The last time we wrote about Auxly Cannabis (TSXV: XLY), we were critical of the company’s re-make into a consumer packaged goods company and away from its roots as a cannabis banking enterprise marketed to investors as a “streaming” company. Not because the original Auxly concept was such a great model, but because we don’t like the prospects of success for any of the companies trying to re-invent the cannabis wheel.

P&L

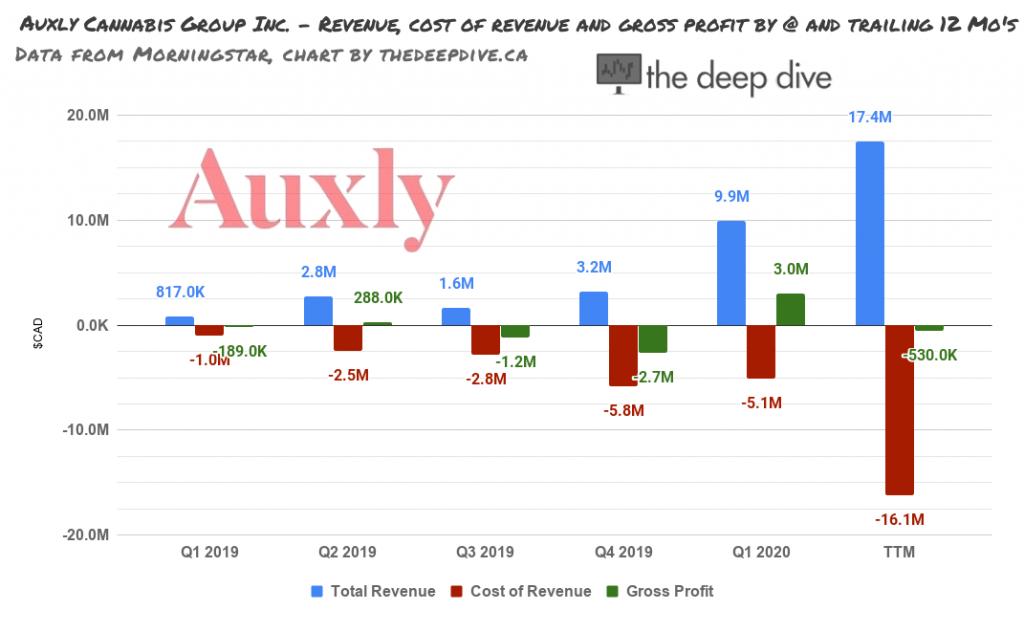

In its Q1 financials, released yesterday, Auxly managed to give the street a decent look at its new self. It’s the first quarter in which Auxly has showed shareholders that it can be a conventional operation that sells products into the market at a gross profit. Auxly was above water on the top line for the first time ever, materially speaking, posting $9.9 million in product sales (net of excise tax) and a $3 million gross profit, its first of any significance.

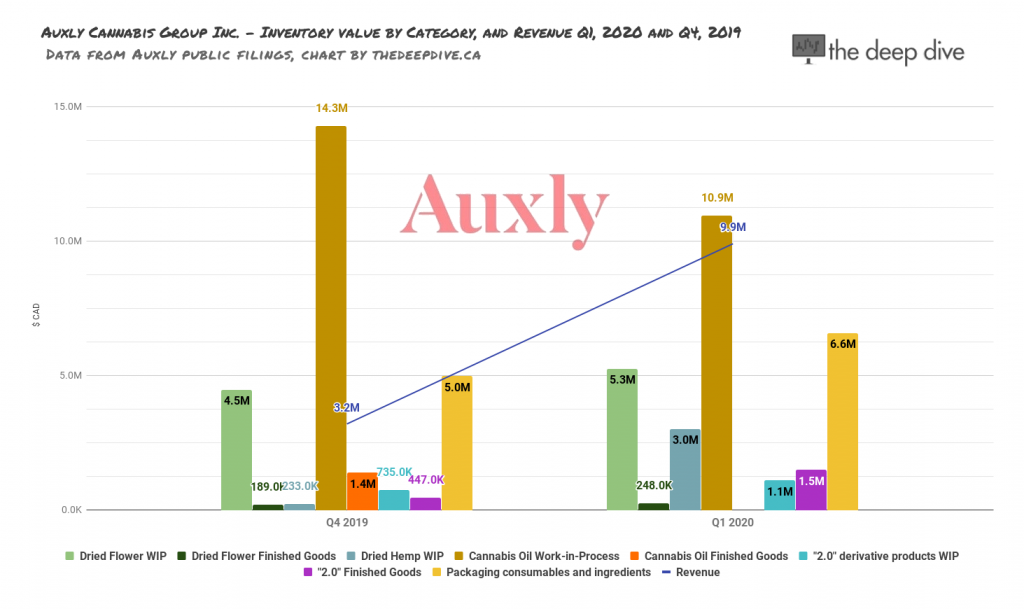

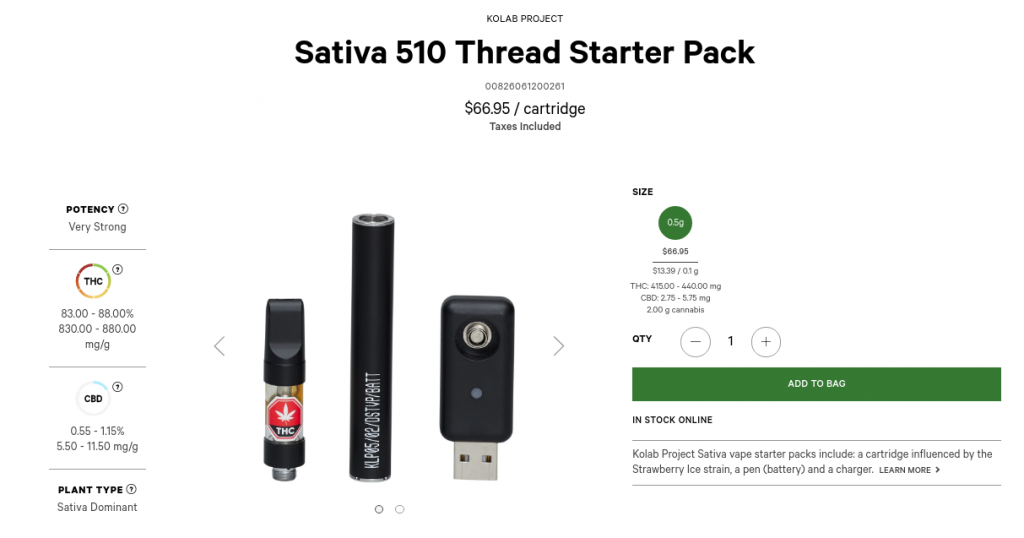

Auxly appears to be walking the walk in terms of its planned focus on cannabis 2.0 products. It reports 65% of the revenue having come from vape products, and is making a pronounced move towards products other than flower in its branding initiatives. The $10 million in sales were generated out of a Q4 inventory that was notably light on finished goods in all categories.

Inventory

It looks at a glance like Auxly found a way to turn some of its oil inventory into “generation 2 derivative products” of some description, because the bulk of this inventory by value in both the December and March quarters is oil. Second place is packaging.

The $3 million gross profit (30% gross margin) would have looked a bit juicier had Auxly not written down $259,000 worth of dried hemp and $493,000 wroth of cannabis inventory, weighing down the cost of sales. It’s the second quarter in a row that the company has written down inventory.

The relative novelty of “2.0” offerings makes it worth noting that the company hasn’t booked any provision for returns because, if the products don’t sell, you’d better believe they’re coming back.

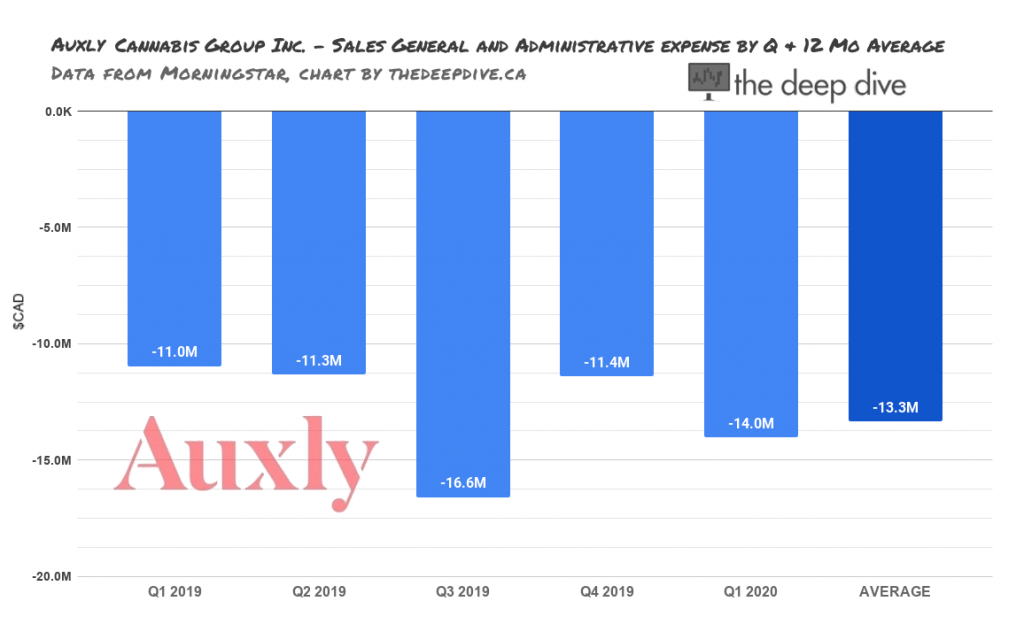

Spend and financing

While the sales growth is respectable, it still has a long way to go. Auxly is averaging an SG&A spend of $13 million per quarter, and it’s been pretty consistent. We don’t have a growth rate on the revenue, because it’s only really been one quarter, but it’s a fair bet that the $21 million cash balance won’t make enough runway to last the company until its making more than it spends, so look for a trip back to Imperial Tobacco, the only Auxly shareholder to whom cost of capital doesn’t make a difference. For them, that part’s gravy. The accretion expense generated by the convertible debentures in the quarter was $2.2 million: 73% of the gross profit.

Health Canada having not published any sales data since November, there’s no way to gauge the market’s appetite for Auxly’s 2.0 products or anyone else’s. Now that the company has shown the street that it can look like a conventional business, it will be judged on the growth that it produces between this quarter and the next.

Information for this briefing was found via Sedar and Auxly Cannabis Group Inc. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.