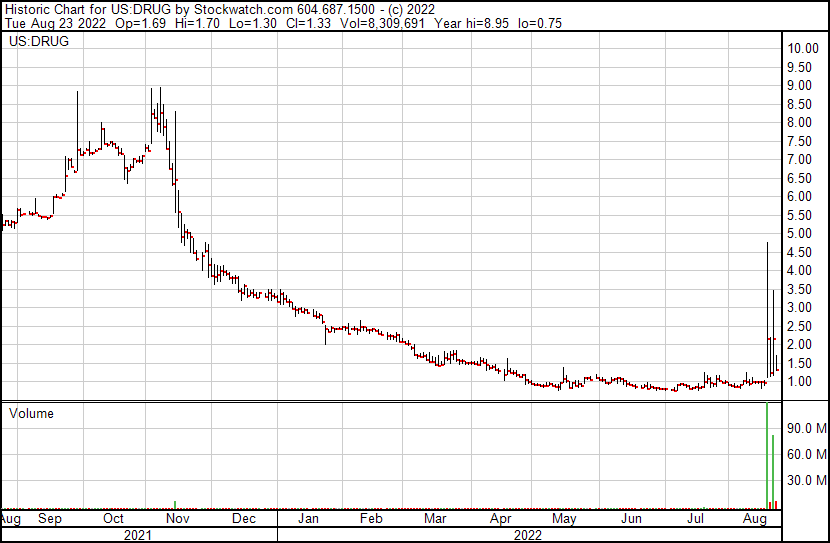

After several days of intense volatility, Bright Minds Biosciences (CSE: DRUG) is looking to capitalize on the sudden investor interest. The firm has now announced terms for the pricing of its overnight marketed offering of units, following the financing initially being announced on Monday.

The company is looking to raise gross proceeds of roughly $4.0 million, with units being sold at $1.40 per each. Each unit is to contain one common share and one common share purchase warrant, with an exercise price of $1.76. Warrants are to be valid for a period of 24 months from the date of issuance.

A total of 2.9 million units are expected to be sold under the offering, with a 15% over-allotment option also having been granted. The option is valid for a period of 30 days following the closing of the financing.

The financing is being lead by Eight Capital, with HC Wainwright & Co acting as the firms US capital markets advisor.

Proceeds from the financing are to be used for preclinical and clinical development activities, in addition to working capital and general corporate purposes.

The financing follows several days in which the company has seen intense volatility, both on its Canadian as well as its US listing, with the company surpassing $6.00 on the CSE on Thursday, following a close of $1.20 on Wednesday.

Bright Minds Biosciences last traded at $1.75 on the CSE.

FULL DISCLOSURE: Bright Minds Biosciences is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Bright Minds Biosciences on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.