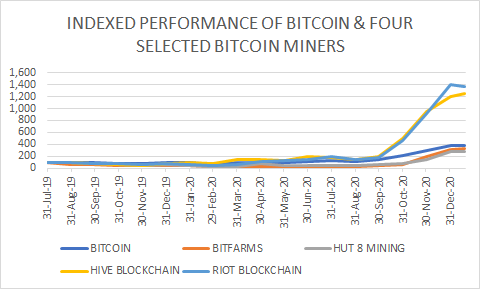

Given the explosive performance of Bitcoin over the past six months, and the even more dramatic positive moves by the shares of Bitcoin miners over this period, it is instructive to compare the performance of each miner to that of Bitcoin.

The figure below charts the 18-month price action of Bitcoin, as well as that of the three main Bitcoin miners listed in Canada, and Riot Blockchain, a major Bitcoin miner listed in the United States. Each price chart is presented in index form and in terms of common currency, where 100 is the uniform starting point.

The financial media has focused on Bitcoin’s rapid appreciation, but Bitcoin miners as a group have performed substantially better than the world’s largest cryptocurrency over the last 18 months. Over the last five months, that outperformance has been even more pronounced. Among the miners, shares of Riot Blockchain and HIVE Blockchain Technologies Ltd. (TSXV: HIVE) have each increased an astonishing 1,100+% since July 31, 2019. In contrast, Bitcoin and the stocks of Bitfarms Ltd. (TSXV: BITF) and Hut 8 Mining Corp. (TSX: HUT) have appreciated by “only” 170% to 280%.

Relative Valuation of the Bitcoin Miners

One way to value Bitcoin miners is to compare their enterprise value to their computing power, measured in Petahash per second (PH/s). Bitcoin miners solve extremely complex math problems, the answer to which is a long string of numbers, called a hash.

In turn, the speed at which a miner’s suite of computers can reach such an answer is termed the hash rate. A miner which has a total of 1 PH/s of computing capacity can create one quadrillion hashes per second. The table below compares the companies’ current EV to their year-end 2020 hash rates, according to SEDAR filings and company press releases.

| Estimated 12/31/20 | BITFARMS (A) | HUT 8 MINING | HIVE BLOCKCHAIN (B) | RIOT BLOCKCHAIN (C) |

| Hash Rate, in PH/s | 965 | 1,147 | 653 | 842 |

| Net Debt, in US$ Millions | $23 | $8 | ($10) | ($39) |

| Stock Market Value, in US$ Millions | $362 | $682 | $1,051 | $1,702 |

| Enterprise Value, in US$ Millions | $385 | $690 | $1,041 | $1,663 |

| EV Divided By PH/s, in Thousands of US$/PH/s | $398,964 | $601,569 | $1,594,688 | $1,975,059 |

(A) Bitfarms added 82 PH/s in September 2020, bringing its total to 747 PH/s at 9/30/20. Bitfarms added 144 PH/s in November 2020 and 74 PH/s in December 2020, bringing total to 965 PH/s for year-end 2020.

(B) In early January 2021, HIVE announced the installation of 334 PH/s of capacity, bringing its installed base to 653 PH/s. Later in January 2021, it announced the purchase of a further 576 PH/s of capacity.

(C) Riot Blockchain installed 278 PH/s of capacity on 1/19/21 to bring its capacity to 842 PH/s. It plans to have installed capacity of 1,300 PH/s by 3/31/21; 2,400 PH/s by 6/30/21; 2,800 PH/s by 9/30/21; and 3,800 Ph/s by 12/31/21.

By this measure, Bitfarms is the most inexpensively valued Bitcoin miner. Hut 8 Mining’s EV/hash rate is fairly close to Bitfarm’s, but HIVE Blockchain’s and Riot Blockchain’s ratios are dramatically higher. It should be noted that Hive has subsequently announced substantial planned additions to its hash rate, with two separate orders of significance. It is possible that the market is valuing those companies based more on hash rate goals they hope to achieve, but even by that gauge, Bitfarms has plans to increase its capacity significantly as well.

Conclusion

Bitfarms stock has appreciated less than its Bitcoin mining peers, particularly versus Riot Blockchain and HIVE Blockchain. In addition, its EV indexed to its computing power likewise trades at a significant discount to other miners. We do note, however, this is not the only way to estimate the relative value of Bitcoin miners. For example, the EV/Hash rate ratio does not factor in the efficiency of a miner’s computer fleet nor its electricity costs, which is the largest part of its cost structure.

An open question is how the Bitcoin miners will perform if Bitcoin itself corrects. Since these stocks rocketed well ahead of the underlying cryptocurrency on the way up, it is possible they could lead on the way down as well.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.