On October 18th, K92 Mining Inc. (TSX: KNT) reported their third quarter production results. The company announced a record throughput of 87,621 tonnes processed, up 35% year over year. Quarterly production grew to 21,908 ounces of gold, 802,545 pounds of copper, and 19,736 ounces of silver. The firm additionally announced that the company approved the Stage 2A expansion at its Kainantu gold mine, which is expected to increase K92’s annual throughput by 25% to 500,000 tonnes.

There are currently 11 analysts who cover K92 Mining with an average 12-month price target of C$11.45, or a 65% upside. Out of the 11 analysts, 3 have strong buy ratings and 8 have buy ratings. Stifel-GMP has the street high price target of C$14 while the lowest comes in at C$8.75.

In BMO’s note, they reiterated their C$11 price target and Outperform rating, saying K92 is “Building Momentum After a Strong Finish to Q3,” although the gold equivalent production of 24,122 ounces came in below their estimates.

Management has noted that COVID-19 related labour issues are the main reason behind mine developments and lower production. Because of this, higher-grade stopes were not mined in the third quarter which impacted head grades, which came in at 9 g/t versus the 14 g/t recorded last year.

Although management has flagged labour issues, BMO notes production from this mine hit 49% of total third-quarter production. They believe that this and the beginning of mining at Judd will help production going into the fourth quarter.

Lastly, BMO expects K92 to not hit managements guided 115,000-135,000 ounces, writing, “While we anticipate a return to strong production in Q4 driven by an improving COVID-19 situation and the start of mining from Judd, in our opinion, it is unlikely that Q4 can make up for the challenges seen earlier in the year.” Because of this, they have slightly lowered their 2021 production forecast to 103,000 ounces from 108,000 ounces of gold equivalents.

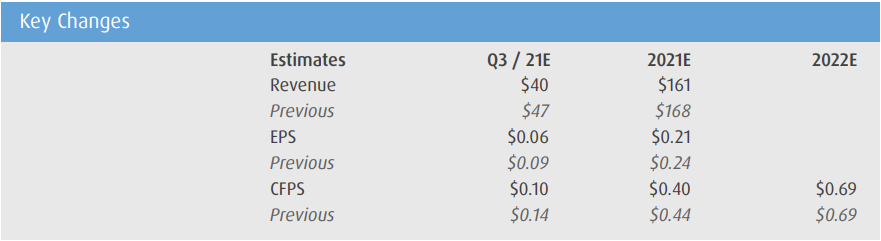

Below you can see BMO’s third quarter and 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.