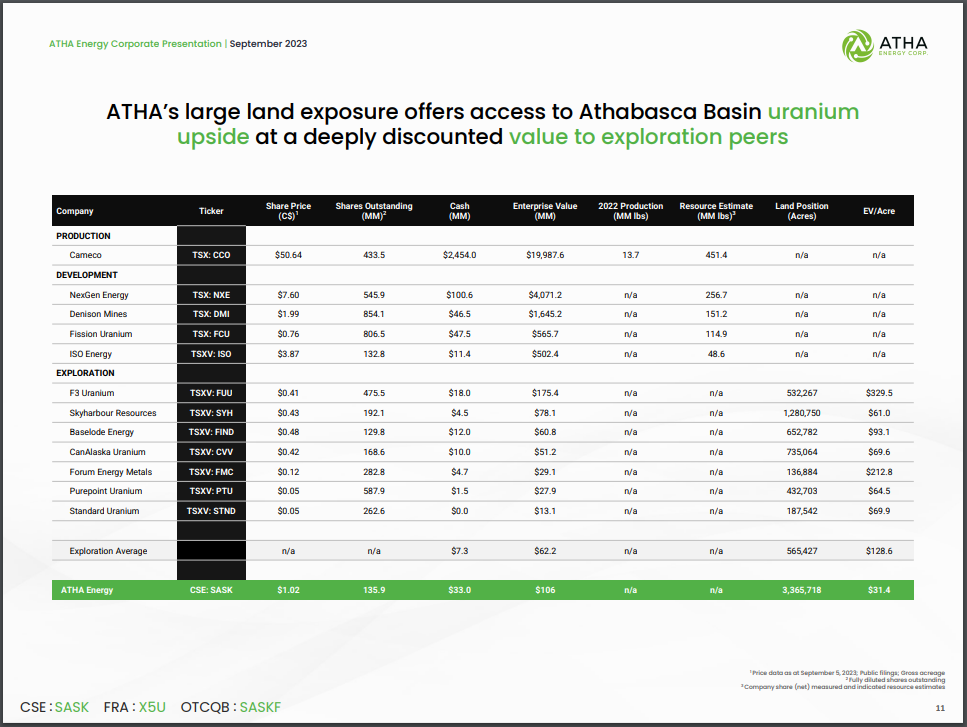

Which should unlock shareholder value, which is evident when comparing ATHA to those that operate in the region. With an EV/Acre of just $31.4, it compares to peers such as Skyharbour Resources, who trades at a multiple of $61.0 in terms of EV/Acre, and Baselode Energy, who sits at $93.1 as of September 5.

Conclusion

So, let’s wrap it up.

It’s often challenging to assess a new issuer to the junior markets in the early days of trading. Especially when they have yet to identify a flagship resource and much of the stock is still in escrow.

Still there are few individuals who have had repeated success in the Athabasca region, couple that with the largest land package in the public markets, and a sizeable balance sheet, and now you have something that merits more digging.

There a dozens of Uranium plays waiting to be noticed to be the next NexGen. Of course, NexGen Energy is a 19 bagger since first going public 9 years ago. The difference between ATHA Energy and all those other names, is that none of them come with the experience, cash and land position of the new Saskatchewan player.

Whether Uranium takes on the tailwinds we saw over a decade ago, or stays steady here is anyones bet. But if you’re looking for a name that should be able to weather either of those storms, ATHA Energy is a name worth taking a look at.

FULL DISCLOSURE: ATHA Energy is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of ATHA Energy. The author has been compensated to cover ATHA Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.