The coronavirus pandemic has left the Canadian economy battered and damaged, and in such a state that has not been witnessed in our lifetimes. Although the peak of the pandemic is showing signs of subsiding as governments have approved the gradual lifting of restrictions, the downturn is far from over. According to Bank of Canada’s governor Tiff Macklem, we should expect to a see an uptake in economic activity by the third quarter, given that households have begun returning to work and resuming some of their day-to-day activities.

Macklem however, suggests that this positive economic outlook is not here to stay. Provinces and industries across Canada have taken varying approaches when it comes to lifting restrictions, as some are still experiencing infection rate increases. Consumer confidence is also a strong indicator of an economy’s wellbeing, and at this time it is difficult to predict its path. Moreover, unemployment numbers in Canada were in excess of 3 million in April, and although businesses are opening back up, many have reduced the number of required, leaving many Canadians with out of the labour force.

Due to the uncertainty surrounding the future course of the pandemic, Canada’s economic recovery will be slow and bumpy with potential setbacks along the way. Some sectors of the economy could undergo changes that would carry through to a post-pandemic scenario. According to Macklem, some jobs may not even come back, leaving some Canadians stranded in terms of employment options.

In response to the severity of the pandemic and the financial hardships that ensued, the Bank of Canada dropped its policy interest rate down to 0.25%, and has initiated a purchasing program aimed at government debt and bonds as a means of uplifting markets. However, such low interest rates- coupled with the severity of the economic shock are having a substantial impact on the target inflation rate.

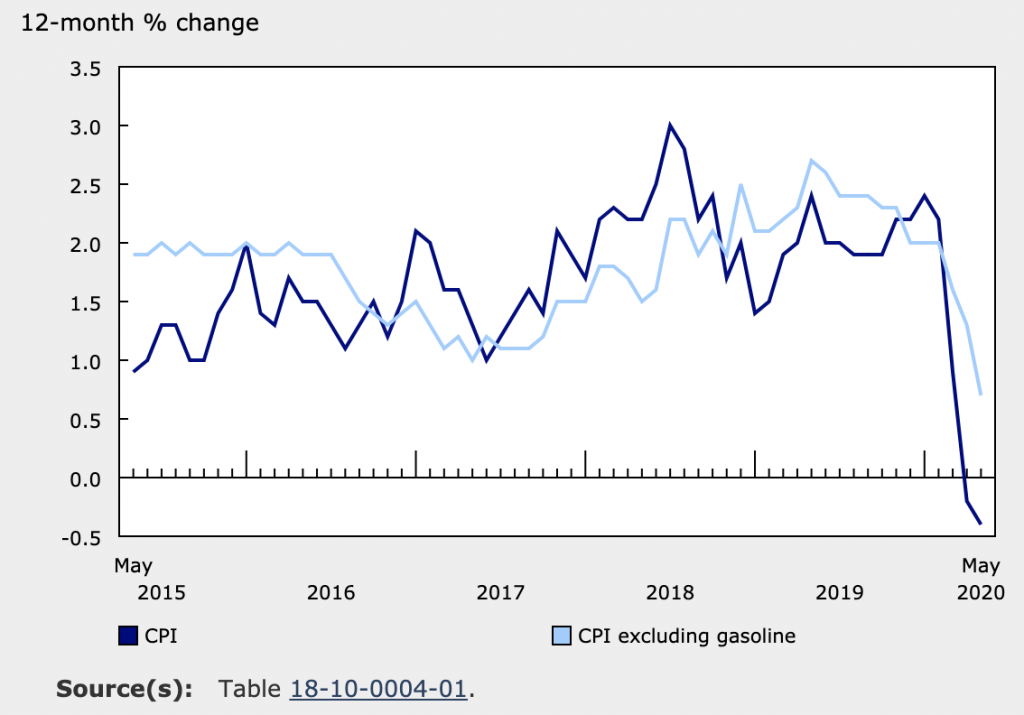

Normally, the Bank of Canada sets the target annual inflation rate at 2%, which is then measured using the consumer price index. During the unprecedented scenario posed by the pandemic however, the basket of goods which form the basis of the consumer price index has changed. Consumer spending habits during the pandemic have shifted significantly, with many Canadians greatly reducing their demand for gasoline, thus causing fuel prices to drop. Conversely, grocery purchases have increased though.

The sudden changes in the consumer price index, as well overall changes in consumerism and household income levels has created a negative annual pace of inflation. According to Statistics Canada. the annual inflation rate measured in May was at -0.4%, giving way to a second consecutive month of negative inflation.

Information for this briefing was found via CBC News and Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Hyperinflation: Remember, GDP = Money Supply x Velocity

When trying to wrap my head around economics, I like to simplify basic principles down...