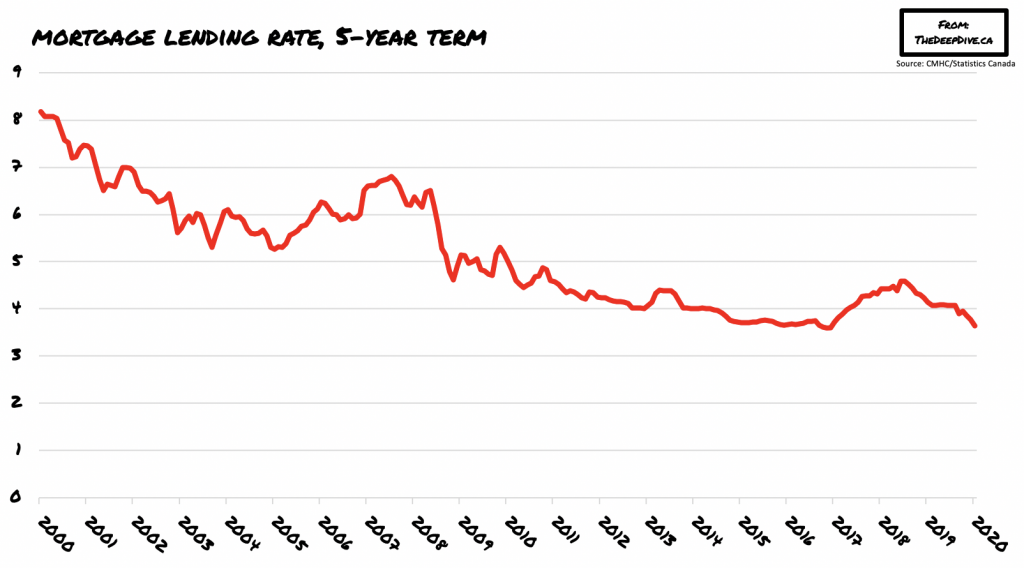

The Bank of Canada has decided to further decrease its benchmark five-year mortgage rate to 4.79%. This is the third reduction over a span of three months, as Tiff Macklem, the central bank’s governor, plans to keep rates low for at least the next three years.

However, the reduced rates will also cause the demand for housing to increase, thus further fuelling disparities in Canada’s housing market. Back in June, the Canada Mortgage and Housing Corporation (CMHC) decided to tighten mortgage borrowing criteria including increasing the minimum allowable credit score as a means of protecting the Canadian housing market from risky mortgages and rising home prices. Nonetheless, many private lenders decided not to observe the new rule changes, prompting CEO Evan Siddall to pen a letter urging for their cooperation.

In response to that letter, Gord Nixon, who is the former Royal Bank of Canada CEO mentioned in a Bloomberg interview that he finds the letter extreme and rather too alarmist. Although Nixon agreed that Siddall’s concerns regarding the current developments in the mortgage market are valid, he assures that lenders are responsible, and as such there is no need to heighten the worry.

But it appears that Siddall’s letter striked just the right nerve among the housing community, as Nixon is not the only one projecting his apparent annoyance. Speaking to Bloomberg, Mattamy Homes Canada CEO Brad Carr pointed the finger right back at CMHC regarding the developing problems in the housing industry. According to Carr, the problem is not the demand for housing– which the CMHC is trying to suppress, but rather the bottleneck in supply.

In response to the ongoing criticism, CMHC’s CEO Evan Siddall turned to twitter in defence of his letter. Instead of taking the comments and concerns among the lending community as a moment to retrospect on some of the issues that the CMHC may have overlooked, Siddall took to twitter to express his discontent. According to Siddall, the push-back in response to his letter is not substantiated, but rather his message has been twisted by “self-serving commentators.”

Although the real estate market has been showing signs of strength amid the coronavirus pandemic, the CMHC projects that average housing prices have the potential to decrease up to 18% compared to pre-pandemic levels.

Information for this briefing was found via the CMHC and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.