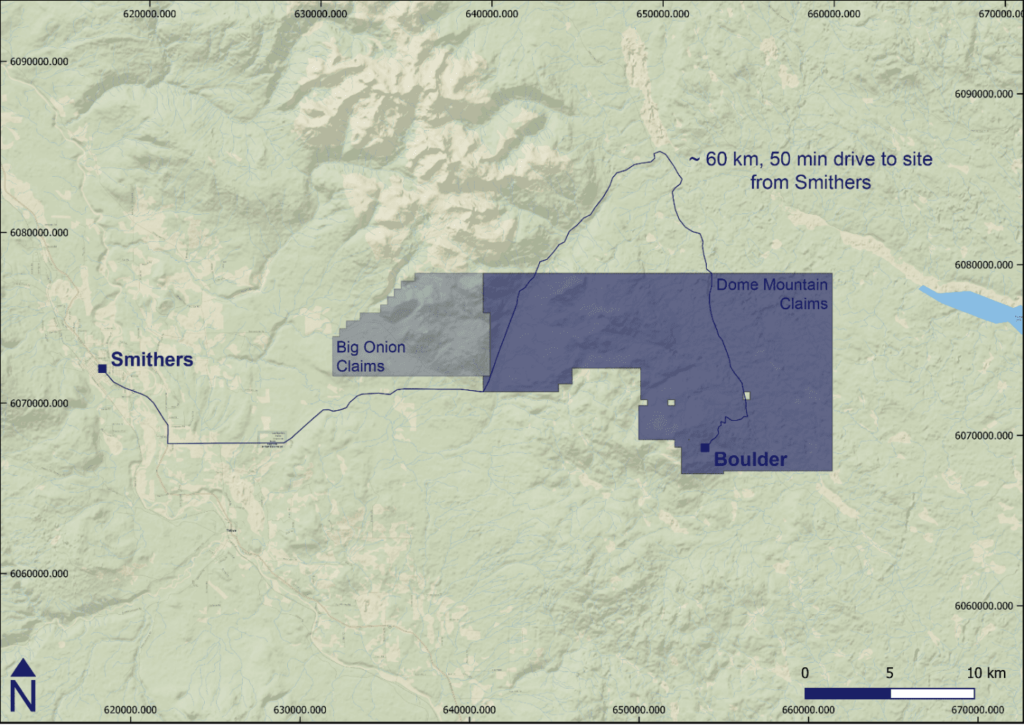

Blue Lagoon Resources Inc. (CSE: BLLG) is a Vancouver-based junior mineral exploration company that is actively exploring and developing its projects in British Columbia. The company is focused on advancing its flagship 100-owned 18,617 hectare Dome Mountain Mine high-grade gold project located 66 kilometres east of Smithers in northwestern BC.

The Dome Mountain project holds both an Environmental Management Act Permit (EMA) and a Mining Permit providing for up to 75,000 tonnes of annual production. The property hosts the past-producing Dome Mountain gold mine and has 15 known high-grade gold veins, including the high-grade Boulder Vein which has attracted most of the historical exploration activity. 90% of the massive property is still unexplored. Blue Lagoon has been generating modest revenue from selling mineralized material from the mine, which helps offset some of the company’s operating costs.

The Dome Mountain property has attracted the attention of serious precious metals investors, including strategic investor Crescat Capital and its Chief Geologic and Technical director, world-renowned geologist Dr. Quinton Hennigh. Hennigh has carefully analyzed the potential of Dome Mountain and assessed that the project has much more discovery potential than just at the Boulder Vein, the area of the property that historical drill programs have focused on.

Further, Hennigh has publicly stated that the vein systems within the Dome Mountain property appear to be almost geologically identical to those of the Buritica Mine in Colombia, South America. Burtica is owned and operated by Zijin-Continental Gold and it is expected to initially produce 240,000 ounces of gold per year. These vein systems are open at depth, and if Dr. Hennigh is correct, Dome Mountain has the potential to become a major gold deposit..

In 2021, drilling by Blue Lagoon discovered a new vein system they call the Chance Structural Corridor. This month, the company announced that a recent drill hole into this structure encountered a new high-grade vein that returned assay values of 14.8 g/t gold and 38.3 g/t silver over 7.3 metres, as well as a second vein further downhole that returned 26.9 g/t gold and over 100 g/t silver over 1.04 metres.

Blue Lagoon will dedicate one of the drills to the Chance Structure to follow up on this development, and the other drill will continue to follow up earlier holes with step-out and infill drilling. The goal of this drilling is to further delineate the size and scope of the vein systems emanating away from the Boulder Vein along strike and at depth.

In a testament to the work Blue Lagoon has accomplished since acquiring the project in 2020, a NI 43-101 technical report was released in early February 2022. The report contains the property’s first instance of measured gold resources, which shows that it contains 45,000 ounces at an average grade 10.32 g/t gold and 250,000 ounces of silver at 57.31 g/t. Indicated resources were 173,000 ounces at 8.15 g/t gold and 876,000 ounces at 41.19 g/t silver. The estimate also included inferred resources of 16,000 ounces at 6.02 g/t gold and 71,000 ounces at 26.13 g/t silver.

The estimate represents a 145% increase in indicated gold resources from the report prepared by the previous property owners, and overall, the new report shows that contained gold ounces increased by 30% and silver ounces by 46%. These numbers only came from a small portion of the property. As drilling progresses on new targets and return high-grade intercepts, management believes that the resource calculation can rise significantly, which will be important for the project’s path to pre-feasibility.

Blue Lagoon Resources is well-capitalized with over $4 million in the treasury. Currently there are also in-the-money warrants that could provide an additional $4.5 million once they are exercised, providing the company with ample cash to execute its exploration programs. BLLG has 88.78 million shares outstanding and a market capitalization of $48.83 million.

The company is currently actively exploring with two drills that can operate 24/7 year-round. The Dome Mountain Property appears to have significant upside potential, and if future exploration programs find a significant discovery and/or if many of the veins can be tied into a sizable overall high-grade deposit, this could attract the attention of a larger mining company looking to put the property into production and therefore provide Blue Lagoon shareholders with a lucrative exit. In the interim, the sheer size of the Dome Mountain property suggests that continuous news flow can be expected as the property continues to be advanced.

FULL DISCLOSURE: Blue Lagoon Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Blue Lagoon Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.