The Liberal’s hot-off-the-press 2023 budget delivers a Pandora’s box of larger-than-expected deficits, even more government spending, higher taxes, and a big bet on a green economy.

I checked three times. Nope, this is not a parody account.

— Lion Advocacy (@LionAdvocacy) March 28, 2023

Balancing the budget: A long lost dream

The Liberals have completely given up on balancing the budget in five years, and instead are throwing nearly all of their eggs in one basket and banking on a future green economy and more fiscal measures that are supposedly inflation-proof. Finance Minister Chrystia Freeland is now forecasting a $40.1 billion deficit, up from fall projections calling for a $30.6 billion deficit, with eager expectations to bring the shortfall to $14 billion by 2027/28— evidently the same year she promised books would return to a surplus.

Here's that "fiscal restraint": program spending over the five years FY 2023-2027 is now running more than $20 billion a year over what was projected in last year's budget; more than $30 bil annually over the projections in fall 2021, and more than $40 bil over Budget 2021. https://t.co/WU6zVpmeyl pic.twitter.com/prqSGfrAgf

— Andrew Coyne 🇺🇦 (@acoyne) March 28, 2023

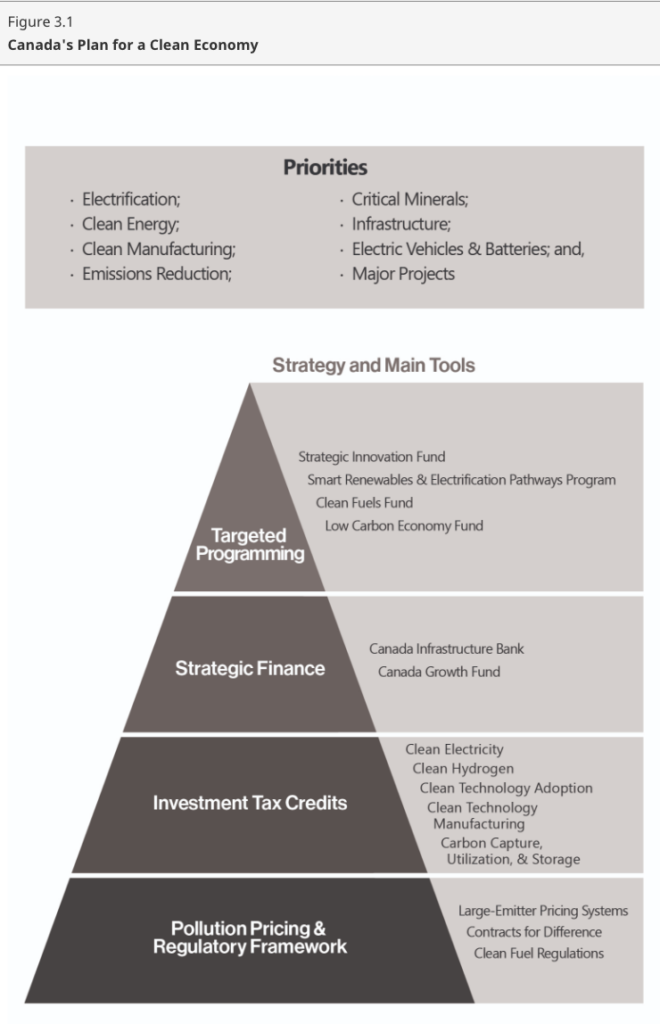

Betting big on going green

In delivering the budget on Tuesday, Finance Minister Chrystia Freeland heavily emphasized the Liberals’ alignment with Washington’s Inflation Reduction Act, focusing on clean energy incentives that will cost Canadian taxpayers at least $21 billion.

The 2023 budget includes an investment tax credit that will cover 30% of the costs for new equipment and machinery for the manufacturing of clean technologies and extraction of critical minerals. The cost of the tax credit will total $4.5 billion over a five-year span, and then $6.6 billion through to 2035.

The Liberals also provided new details surrounding the convoluted Canada Growth Fund, which was first unveiled in last year’s budget. “The Canada Growth Fund is a $15 billion arm’s length public investment vehicle that will help attract private capital to build Canada’s clean economy by using investment instruments that absorb certain risks in order to encourage private investment in low carbon projects, technologies, businesses, and supply chains,” reads an excerpt.

The Liberals also plan to place management of the budget into the hands of the Public Sectors Pensions Investment board, which will independently invest in Canadian projects focused on reducing the country’s carbon footprint. “In what is the most significant economic transformation since the Industrial Revolution, our friends and partners around the world— chief among them, the United States— are investing heavily to build clean economies and the net-zero industries of tomorrow,” explained Freeland.

“As a result, our allies are moving quickly to friendshore their economies and build their critical supply chains through democracies like our own. Together, these two great shifts represent the most significant opportunity for Canadians workers in the lifetime of anyone here today,” she added.

More government spending en-route

For those concerned about inflation, the Liberal budget does little to put those worries at bay. Promising targeted relief for low-income Canadians that won’t spur further inflation, the budget earmarks $2.5 billion for a one-time Grocery Rebate that will be tacked onto the GST rebate which last fall was temporarily doubled.

Moreover, Ottawa also plans to boost the withdrawal limit on a registered education savings plan from $5,000 to $8,000.

Jagmeet Singh wore one of his Rolex watches today. #Budget2023 pic.twitter.com/fRhv2xEVzA

— Élie Cantin-Nantel (@elie_mcn) March 28, 2023

Freeland’s budget encompassed some of the main themes the Liberals touched base on leading up to the budget unveiling, including $195.8 billion in health transfers to provinces over the next decade, in addition to $46.2 billion in new funding. Ottawa also delivered on the NDP’s national dental care program as promised, except at a price tag over $7 billion higher than the $6 billion previously budgeted.

“Yes, we’ll be supporting the budget,” NDP Leader Jagmeet Singh confirms as he speaks with journalists on Parliament Hill in Ottawa. “We’re going to be supporting the relief that Canadians deserve and that we forced this government to deliver,” says Singh.#cdnpoli | #Budget2023 pic.twitter.com/9snZZefomo

— CPAC (@CPAC_TV) March 28, 2023

Whilst on the topic of spending, Ottawa will lend another $2.4 billion to Ukraine, bringing total taxpayer support to more than $8 billion since the start of the war. The budget also tables over $200 million worth of military equipment for Kyiv, $84.8 million for humanitarian and mental health assistance, and an additional $171.4 million for Ukrainian citizens that have relocated to Canada.

Budget 2023: Canadians have committed more money per capita to Ukraine than any other county. pic.twitter.com/sPOZY6p6hL

— The Real Andy Lee Show (@RealAndyLeeShow) March 28, 2023

The 2023 budget also addresses foreign interference from authoritarian regimes such as China, Russia, and Iran, stressing the importance of defending Canadian businesses and public institutions from such threats. The Liberals propose $13.5 million to establish a new National Counter-Foreign Interference Office… all whilst attempting to block a public inquiry into— you guessed it— foreign interference.

So, who’s footing the bill? The rich, of course

To help pay for it all, the Liberals are raising the alternative minimum tax (AMT) from 15% to 20.5% and increasing the basic income exemption from $40,000 to $173,000 effective for the 2024 taxation year. The move is estimated to generate about $3 billion in revenue over five years, with 99% of it coming from Canadians earning more than $300,000 annually.

The budget also follows through on a proposed share buyback tax of 2% targeting Canadian public corporations that will come into effect January 2024. “A business would not be subject to the tax in a year if its gross repurchases of equity were less than $1 million,” the budget reads, with government estimates suggesting the measure would generate approximately $2.5 billion over a five-year period. The Liberals also want to amend the Income Tax Act so dividends held by financial institutions are classified as business income, ultimately boosting government revenues by another $3.15 billion over the course of five years.

In other filibuster news

The 2023 budget will temporarily cap the inflation adjustment on alcohol excise duties at 2% for a period of 12 months starting on April 1, 2023, which was otherwise set to increase 6.3% this year. Freeland is also proposing new legislation to reduce junk fees such as cellphone roaming charges, event fees, unjustified shipping fees, and high baggage fees, as well as explore ways to implement a standard charging port for electronic devises, similar to amendments made in Europe.

The winner is the beer industry, who will receive (if the budget passes, which it will) $550 million in excise tax relief from the federal government.

— Matt Lamers 🌻 (@matt_lamers) March 28, 2023

The cannabis industry will receive $0.00. #cdnpoli https://t.co/mA6uJnc5b2

Information for this briefing was found via the Government of Canada and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.