Ayr Strategies (CSE: AYR.A) this evening announced that it is offering a short term incentive for the exercise of up to 3 million warrants. The incentive will see the company offer $0.50 per warrant for the exercise of up to 3 million warrants that were originally issued on December 21, 2017 with an exercise price of $11.50 per share.

The kicker here, is that the warrants are well into the money. Originally issued as part of a December 2017 offering, the warrants were issued during the financing round that ultimately took the company public nearly two years later that saw a total of 13,475,000 Class A Restricted Voting Units issued.

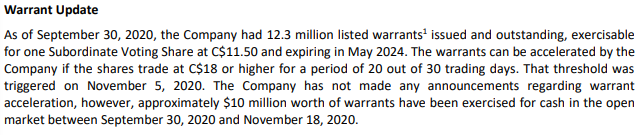

An acceleration clause was also applicable to the warrants issued, which states that the company can accelerate the expiry of the warrants should its shares trade at C$18 or higher for a period of 20 out of 30 trading days. When the company announced its third quarter financial results on November 18, it indicated that this clause had been met as of November 5, 2020. Even more interesting, is that warrants were already being exercised.

The company notes that $10 million worth of warrants were exercised between the period of September 30 and November 18, 2020. Notably, the $10 million value is not indicated to be in Canadian dollars, while the share prices listed above for the acceleration clause is. This dollar value would translate to roughly $13.08 million Canadian, or the equivalent of 1,137,491 warrants.

Thus, the question arises: why offer an incentive to exercise warrants, when the warrants are in the money, and the acceleration clause has been triggered, but not exericsed?

Should all 3.0 million warrants be exercised that the offering pertains to, the company would receive C$33.0 million in gross proceeds, or US$25.0 million. Holders of the warrants have until December 8, 2020 to take advantage of the offer. If more than 3.0 million are exercised under the offering, the discount will be applied on a pro-rata basis.

Ayr Strategies last traded at $23.75 on the CSE.

Information for this briefing was found via Sedar and Ayr Strategies. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.