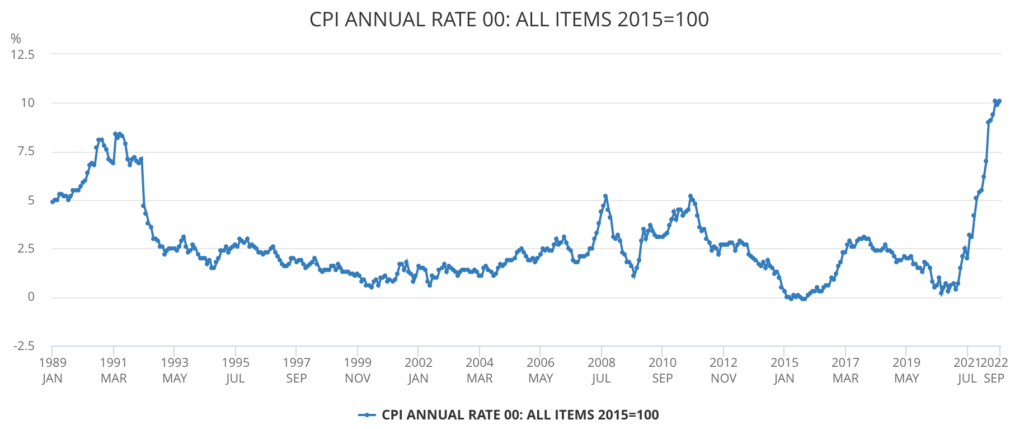

The Bank of England delivered one of the largest rate hikes in 33 years on Thursday, which will soon be followed by a dark and prolonged recession against some of the highest inflation in over 40 years.

Following in the footsteps of the Federal Reserve, England’s central bank opted to raise interest rates by 75 basis points, marking the biggest increase sine 1989. Borrowing costs will now rise from 2.25% to 3%— the highest since 2008 during when the UK’s banking system imploded. Making matters worse though, are the Monetary Policy Committee’s projections on the upcoming state of the economy: not only did policy makers concede the British economy is already in a “challenging” downturn, but the double-dip recession is expected to continue throughout next year and into the first half of 2024 with only one positive quarter of growth.

Although the downturn wouldn’t mark UK’s deepest one, it will be the longest on records dating back to the 1920s. Latest BOE projections suggest that GDP fall 3% next year should interest rates peak at 5.25% as per the current market path, which will bring inflation to essentially zero. However, should borrowing costs remain at the current 3%, the economy will contract 1.7% in two-years time, and the recession would be shorter and less severe, but it would take at least two years to bring inflation back to the bank’s 2% target range.

The economic landscape was further complicated by former disgraced prime minister Liz Truss’ disastrous “mini budget,” as the prospect of unfunded tax cuts sent the pound plummeting, crashed bond prices, and wreaked havoc across mortgage markets, ultimately prompting an emergency intervention from the BOE to save collapsing pension funds. Although her plan has since been ditched and medium-term inflation expectations have eased, price pressures still remain persistent. Inflation across Britain rose from an annual 9.9% in August to 10.1% in September, once again bringing price pressures to the highest in over 40 years.

The BOE forecasts inflation will peak at 10.9% over the next several months, before eventually falling to 1.4% in two years.

Information for this briefing was found via the Bank of England and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.