Last week, Osisko Gold Royalties (TSX: OR) announced their preliminary second quarter deliveries and gave investors an asset update. Osisko earned roughly 20,178 gold equivalent ounces, or GEO’s, in the second quarter and had preliminary revenue of $57.2 million, with costs of sales amounting to $10.1 million for the second quarter. The company also provided an update for their Malartic and Kirkland Lake exploration assets.

Osisko Gold has 14 analysts covering the company with an average 12-month price target of $23.11, or a 38% upside. Scotiabank has the street high at $28.50, while the lowest sits at $19.60. Out of the 14 analysts, five have strong buy rates, eight have buys and one analyst has a hold rating.

In BMO’s note to investors on July 12, they reiterated their $21 12-month price target and Market Perform rating, saying that Osisko’s pipeline project is starting to show growth. Osisko’s preliminary results and GEO’s are in line with BMO’s estimates, and they believe that Osisko is on track to hit its full year GEO guidance range of 78,000 – 82,000 GEO.

BMO says that Osisko, “continues to highlight organic growth opportunities,” including its Minera Alamos Santana project, Victoria’s Eagle mine, and Canadian Malartic.

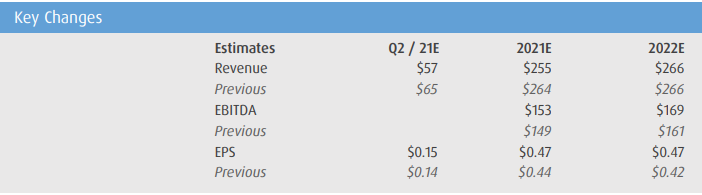

Below you can see BMO’s updated second quarter, 2021, and 2022 estimates, including the Canadian Malatric exploration upside. The estimates notably do not include the Santana project.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.