FULL DISCLOSURE: This is sponsored content for Temas Resources.

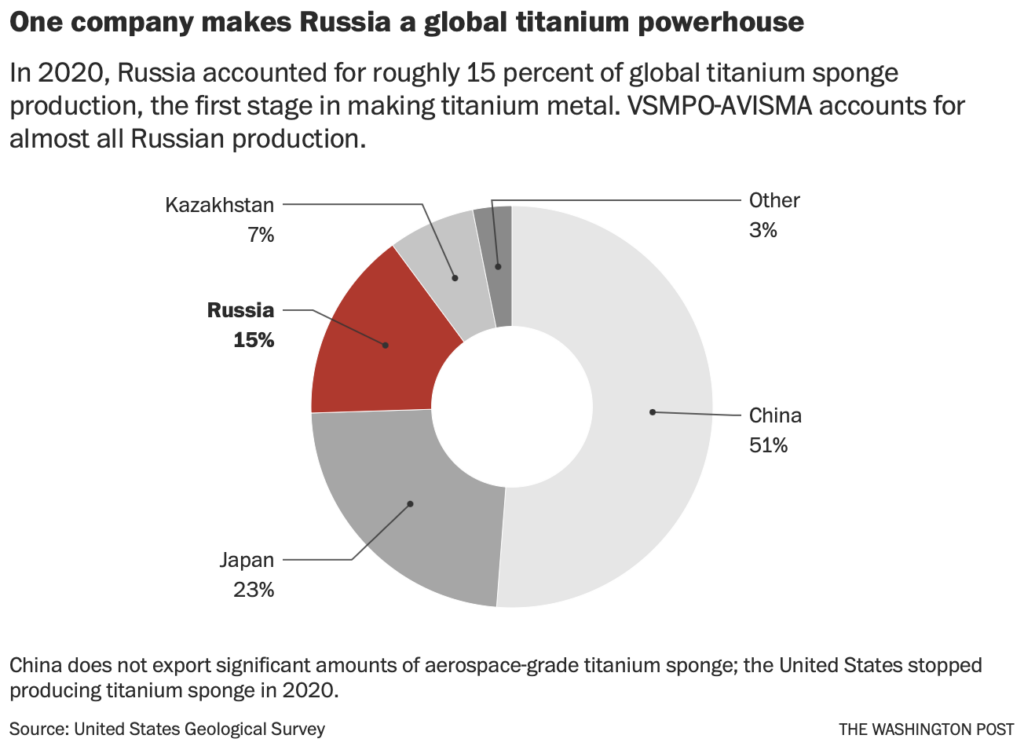

In a review of Russian export data, it has been revealed that Western firms have made substantial purchases of titanium metal from Russian sources, highlighting a concerning reliance on Russia for critical materials. Despite geopolitical tensions and pledges to reduce economic ties with Moscow, the West continues to grapple with dependency issues, particularly in sectors crucial for both commercial and military purposes.

The Russian company VSMPO-AVISMA, partly owned by the defense conglomerate Rostec, has emerged as a significant supplier of titanium, a metal essential for manufacturing aircraft. The firm’s ties to Russia’s defense industry add layers of complexity, raising security concerns among industry and defense analysts.

According to trade data, Western nations, including Germany, France, the United States, and Britain, have been the primary recipients of Russian titanium, with purchases totaling hundreds of millions of dollars. Despite efforts to diversify sourcing, European aerospace giant Airbus and other major players have struggled to cut ties completely, with continued imports from Russian suppliers observed well after initial pledges to do so.

While some companies like Boeing have taken steps to sever ties with Russian titanium suppliers, others, including Safran and Rolls-Royce, have seen their imports from VSMPO increase. The European Union’s significant imports of Russian titanium in 2023, only slightly reduced from previous years, underscore the broader challenge of reducing dependence across the Western world.

Concerns extend beyond Russia, as the U.S. faces challenges in sourcing titanium sponge, a crucial precursor for aerospace-grade metal. With Japan supplying the majority of titanium sponge to the U.S., disruptions in the supply chain highlight vulnerabilities in strategic sectors.

Efforts to address these challenges are underway, with calls for increased investment in domestic titanium production and supply chain mapping to mitigate risks associated with reliance on potentially unreliable sources. However, experts emphasize the need for a long-term strategic approach, emphasizing the importance of national security and technological innovation in securing critical supply chains.

Supply chain crises amid Ukraine war

Titanium and its alloys boast exceptional properties, including lightweight yet robust characteristics, high resistance to corrosion, and suitability for high-temperature environments. These attributes have made titanium indispensable across various sectors, including aerospace, chemical processing, power generation, and medical applications.

In aerospace, titanium’s importance is underscored by its use in advanced composite aircraft like the Boeing 787 and Airbus A350XWB. Particularly notable is its compatibility with carbon fiber reinforced plastic (CFRP) parts, where it mitigates the risk of galvanic corrosion, a critical concern in aircraft construction. Additionally, titanium’s thermal properties align closely with those of CFRPs, ensuring structural integrity under varying temperature conditions.

The production of titanium begins with ores like ilmenite and rutile, with Russia, alongside other nations including the U.S., Kazakhstan, Ukraine, Japan, and China, contributing to titanium sponge production.

Forging, a crucial step in titanium processing, strengthens the metal by aligning its grain structure with the desired shape. However, forging titanium alloys presents unique challenges due to their inherent difficulty in flow and machinability. To address this, producers aim for “near net” shapes to minimize machining time and costs, crucial for aerospace applications where reliability is paramount.

Boeing’s partnership with VSMPO underscores the interconnectedness of the aerospace industry. Joint ventures like Ural Boeing Manufacturing highlight the collaboration between Boeing and Russian counterparts in titanium forging for commercial aircraft programs. Similarly, Airbus relies on VSMPO-supplied titanium forgings through partnerships with companies like Aernnova Aerospace, further illustrating the global nature of titanium supply chains.

Despite its critical importance, the U.S. remains heavily reliant on imported titanium, with domestic production facing challenges from foreign competition and economic pressures. The closure of domestic titanium facilities in recent years has exacerbated this dependency, raising concerns about supply chain resilience, especially amidst geopolitical tensions.

As Boeing cautioned earlier this year, the ongoing crisis in Ukraine and Russia has the potential to disrupt titanium supply chains significantly.

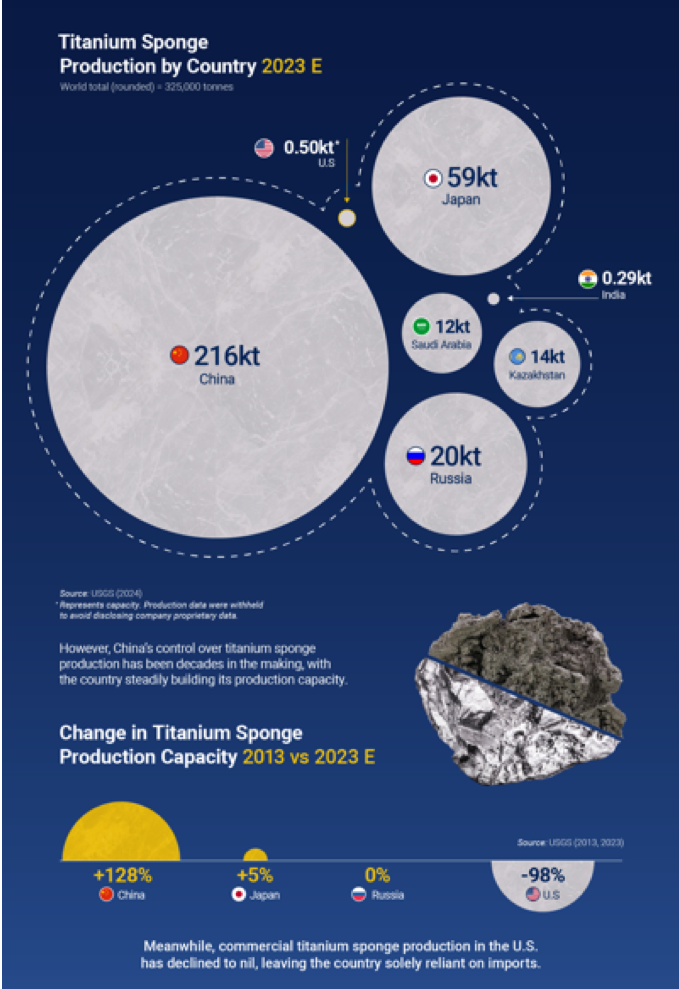

China continues to assert its dominance in the global titanium market, with significant contributions across various stages of the supply chain. As the leading producer of titanium minerals, China commands 34% of global production at 3,100,000 tonnes, almost double than the second-largest producer Mozambique. In contrast, the United States, while a notable player, maintains an annual production of 197,000 tonnes, highlighting its comparatively smaller role in the global landscape.

Moreover, China’s influence extends to the production of titanium sponge, where it controls a staggering 66% of global output. The United States, on the other hand, faces a significant challenge due to its reliance on foreign sources for titanium. With domestic production unable to meet demand, the U.S. finds itself heavily dependent on imports to fulfill its titanium requirements, exposing vulnerabilities in its supply chain.

In 2019, the U.S. imported 95% of the titanium it consumed. Recent data indicates that the value of titanium mineral and synthetic concentrates imported into the United States reached an estimated $690 million in 2021.

Boosting titanium production

Amid the increased reliance on Russia and China for titanium supply, Western countries have been doubling down on efforts in enriching local critical mineral production. On the other hand, local producers are also working on boosting their operations to generate enough supply that will meet local demand.

A notable example, Temas Resources (CSE: TMAS), is currently developing the La Blache titanium-iron-vanadium project in eastern Quebec, where it aims to produce high quality ore that is suitable for processing into a pigment-grade titanium dioxide.

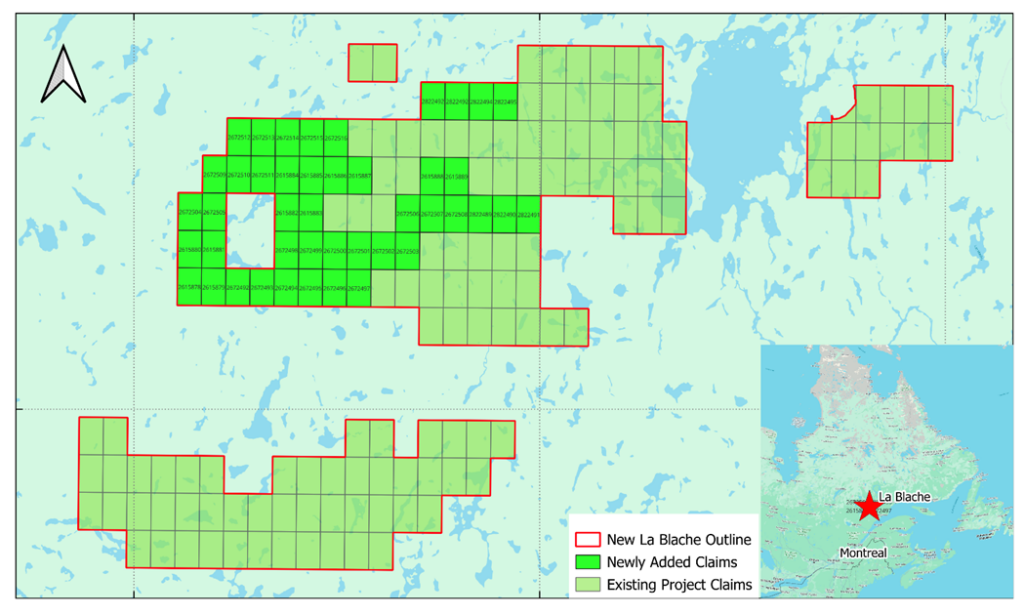

The La Blache Project spans 117 claims, covering 6,203.12 hectares, situated 100 km north of Baie-Comeau, Quebec, with the company recently acquiring further claims as part of an expansion strategy. It is part of the La Blache Anorthosite Complex and hosts the Farrell-Taylor magnetite-ilmenite deposit, encompassing the Hervieux-Est and Hervieux-Ouest mineralization zones.

The company also holds proprietary processing technology through ORF Technologies Acquisition, enabling the recovery of titanium dioxide (TiO2), vanadium pentoxide (V2O5), and ferric oxide (Fe2O3) from ore. Testing demonstrated full recoverability of TiO2 suitable for further processing.

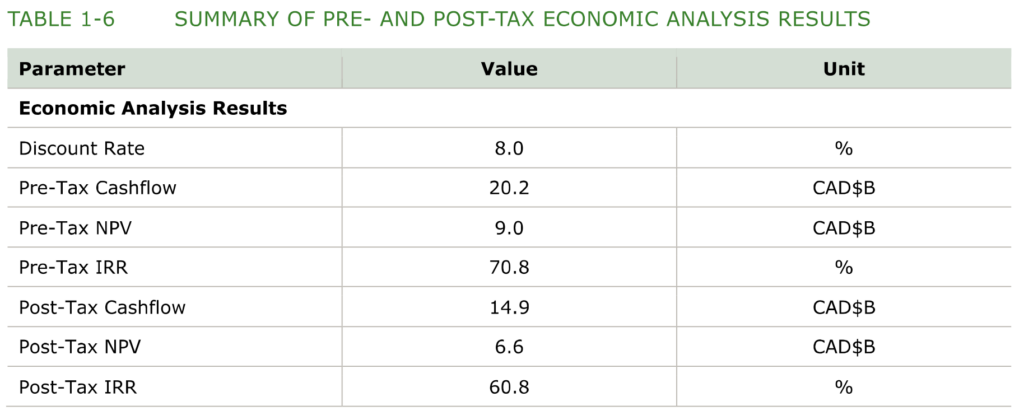

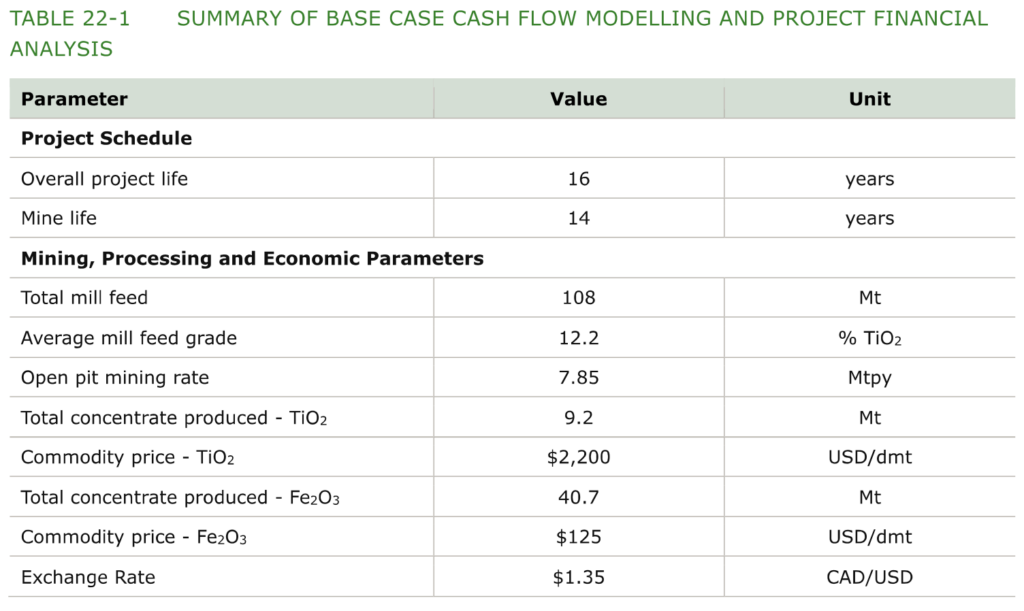

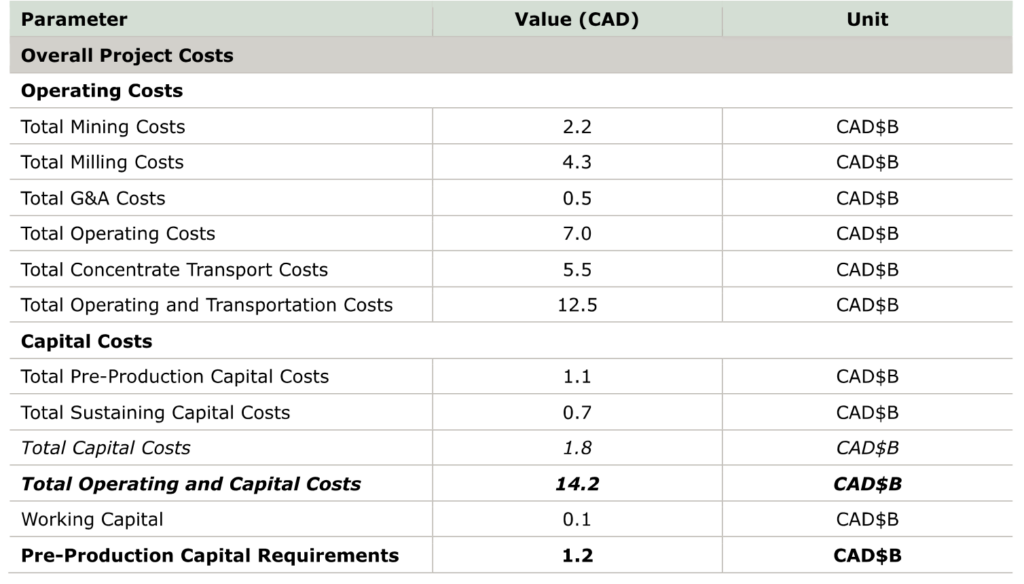

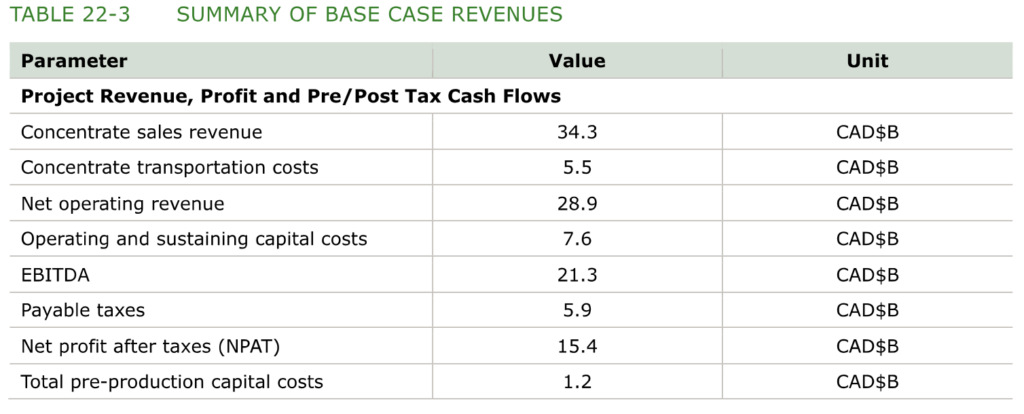

A recent preliminary economic assessment (PEA) conducted on the property outlined a post-tax net present value of $6.6 billion, with a discount rate of 8%, and a post-tax internal rate of return of 60.8%, based on a mine life of 14 years. The payback period on the project is under two years from the start of production.

The La Blache project is expected to produce a total of 9.2 million tonnes of TiO2, 40.6 million tonnes of Fe2O3, and 152,000 tonnes of V2O5 over its 14 year life of mine.

The PEA is said to have further increased the firm’s confidence in the project showcasing its “proprietary, environmentally friendly extraction technology.”

“Titanium has been trading well above our assumptions of USD $2,200 per tonne for over three years and at over USD $3,000 per tonne since August 2022. We believe this trend will continue due to the increasing demand for TiO2, major global supply coming to end of life, and lack of both brownfield expansion and new projects coming online in North America,” Temas President Tim Fernback said.

Fernback cited the positive results of the PEA as a motivation for the firm to “further refine [its] understanding of the best path forward for the development of the combined La Blache project.”

“By adding the additional mineralization, optionality opens up on the best approach and overall path to development. There is still a lot of work to do on the Farrell-Taylor, but we are keen to apply what we have already learned to this part of the trend,” he added.

Information for this briefing was found via The Washington Post, Forbes, and the sources mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: Temas Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Temas Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.