A research paper written by Soyoung Lee of the Financial Stability Department of Bank of Canada has conducted a quantitative analysis of the effects of debt relief as a stimulus policy during economic recessions. Using a dynamic stochastic general equilibrium (DGSE) model that considers the diversity of households’ financial situations, this research looks on the potential benefits of mortgage principal reduction in stabilizing the economy during downturns.

“I study debt relief as a stimulus policy using a dynamic stochastic general equilibrium model that captures the rich heterogeneity in households’ balance sheets. In this environment, a large- scale mortgage principal reduction can amplify a recovery, support house prices and lower foreclosures,” Lee prefaced in his paper.

One of the primary motivations for exploring the impact of debt relief during recessions is the aftermath of the Great Recession. Many have argued that mitigating the financial distress of underwater borrowers could have mitigated the sharp rise in foreclosures and the subsequent decline in house prices. Furthermore, preventing substantial initial house price declines might have led to reduced foreclosures, thereby supporting house prices and household spending over time. However, to date, there has been a scarcity of quantitative analysis regarding debt relief as a stimulus policy.

Lee’s objective is to provide a comprehensive quantitative assessment of the effects of mortgage relief programs, and he uses a DSGE model designed to capture the heterogeneity in households’ assets and liabilities. In his research, he uncovers a series of intriguing findings.

In a recession marked by a significant drop in house prices, Lee’s research demonstrates that a large-scale mortgage principal reduction does not merely lower foreclosure rates but can also amplify economic recovery. Key to understanding this phenomenon is the interplay of general equilibrium responses in prices, which play a pivotal role in propagating the effects of the policy intervention over time.

— Tablesalt 🇨🇦🇺🇸 (@Tablesalt13) October 11, 2023

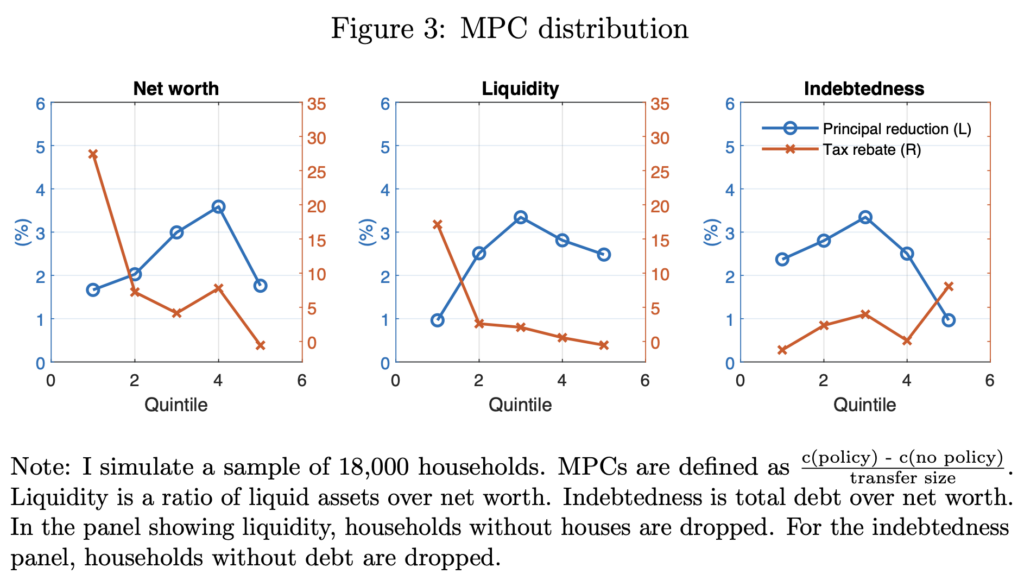

Lee highlights that the design of such a policy, including eligibility criteria, the type of transfer, and how it is financed, significantly shapes its macroeconomic consequences. Crucially, the magnitude of these effects hinges on the extent to which debt relief policies redistribute resources across households with varying marginal propensities to consume (MPC).

To offer a holistic analysis, Lee develops a model that allows for a comprehensive examination of the effects of mortgage-related programs. In this model, households can borrow or save in liquid assets, while also holding illiquid assets and liabilities in the form of houses and mortgages. Housing provides service flows, which are valued alongside non-durable consumption, but households face idiosyncratic risks and have limited ability to insure themselves due to incomplete markets. Borrowers have the option to declare bankruptcy on unsecured debt and foreclose on their mortgages.

Lee’s research reveals that a substantial mortgage principal reduction has persistent effects on aggregate consumption, output, bankruptcy, foreclosure, and house prices.

“By comparing debt relief to a tax rebate, an untargeted, liquid income transfer, I find that the liquidity of transfers and the distribution of recipients’ MPCs play a large role in determining the response in macroeconomic variables,” Lee concludes.

Moreover, the availability of bankruptcy as an option plays a pivotal role in assessing large-scale debt relief policies. It provides partial consumption insurance to households, potentially making additional debt relief less necessary. The presence of the bankruptcy option also influences households’ borrowing and savings decisions, ultimately altering the distribution of assets across households, which, in turn, significantly impacts the effectiveness of policies.

“This distribution is a key determinant of the effects of policies, and I found policies appear to be more effective when a bankruptcy option does not exist,” Lee added.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.