On December 16th, Bonterra Resources (TSXV: BTR) announced its 2022 guidance. They are now guiding for $55 to $65 million in capital expenditures, with production being roughly 13,300 to 13,700 BEO per day. They expect that at roughly C$80 oil, the company could see $150 million in funds flow and $90 million in free funds flow. Additionally, they expect to grow production roughly 5% year over year and post a 33% reduction in net debt while abandoning 120 inactive wells by the end of 2022.

Bonterra Energy currently has 9 analysts covering the stock with an average 12-month price target of C$7.65, or a 56% upside to the current stock price. Out of the 9 analysts, 2 have buy ratings, 6 have hold ratings and the last analyst has a sell rating on the stock. The street high sits at C$10 from 2 analysts while the lowest comes in at C$4.50.

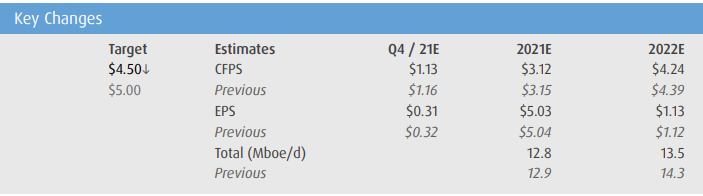

In BMO Capital Markets’ update, they reiterate their underperform rating and cut their 12-month price target from C$5.00 to C$4.50 saying that the companies guidance came in below their expectations.

For the capital expenditures, BMO expected Bonterra to spend $70 million while production guidance also came in below their 14,340 BEO per day.

Lastly, BMO likes the idea that the company will continue to pay down its debt. If Bonterra can hit their guidance, the leverage will drop from 1.8x debt to cash flow to 1.2x in the fourth quarter of 2022. Though, BMO says that the company might consider “adding growth capital if the market improves and debt repayment is accelerated.”

Below you can see BMO’s updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.