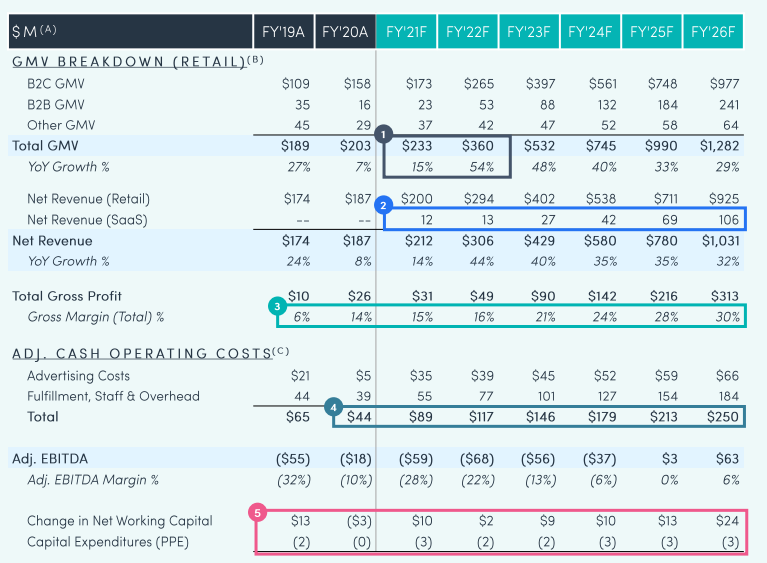

As a reflection of SPAC sponsors’ and perhaps investors’ appetite for risk and willingness to utilize optimistic assumptions as the basis for SPAC valuations, grocery courier Boxed Inc. and Seven Oaks Acquisition Corp. (NASDAQ: SVOK) agreed to merge on June 14. In broad terms, Boxed Inc. expects that its revenues will total just over US$1 billion in 2026, up a dramatic 450% from US$183 million in 2020, yet its EBITDA will only turn slightly positive in 2025 and reach US$63 million in 2026.

Despite this, at Seven Oaks’ current share price, the business is valued at an enterprise value (EV) of US$640 million, or about three times projected 2021 revenues. An EV/EBITDA valuation cannot be computed based on 2021 projections because the company’s EBITDA loss this year is projected to be about US$59 million.

According to Washington Monthly, online grocery sales in the U.S. nearly tripled during the first few months of the COVID-19 pandemic. However, The Wall Street Journal reports that sales growth has slowed recently.

In the meantime, competition is becoming much stiffer. Softbank has pledged to invest US$1 billion in grocery delivery startup GoPuff. Instacart raised an additional US$265 million in venture capital funding in March 2021, bringing its valuation to nearly US$40 billion. DoorDash is building delivery-only “dark store” warehouses; Uber’s Uber Eats unit continues to broaden its offerings outside of restaurant meals; and GrubHub has agreements with more and more supermarkets.

Boxed Inc. also believes that business customers, such as airlines, will be an important part of its customer base. More specifically, Boxed Inc. believes that the gross merchandise value (GMV) of all groceries delivered to U.S. businesses (B2B) will explode. See the right side of the below graph.

Another key plank of Boxed Inc.’s forecast is a near quintupling of its gross margins over the next five years through negotiations with vendors (primarily grocery stores), better ad spending and customer retention strategies, and other methods. Such a margin expansion has little precedent in the history of any industry.

Boxed Forecasts Explosive Revenue and Gross Margin Increases

The company’s 2025 revenues are expected to be more than five times sales in 2019, the most recent pre-pandemic year. Over that same period, Boxed Inc.’s gross margin is projected to grow nearly 400% (from 6% to 28%). Still, EBITDA may only reach US$3 million in 2025.

Despite a marked reduction in SPAC (over) enthusiasm since February, interest in companies with ambitious business plans and financial forecasts remains quite high. It is possible that Boxed Inc. does achieve the revenue and profit forecasts it laid out in its merger transaction with Silver Oaks. But if it does, it will have to surmount challenges from many far better capitalized competitors and achieve a degree of margin expansion which has been rarely achieved in any industry.

Silver Oaks Acquisition Corp. last traded at US$9.87 on the NASDAQ.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.