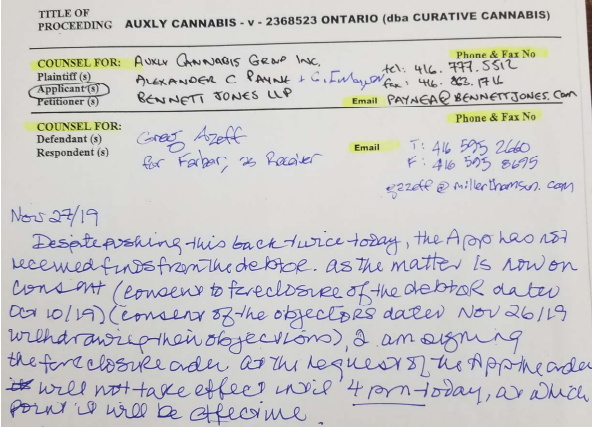

Auxly Cannabis (TSXV: XLY) has officially completed the foreclosure process on the share collateral of Curative Cannabis as of 4:00 PM Wednesday. The result, is that Auxly is now in possession, and owns, all 125 shares of Curative Cannabis, effectively making the LP applicant a wholly owned entity of Auxly.

As The Deep Dive previously reported earlier this week, Auxly Cannabis had its final hearing on Wednesday in relation to the foreclosure of Curative Cannabis’ assets, for which it has now successfully acquired a court order to secure the assets. The firm had failed to pay its secured debts, highlighting the risk that such debt within the cannabis sector can hold. Over $21.2 million was owed to Auxly by the time everything was said and done, with the amount now being paid via share collateral under a court order.

Auxly was previously in possession of the share collateral as a form of security should such events occur. Thus, it is believed that little has to be done to actually “secure” the assets from Curative Cannabis. Rather, it is believed that operations will relatively continue as normal, with Auxly being in full control.

In terms of the assets themselves, Curative Cannabis’ facility is located in Chatham, Ontario. The facility, 31,000 square feet in size, is located on a 33 acre plot of land and now has substantially completed construction as of September 30. The facility is intended to be the first phase of operations for the entity, with outdoor cultivation and a larger indoor facility planned for the future.

Construction was complete enough that on September 12, Curative applied to Health Canada for its cultivation license. Given that the licensing process has sped up significantly in the last year, it can be anticipated that the facility receives its first license for cannabis operations relatively soon.

Auxly has yet to formally issue a press release related to securing the assets of Curative. It’s recently filed financials made little mention of the matter, relegating the news to a simple sentence under its note receivables, stating, “Curative is delinquent on the secured debts owed to Auxly, and as a result Auxly has commenced the foreclosure process.”

Auxly Cannabis last traded at $0.66 on the TSX Venture.

Information for this briefing was found via Sedar, Farber & Partners Inc, and Auxly Cannabis Group Inc. The author is no position in this security and has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.