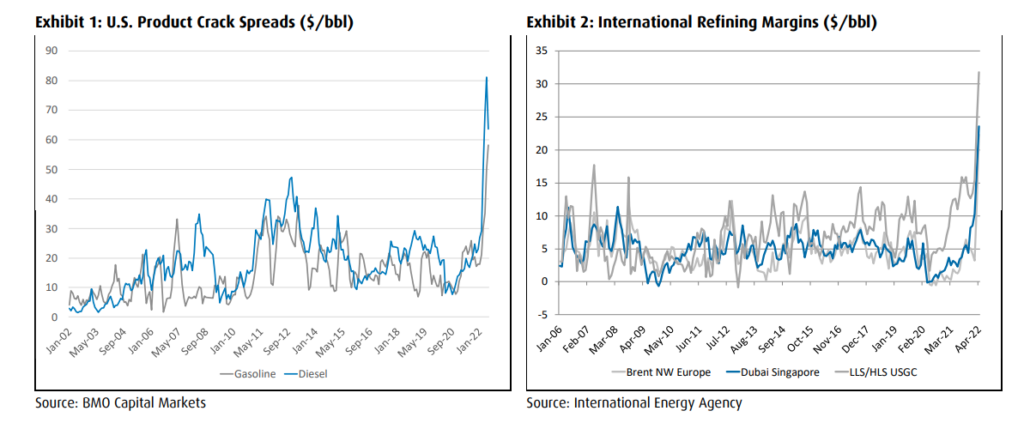

This week BMO Capital Markets released a note on oil and gas, saying that they believe that we could continue to see prices soar “amidst global product shortages stemming from rising demand, refinery closures, and most significantly, the loss of Russia petroleum product exports.” Additionally, they believe that petroleum products will continue to outpace crude oil prices which will help lead to strong margins and “record financial results” for downstream segments for oil & gas companies.

They have coined this period “the third golden age,” saying that petroleum product prices are soaring “amidst the largest re-alignment in energy supply since the 1970s.” They note that crack spreads for gasoline and diesel have reached all-time highs and believe they could rise even higher as the summer weather increases driving.

BMO says that they have three primary factors for this, the first being a stronger than expected recovery in global demand, the second being refinery closures and the third reason is a change in global product trading patterns and shortages due to the Russian invasion of Ukraine.

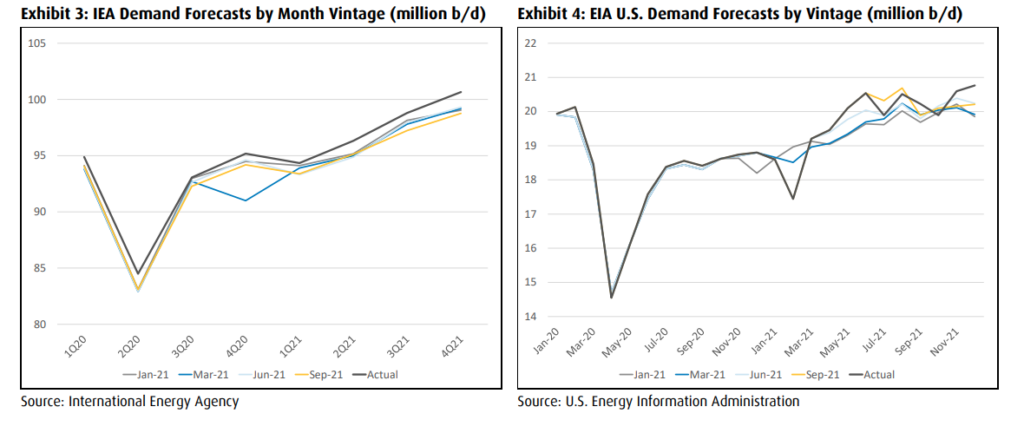

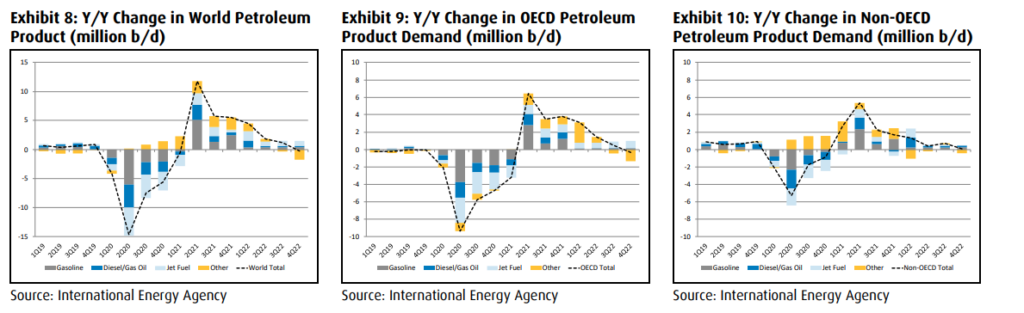

BMO notes that worldwide oil demand recovered to pre-COVID-19 levels by the end of 2021, which has occurred a lot more quickly than previously expected. The demand in the fourth quarter of 2021 reached roughly 101 million barrels per day, versus the estimate of 99 million.

They say that this demand bump came primarily from both U.S and Asian demand, with gasoline demand leading the recovery in 2021. BMO notes that jet fuel and petrochemical demand is still slightly behind pre-COVID-19 levels but is expected to drive growth in overall demand.

They also note that they believe demand growth for the second half of 2022 could exceed the IEA’s expectations.

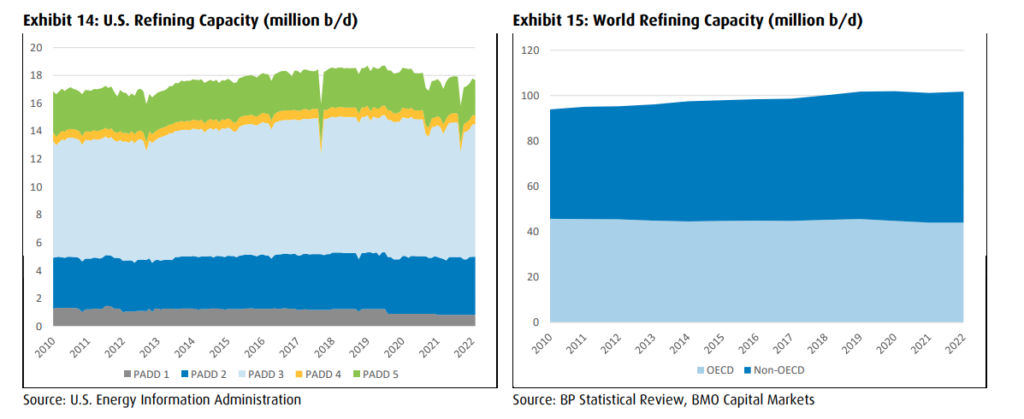

Secondly, BMO comments that global refining capacity declined in 2021 due to refinery closures in the U.S and Europe, “which has contributed somewhat to the overall tightness in global product markets.” They note that in the U.S alone, the operable refining capacity has declined by more than 700,000 barrels per day.

While the overall refinery utilization in the U.S currently remains at pre-COVID-19 levels, BMO expects the U.S refiners to run at a higher utilization rate over the next several months.

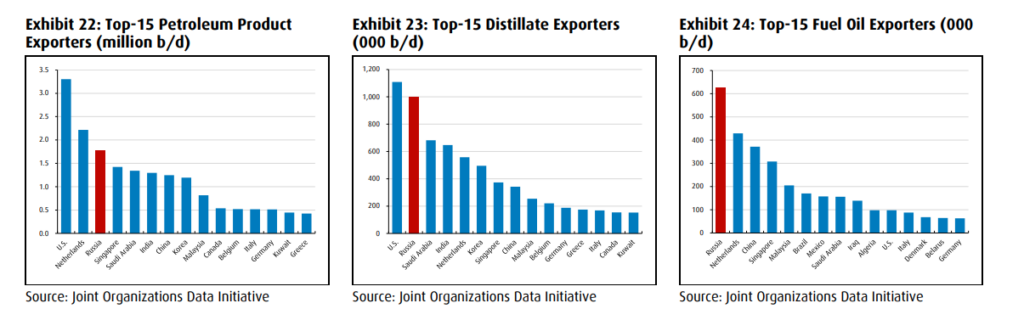

Lastly, BMO notes that the biggest disruption to the global product markets currently is due to the decline in Russian product exports. They highlight that Russia previously would export 1.8 million barrels per day of petroleum products, which would make it the third-largest exporter.

They add that Russia also consumes 4 million barrels per day while exporting 5 million barrels per day of oil.

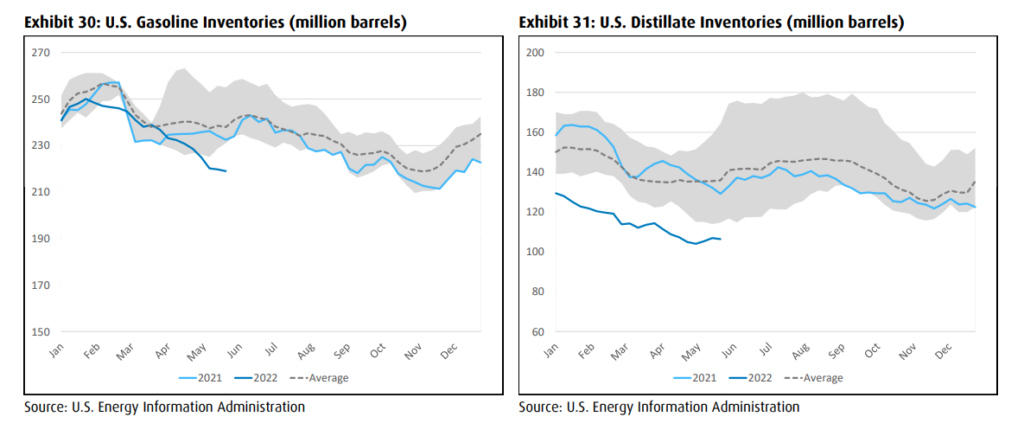

All these factors have put pressure on inventories to keep up with the sudden spike in demand. This has led to gasoline inventories being at the lowest level since 2014, while distillate inventories are at the lowest level since 2005.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.