Bank of Canada Governor Tiff Macklem warned on Friday that proposed US tariffs would permanently lower Canada’s economic output by 2% and nearly erase growth for two consecutive years while pushing inflation above target.

Speaking to the Mississauga Board of Trade, Macklem presented the central bank’s most detailed analysis yet of the potential damage from President Trump’s February 1 executive order imposing 25% tariffs on non-energy goods and 10% on energy exports.

“If U.S. tariffs play out as threatened, the economic impact would be severe,” Macklem said. “A protracted trade conflict would sharply reduce exports and investment. It will cost jobs and boost inflation in the next few years and lower our standard of living in the long run.”

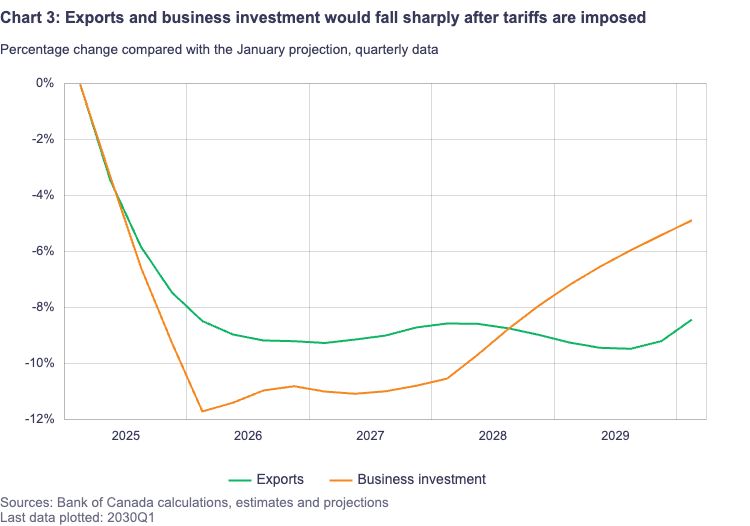

The central bank’s economic models project exports would plummet 8.5% within a year of the tariffs taking effect, while business investment would collapse by nearly 12% by early 2026, according to charts presented during the speech.

Consumer spending would decline more than 2% by mid-2027 as household incomes fall due to reduced export revenues, triggering a downward economic spiral.

“This implies tariffs would all but wipe out growth in the economy for those two years,” Macklem said, describing the impact as more than just a temporary shock.

Unlike the COVID-19 pandemic’s temporary disruption, Macklem emphasized these tariffs would cause permanent structural change to Canada’s economy, with output “permanently lower” even after the initial adjustment period.

The governor acknowledged that monetary policy faces severe limitations in addressing tariff-driven economic damage.

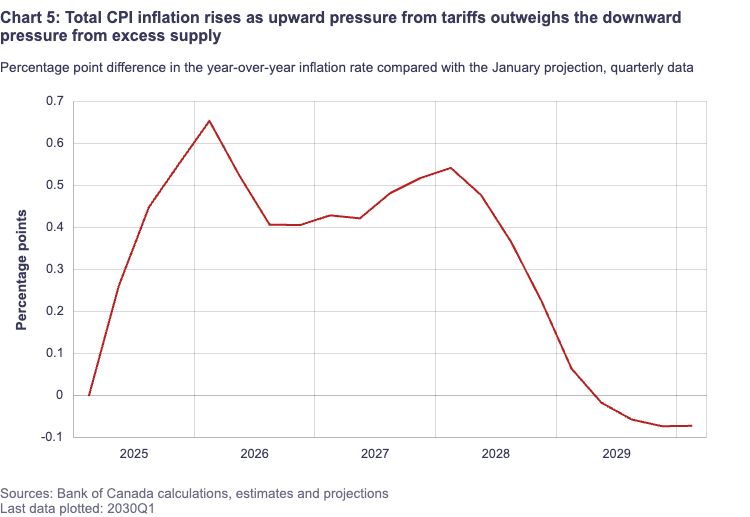

“Central banks can do little to mitigate the damage caused by a trade war,” he said. “Our role will be to balance the upside risks to inflation from higher costs with the downside risks from weaker demand.”

The speech comes at a sensitive time as roughly three-quarters of Canada’s exports flow to the United States, with Canadian energy products “literally fuel[ing] the U.S. economy at a price no one else in the world can provide,” according to Macklem.

The Bank of Canada plans to focus on helping smooth what Macklem described as a “painful adjustment to a lower path for the economy while preventing price increases from becoming higher ongoing inflation.”

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.