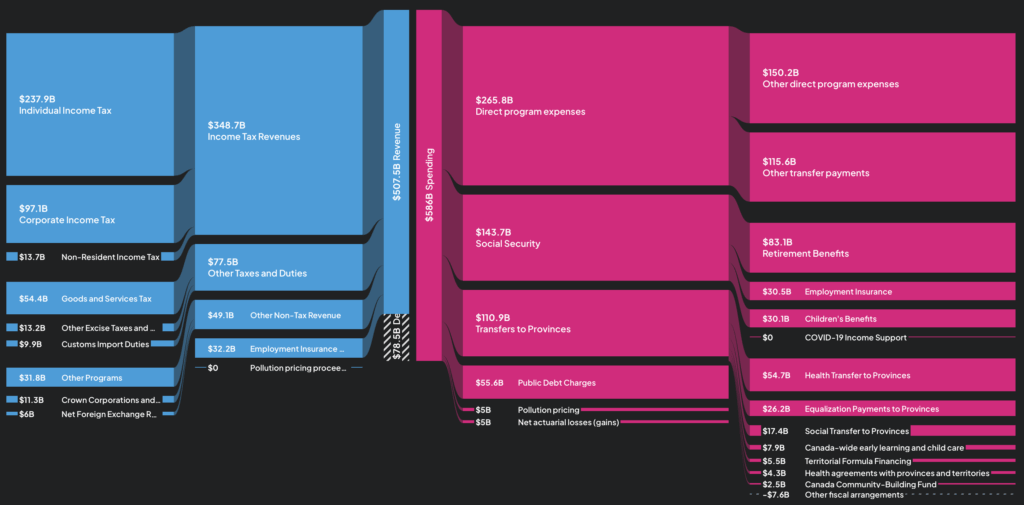

A projected $78.3 billion deficit headlines the Budget 2025 that the Carney government tabled for the current fiscal year, up from the $42.2 billion shortfall previously estimated. The deficit is paired with $60 billion in savings and revenues and a plan to enable $1 trillion in total investment over the next five years.

Prime Minister Mark Carney called it “a generational investment budget.”

This is a generational investment budget — a confident Canada taking control of its future.

— Mark Carney (@MarkJCarney) November 4, 2025

Budget 2025 is our plan to build Canada Strong: https://t.co/tl0SmFXvUh

*CANADA PROJECTS C$78.3B DEFICIT THIS YEAR; PREV EST. C$42.2B

— zerohedge (@zerohedge) November 4, 2025

keep selling your hard assets

The federal deficit is projected to be ~$78B, approximately 44% increase over last year's spend pic.twitter.com/oPHyUWuFCA

— Canada Spends (@canada_spends) November 4, 2025

The fiscal framework sets two anchors. Ottawa aims to balance day-to-day operating spending with revenues by 2028–29 and to keep the deficit-to-GDP ratio on a declining path. The deficit is forecast to narrow to $57.9 billion by 2028–29. Debt service costs are expected to climb from $55.6 billion in 2025–26 to $76.1 billion in 2029–30, a $20.5 billion increase that represents 36.9% growth in five years.

The Comprehensive Expenditure Review identifies $60 billion in savings and revenues across five years. Separate briefing material details $56 billion in program cuts, a planned reduction of about 16,000 full-time equivalent positions over the next two years including 1,000 executive roles, and an overall public service headcount that falls from a 2023–24 peak near 368,000 to roughly 330,000 by 2028–29. Most of the reduction relies on attrition and workforce adjustment.

There's going to be a lot of talk about the deficit today, but another interesting item is that the targets for international student admissions in 2026 and 2027 have been cut in half from last year's plan. This has big implications for IMP levels as well.

— Millennial Moron (@Mill_Moron) November 4, 2025

🚨BREAKING: Public Service Purge Incoming

— Shazi (@ShaziGoalie) November 4, 2025

Ottawa quietly drops a bombshell in today’s federal budget.

$56 billion in cuts. 16,000 public sector jobs gone. 1,000 executives axed. Attrition weaponized. The public service ballooned far faster than 🇨🇦 population — now the knives… pic.twitter.com/4nJzFxMVCX

Spending shifts toward capital formation, productivity and major projects. The budget restores the Accelerated Investment Incentive and introduces a productivity deduction to speed write-offs for machinery, equipment and buildings, alongside enhancements to the SR&ED program. It creates a $2 billion Critical Minerals Sovereign Fund and earmarks $1 billion for artificial intelligence investments.

Trade-related infrastructure receives $6 billion, with $1 billion set aside for an Arctic Infrastructure Fund. The Canada Infrastructure Bank receives $10 billion in fresh capital and an expanded mandate to invest in any nation-building project referred by the new Major Projects Office, which has been tasked to coordinate financing among private investors, provinces and the federal government.

Ottawa’s investment plan seeks to crowd in about C$500 billion of private capital as part of the five-year C$1 trillion objective.

There are no personal or corporate rate cuts and no corporate tax review. The lifetime capital gains exemption moves to $1.25 million effective June 25, 2024. The Underused Housing Tax is eliminated starting in 2025.

The luxury tax is removed for aircraft and boats but remains on automobiles. The budget also introduces a temporary Personal Support Workers Tax Credit starting in 2026 for five years and advances automatic tax filing for certain low-income Canadians.

Immigration policy splits between permanent and temporary streams. The 2026–2028 Immigration Levels Plan stabilizes permanent resident admissions at 380,000 per year. The 2026 target allocates 239,800 to economic classes, 84,000 to family reunification, and 56,200 to refugees and other humanitarian categories. The 2027 and 2028 targets set economic admissions at 244,700 each year, family reunification at 81,000, and refugees and other humanitarian categories at 54,300.

French-speaking admissions outside Quebec are targeted at 9.0% or 30,267 in 2026, 9.5% or 31,825 in 2027, and 10.5% or 35,175 in 2028. New temporary resident admissions fall from 673,650 in 2025 to 380,000 in 2026 and 370,000 in both 2027 and 2028.

Carney's very first Immigration Levels Plan is out, and it *increases* numbers.

— Riley Donovan (@valdombre) November 4, 2025

Under Trudeau, permanent resident admissions were set to fall to 365K/yr. Under Carney, it will be 380K/yr.

Mass immigration will continue unchecked. pic.twitter.com/9wNXiBq71h

Borrowing plans remain large but are framed as manageable. The government projects $594 billion in gross borrowings in 2026–27, with about 75% used to refinance maturing debt. The legislated borrowing authority stands at C$2,126 billion.

This is scary.

— Martyupnorth®- Unacceptable Fact Checker (@Martyupnorth_2) November 4, 2025

Ottawa is set to borrow $594 billion in 2026/27. Seventy-five per cent of the total borrowings will be used to refinance maturing debt.

We're borrowing money to pay off credit cards. pic.twitter.com/xlbOgrl9Dx

Ottawa highlights IMF data showing Canada’s net debt-to-GDP at 13.3% in October 2025, the lowest in the G7, and notes a AAA sovereign rating shared by only one other G7 economy. It also underscores that 85% of Canada’s trade with the US is tariff-free and that Canadian exporters face the lowest average US tariff at 5.4%.

Well, if you’re a fan of big government spending, then this is the budget for you.

— Kim G C Moody (@KimGCMoody) November 4, 2025

In addition, if you believe huge government intervention into the economy is necessary and good, well, you’ve got the budget of your dreams.

My quick summary before my colleagues at Moodys…

Conservatives say they will not support the budget as written but have floated an amendment as a path to backing it.

Pierre has said CPC will NOT support the budget as is.

— HoCStaffer (@HoCStaffer) November 4, 2025

But CPC offers hand to Liberals to support CPC amendment to gain it.

The budget now moves through House debate and votes while the Treasury Board executes the Comprehensive Expenditure Review.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.