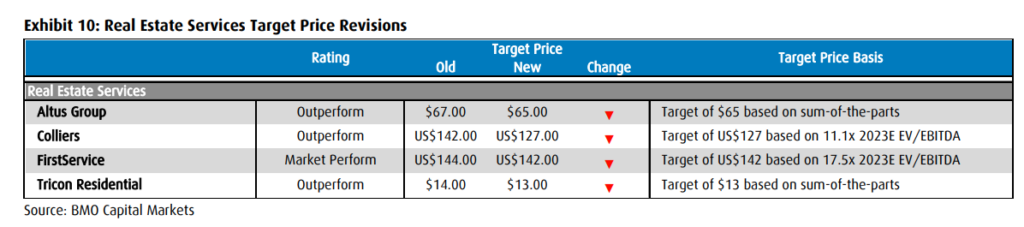

On December 16th, BMO Capital Markets provided their 2023 real estate services sector outlook. They say they cover many companies that operate and are affected in different ways in real estate. As a result, they have only reiterated an outperform rating on three names, Altus Group, Colliers, and Tricon Residential. They believe these three companies have “resilient business models and the ability to emerge from near-term economic weakness in a position of strength.” While they reiterate their market perform rating for FirstService. Additionally, BMO has lowered its price targets for all four companies.

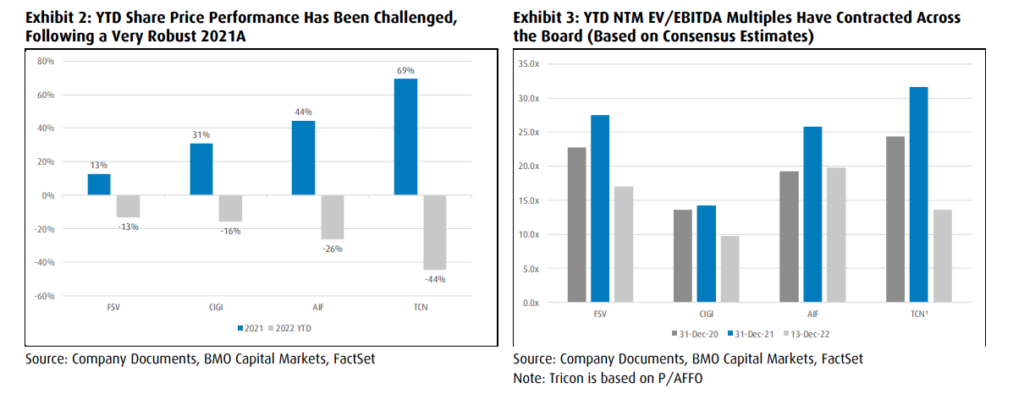

Before BMO gets into its key themes, they point out that the average share price has declined by 25% year to date, and multiples have come down significantly.

Heading into 2023, BMO provides investors with some high-level takeaways from 2023 and explains what to expect in 2023. The first and most obvious thing the investment firm points to is that companies will need to see interest rates plateau as well as the outlook for the economy to become more clear.

They say that due to this uncertainty, there is a wide gap between the buyer and seller pricing expectations. This has led to a sharp drop in commercial real estate volumes. Though BMO does not try to predict when these factors will change, they say that once there is clarity, the buyer and seller gap will close, leading to higher transaction volumes.

One Man’s Loss is Another Man’s Gain

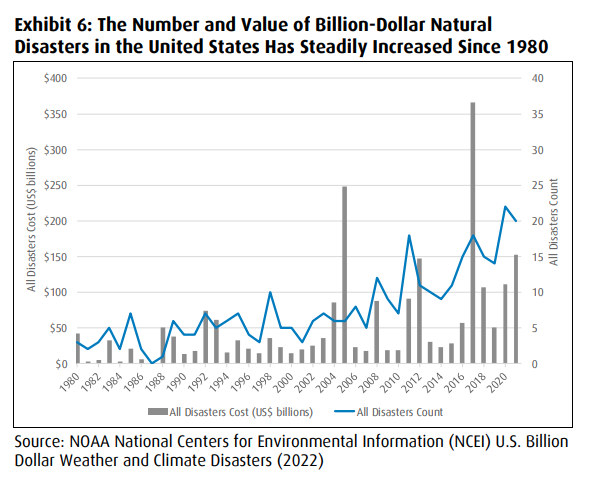

Real Estate investors should start thanking mother nature as BMO provides a bullish data point in what looks like a sea of headwinds affecting the sector. BMO points to climate change, specifically natural disasters as being bullish for these investors, as they note that the number and cost of over $1 billion dollar natural disasters have been increasing throughout the years. These natural disasters have been happening more frequently and have caused must more damage than in previous decades.

As a result of the uncertainty for interest rates and the macroeconomic outlook continues, BMO looks to defensive subsectors such as multi-family and single-family rental units as the best place to hide and weather the storm. They expect that demand for single and multi-family homes will continue to rise due to the still high costs to build a home, coupled with the non-existent supply in the United States.

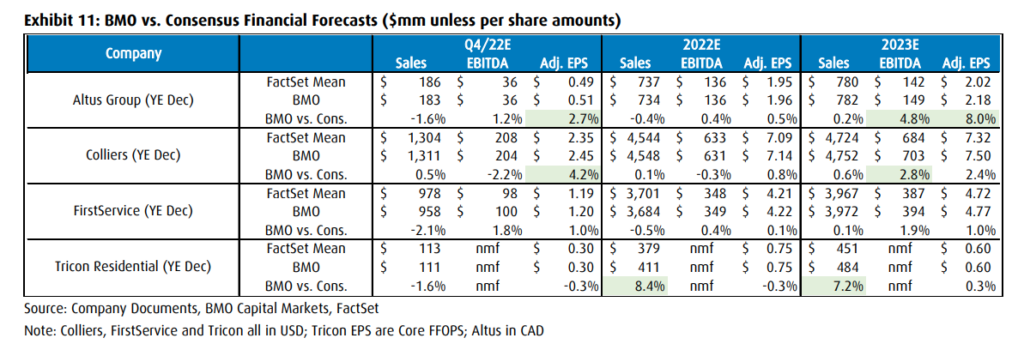

Below you can see BMO’s estimates for the companies in their coverage.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.